5 Predictions for What the Market Correction May Mean for the Ecommerce Ecosystem

In 4Q 2021, a market correction began. At first, it seemed to mostly impact the private sector—taming the rate of venture capital and cooling red hot startup valuations. But in 2Q 2022, the up and down volatility of the Covid 19 pandemic era began a clear downward trend.

These are difficult and unpredictable times, for individuals and businesses alike. It’s hard to know what’s coming around the corner.

As a part of my role at Shogun, I am in constant contact with scaling ecommerce brands, SaaS founders, agencies, analysts, and venture capital and private equity investors. As such, I'd like to share my perspective in the hope that any info I come across might be helpful to you as you plan amid uncertainty.

These opinions are my own, and they are just that; opinions and predictions for what may happen. Here, I’ll also offer some recommendations—focusing on actionable things you can do now—that will hopefully serve as guidance to merchants, agencies, and startup founders weathering these tough times.

Out of the frying pan and into the fire

What started as a bear market is evolving into a full on recession.

USA Federal Reserve policy, oil prices exacerbated by an unjust and horrific war on Ukraine, sky high inflation, and a bloated tech sector are a few of the factors likely to have brought us to present day market conditions.

According to Reuters, economists see roughly a 40% chance of a U.S. recession next year, with inflation remaining high.

Ecommerce in particular is also experiencing a market correction. Both in terms of retail/discretionary spending, and ecommerce tech company valuations. Venture capital firms injected $78 billion into ecommerce companies globally in 2021, and there’s a bit of a hangover from this.

This piece summarizes the impact on key public market players:

“The implosion in public tech-driven retail and payments companies has been breathtaking—with investors losing tens of billions of dollars. Amazon shares have tumbled more than 40% from pandemic-era heights. Companies that help process online transactions took an even bigger hit. PayPal has plummeted 77% from its 2021 highs, and Shopify […] is down 82% from a November peak.”

So, what might all of this mean for ecommerce brands, agencies serving DTCs, and investors alike? Where can you focus right now?

Prediction 1: DTC native brands will need to laser-focus on EBITDA ASAP

When I first started investing in startups, I got sage advice from Y Combinator’s CEO: “Pay closer attention to the business models. You’re a software guy. The company you’re looking at is retail. Ecommerce businesses are traditionally valued on an EBITDA multiplier, not a SaaS multiple.”

As defined by Invetsopedia, “EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company’s overall financial performance and is used as an alternative to net income.”

Some ecommerce brands have leveraged venture capital or private equity to get their start and fuel their growth, but losing sight of capital efficiency and how the market (private or public) values ecommerce businesses means that history may be doomed torepeat itself.

In other words, brands that otherwise would have stood a chance using older, well-worn playbooks, may crash hard, and even faster this time for the new wave of DTCs born out of the pandemic ecommerce boom.

Ruthlessly focus on EBITDA and capital efficiency

Focusing on EBITDA, brands need to watch they aren’t investing time on things they should absolutely outsource.

Companies like Glossier are amazing, for example, but they’re amazing for what they can best offer to shoppers; a fresh take on cosmetics. DTC companies should focus on building a unique brand, not unique owned technology. The consequences of focusing on tech can be painful. Early this year Glossier announced a significant reduction in force: “[W]e are shifting our technology strategy to leverage external partners for parts of our platform that we’re currently maintaining internally.”

Glossier’s movement away from in-house R&D to SaaS was significant because the beauty retailer had been describing itself as a technology company. Creating custom systems, infrastructure, and web applications is software development—and there is no need to build from scratch what already exists as SaaS if you’re a DTC brand.

#cta-paragraph-fe#Recommendation: If EBITDA is a big focus already; great! Keep on keeping on. If it hasn’t been as much of a consideration—increase attention on EBITDA and capital efficiency. Consider how your company would be valued on an EBITDA multiplier. Much like trends in the greater economy—the focus for businesses during this time is building a business that can stand on its own two feet, without reliance on funding. Also consider how you might increase your operational efficiency with Glossier’s learnings in mind. You likely do not need to construct your own tech or become a tech company as a DTC.

Prediction 2: The revenue bill will come due for ecommerce SaaS startups (so choose your tech stack carefully!)

Startup investing got out of control in 2020 and 2021. From public market giants like Shopify, down to Seed stage startups in the private market, and there has been a sweeping market correction.

Companies once fueled by a red hot VC market, will now have to face their inflated valuations and unsustainable business models. Some of this has happened already, as the market corrected some major players in the checkout space.

Many ecommerce SaaS companies will need to reconsider the sustainability of their current valuation, and reevaluate. Some will have to consider some very difficult options, such as pivoting or sunsetting their companies.

