Exceptional Ecommerce

Blog

Get actionable ways to scale your store

-

23 Apr 24

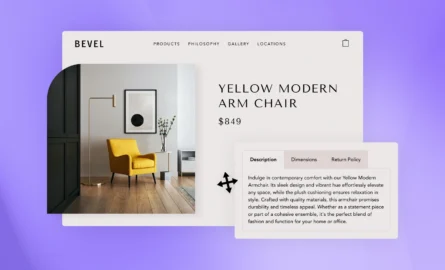

Add Tabs to Your Product Pages in Shopify

-

23 Apr 24

How to Diagnose and Fix a Low Conversion Rate in Shopify

-

23 Apr 24

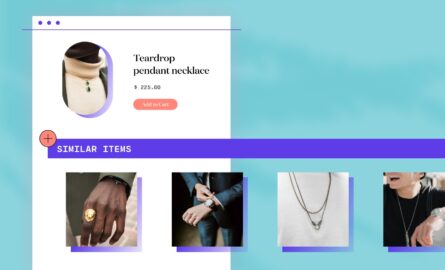

Adding Complementary Products to Your Shopify Store

-

12 Apr 24

How to Add Related Products to your Shopify Store to Increase AOV

-

12 Apr 24

The Ultimate Google Optimize Alternative for Shopify

-

12 Apr 24

How To Set Shipping Rates by Location in Shopify

-

02 Apr 24

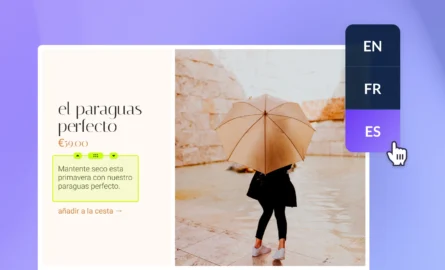

How To Translate Product Descriptions in Shopify

-

02 Apr 24

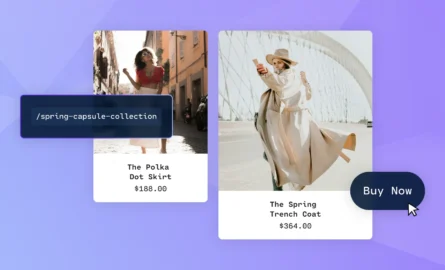

Optimizing Shopify Collection Pages for Max Conversions

-

02 Apr 24

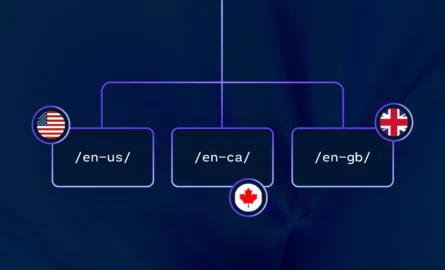

How To Handle Geolocation Redirects in Shopify

-

25 Mar 24

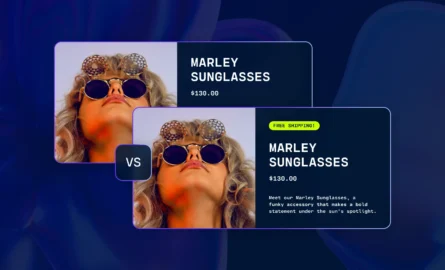

How to A/B Test a Product Page in Shopify

-

25 Mar 24

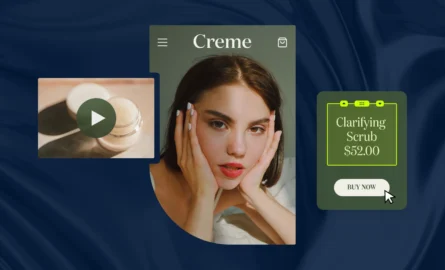

The Ultimate Guide to Shopify Product Page Optimization

-

18 Mar 24

How To Create Optimized Landing Pages in BigCommerce

-

18 Mar 24

Maximizing Your Shopify Product Pages for SEO

-

18 Mar 24

How To Create the Ultimate Homepage in BigCommerce

-

05 Mar 24

How To Show Content Based on Customer Location in Shopify