The Complete Guide to BigCommerce Payment Gateways

BigCommerce comes pre-integrated with over 65 payment gateways, and it offers the following payment features as well:

- No transaction fees: There is no additional fee for using a payment gateway.

- PCI compliance: The pre-integrated BigCommerce payment gateways are all PCI-compliant. This saves you from the trouble of obtaining this certification yourself, and you can be confident that your customer data is secure.

- Mobile-optimized: In addition to being compatible with many different payment gateways, BigCommerce also integrates with digital wallets such as Apple Pay and Masterpass.

In this guide, we’ll review how payment gateways work, how to add payment gateways to your BigCommerce store, and everything else you need to know about accepting payments on BigCommerce.

#cta-visual-fe#<cta-title>Fast and Flexible CMS For BigCommerce<cta-title>Gain full control over your site without sacrificing page speed with Shogun Frontend.Learn more

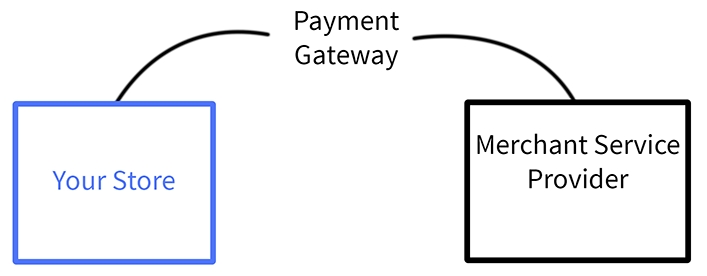

How Payment Gateways Work

A payment gateway is software that’s used to process online payments. One payment gateway can allow you to offer multiple payment methods (PayPal, Visa, MasterCard, etc.) to your customers.

A merchant service provider is a company that provides payment gateways. They function as an intermediary between your BigCommerce store and credit card companies/banks.

In less than a couple seconds, a payment gateway performs the following tasks during a transaction:

- Integrates with your store and allows you to process payment information provided by the customer.

- Encrypts payment information and transmits it securely.

- Relays back to your store whether the payment was approved or denied, so you can take the customer to a confirmation page or prompt them to try another payment method.

Not all payment gateways are equal. When deciding which payment gateway to use for your store, consider the following factors:

- Available Payment Methods: What if a potential customer only has a Discover card, but when they go to check out they find that your payment gateway doesn’t accept Discover? A limited number of payment methods will result in lost sales opportunities. In other words, the more payment methods available, the better.

- Fraud Protection: Your payment gateway should have tools for detecting and preventing fraud. Otherwise, you could end up losing a lot of money on fees, penalties, and lost merchandise.

- Recurring Billing: Do you use a subscription-based model to sell any of your products or services? If so, you should make things easy for yourself. Look for a payment gateway that offers features such as automated billing, upcoming payment reminders, and customizable billing plans.