Ultimately, the SaaS market correction may prove painful for some merchants who have adopted tech from companies that may not have the longevity previously assumed.

#cta-paragraph-fe#Recommendation: I recommend ecommerce brands increase due diligence before adopting any significant piece of software. Look up the company on Crunchbase. Consider what stage the company is at, when they started, and when and how much they raised. If the company was started in 2018 or later, and raised big rounds at high valuations (around $1B) in 2020 and 2021, take some pause to consider the risk of the company sunsetting in the next 24 months.

Perhaps controversial, but I also think if you’re about to sign a contract with an early stage (Seed, Series A, Series B) ecommerce SaaS company in 2022 and 2023, it should be appropriate to ask to speak to the founder and ask them to give a sense of their runway.

Prediction 3: Household staples/verticals will fair well, with a focus on subscription businesses

For ecommerce businesses focused on essentials, like household staples, healthcare, and utilities; take reassurance in knowing that these verticals are often less impacted by market fluctuation.

DTC brands who have created products for kitchen and bathroom—for example skincare, health conscious snacks, sustainable toiletries, etc.—you’re in luck! According to Investopedia, “Consumer staples, including toothpaste, soap, and shampoo, enjoy a steady demand for their products during recessions and other emergencies, such as pandemics.”

Also on the recession favored list; grocery stores and discount retailers, cosmetics, and alcoholic beverage manufacturing.

When recession hits, it tends to impact big ticket items that can be shifted to a post recession purchase; think about something like a big European vacation. That purchase and all adjacent purchases (e.g. luggage) get bumped. However, consumers compensate for the loss of a big “reward purchase” by engaging in “the lipstick” effect:

“The lipstick effect is when consumers still spend money on small indulgences during recessions, economic downturns, or when they personally have little cash. They do not have enough to spend on big-ticket luxury items; however, many still find the cash for purchases of small luxury items, such as premium lipstick.”

The next few months will be a good opportunity for merchants to lean into subscription programs to build brand loyalty and predictable revenue streams.

#cta-paragraph-fe#Recommendation: If you’re in a “home goods/housewares” or “kitchen and bathroom” type category that is generally considered to be “essentials”—temper your pessimism and lean into customer loyalty endeavors like subscriptions and establish loyalty programs.

Prediction 4: It will be a mixed bag for travel-focused merchants/brands

On the one hand, the pandemic easing may mean more sales than when travel was highly restricted because of the pandemic:

According to Business Insider, “Airbnb previously shared that it already has 30% more rooms booked for the summer, compared to the same time in 2019, and analysts pointed to how mobility limitations for the past two years due to the pandemic could open up pent-up demand.”

However, costly excursions fall way side to essential spending. Verticals that are much more discretionary (e.g. non-essential fashion and accessories brands, nice-to-have consumer electronics) tend to feel the impacts here most.

#cta-paragraph-fe#Recommendation: For those in the travel vertical, or other highly discretionary verticals, focus on capital efficiency, EBITDA, and maintaining “prudent reserve” to weather a 24 month lull. Instead of emphasizing net new customer acquisition, focus on driving increased Average Order Value (AOV) and customer loyalty through incentive programs.

Prediction 5: Competition will tighten for ecommerce agencies

With ecommerce and small business growth softening, it’s logical to assume softening growth for the service providers supporting these businesses too.

Service provider ecosystems flourished during the pandemic inspired ecommerce boom. The Shopify Plus service provider ecosystem used to sit at several dozen select firms; today it boasts close to 300 agencies.

As demand for new projects wanes, service providers should anticipate aggressive competition and pricing cutting strategies. Additionally, merchants who were on the fence about top quality versus budget conscious may fall into the latter category.

#cta-paragraph-fe#Recommendation: Agencies should be wary of a “race to the bottom” on services pricing. Instead of engaging in project pricing wars, consider reducing client volume and only focusing on high budget projects for established mid market enterprise ecommerce merchants.

Beyond preventing de-valuation of work, fewer clients will mean less risk of cash flow constraints, and less risk you have a smaller client become delinquent due to bankruptcy.

Additionally, agencies shouldcarefully avoid over engineering client’s tech stacks

Some of the new tech emerging is quite developer oriented—the flexibility is really appealing, but it tends to be at the cost of merchant usability and autonomy. This reliance on developers eats away at EBITDA for brands, and can be a real pitfall for merchants who are not true enterprise level companies (see Prediction 1). Instead, find quality SaaS partners and leverage those products to your and your client’s advantage.

It’s been my experience, from starting Glass + Marker, that agencies perform best when they focus on building their brand through consistently high quality execution on client projects. Prices for services should always increase as quality remains constant or increases. The only time price should decrease is if quality of work is decreasing as well (and generally that’s indicative of a greater problem).

Don’t “wait and see”—take action, even amid uncertainty

Whenever there is a significant market correction (like a recession) on the horizon, it can be tempting to stay in “wait and see mode”.

However, I recommend erring on the side of caution and start taking action. One of the best places to start is scenario planning. Because I work in software, most of my experience is with scenario planning for SaaS startups, but I would recommend everyone review these resources to get a sense of what frameworks and action items can look like:

- A Framework for Navigating Down Markets (Justin Kahl, David George, a16z)

- The 4 Startup States During a Recession (Tomasz Tunguz, Redpoint)

- YC advises founders to ‘plan for the worst’ amid market teardown (this was nonpublic information from Y Combinator leaked by TechCrunch. Now that it’s public I assume they don’t mind the share)

Like many others, I believed that “the fast forward button was pressed down on ecommerce and that pandemic “learned” behaviors would transfer as the pandemic eased. However, as noted by The Information, the payment processing tech giant Stripe saw the volume of payments it processed jump 60% to $640 billion in 2021 from just a year earlier, and warned that much of that boom came from “one-time behavioral adjustments caused by the pandemic. That aberration combined with other macroeconomic factors are making commerce overall more turbulent than expected at this time.

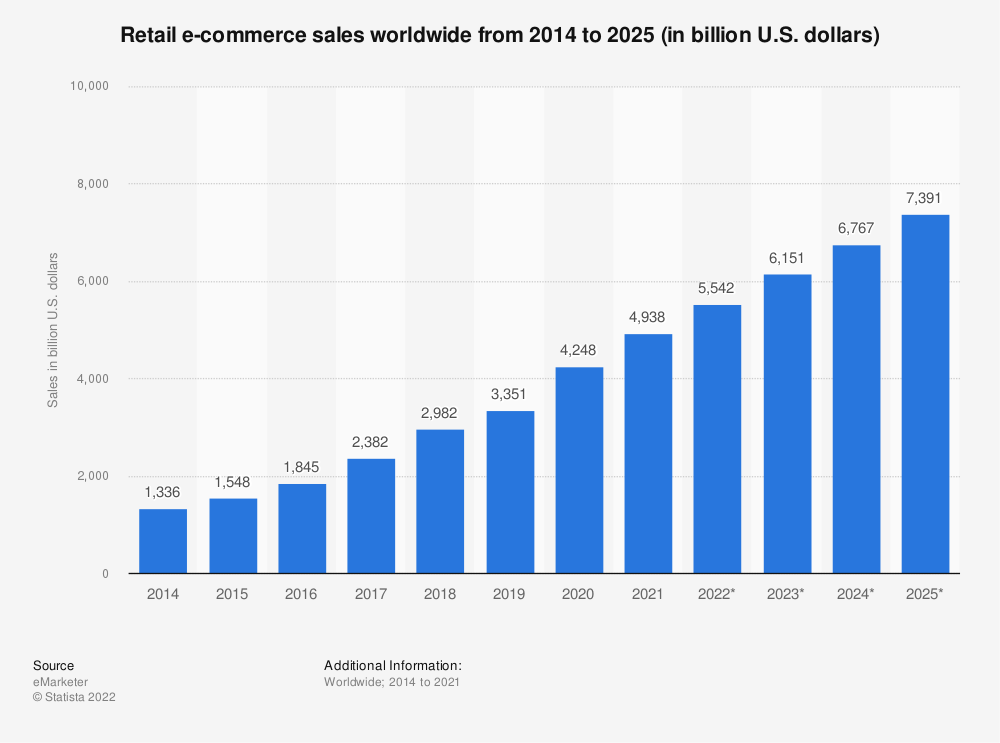

That said; this is near-term pain. Ecommerce isn’t going anywhere. Transacting online isn’t a fad—it’s a foundational pillar of the internet. The majority of commerce we conduct is still offline, and with a consistent upward trend in ecommerce growth—the future looks bright.

For the right people and businesses, this period of volatility and downward trajectory will make for business opportunity. Afterall, we all have to face the same challenges; including our competitors.

Nick Raushenbush

Nick Raushenbush is the cofounder of Shogun, software for building the next generation of ecommerce websites. Shogun helps 18,000+ ecommerce brands drive conversions, including Leesa mattresses, Gaiam yoga apparel, K-Swiss, MVMT watches and Chubbies shorts. Before Nick started Shogun, he founded a creative agency that has done work for Google, Roku, Soylent and Pokemon Go.