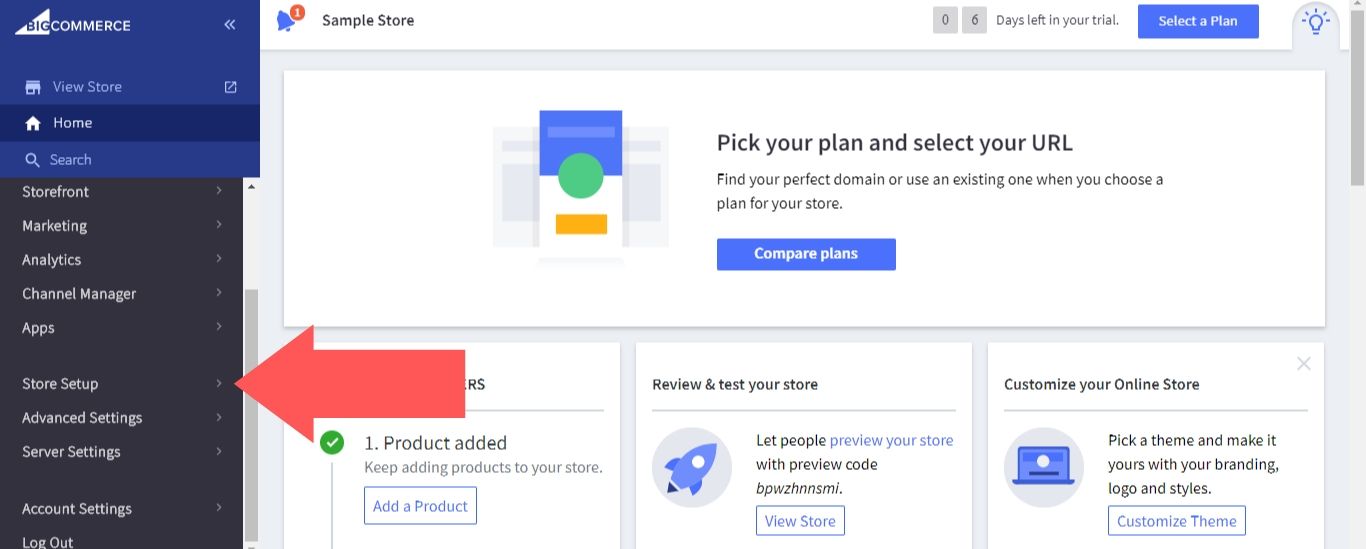

Adding Payment Gateways to Your BigCommerce Store

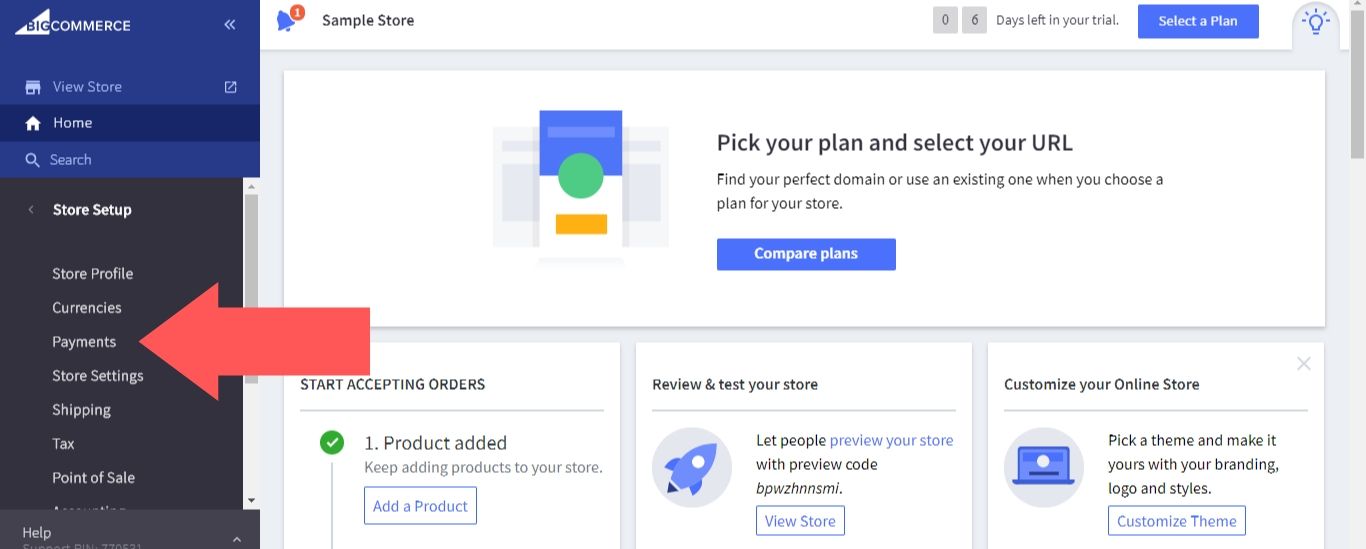

To add a payment gateway to your store:

1. After logging in to your BigCommerce account, go to “Store Setup”.

2. Select “Payments”.

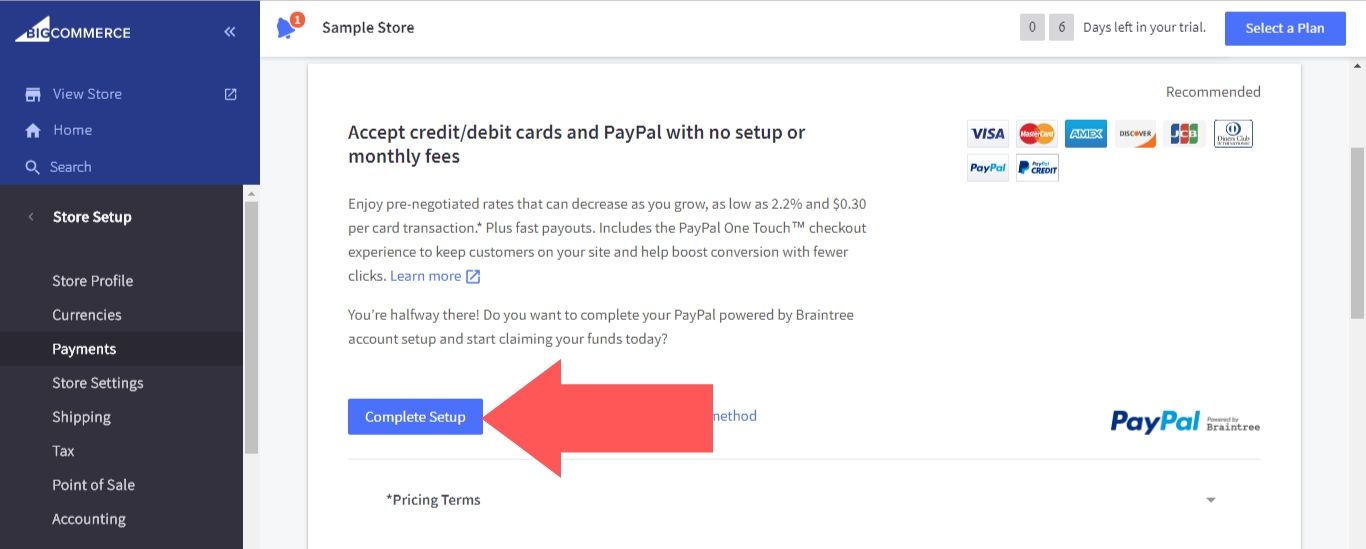

3. If your store is based in the US, you’ll see that the “PayPal Powered by Braintree” option is automatically enabled (it’s also supported in over 45 other countries). This gateway allows you to accept payments from PayPal and most major credit cards.

While BigCommerce does not charge you any transaction fees for using payment gateways, the payment gateway itself will charge you fees for using their service. The main benefit to choosing PayPal Powered by Braintree is that BigCommerce has negotiated an exclusive credit card rate for this gateway that’s lower than the average rate.

The credit card rate your BigCommerce store is charged with PayPal Powered by Braintree depends on your BigCommerce plan (the higher the pricing is for your plan, the lower your rate will be):

- Standard: 2.9% + $0.30 per transaction

- Plus: 2.5% + $0.30 per transaction

- Pro: 2.2% + $0.30 per transaction

- Enterprise: 2.2% + $0.30 per transaction or lower (exact rate can be customized for each plan)

If you’d like to use PayPal Powered by Braintree, select “Complete Setup” to create/connect your account.

You will need to submit an application to the PayPal Powered by Braintree team to have the negotiated credit card rate applied to your account.

Once your application is approved, you’ll be emailed a contract to sign in the next two to three business days. You should whitelist the email address “echosign@echosign.com” in order to prevent the contract from being sent to your spam folder.

After you send back the signed contract, the negotiated rate will be applied to your account within the next 10 days.

Of course, you don’t need to use PayPal Powered by Braintree if you don’t want to. The most popular pre-integrated payment gateway alternatives for your BigCommerce store include:

Amazon Pay

This is a hosted solution, which means it directs customers off of your website and onto the provider’s website to fill out their payment information. Then, it directs them back to your website when the payment is complete. Amazon Pay is supported in the United States, the United Kingdom, Germany, France, Italy, Spain, Luxembourg, the Netherlands, Sweden, Portugal, Hungary, and Denmark.

Square

This non-hosted solution is supported in the United States, the United Kingdom, Canada, and Australia.

Stripe

This non-hosted solution is supported in the United States, the United Kingdom, Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Singapore, Spain, and Sweden.

Authorize.net

This non-hosted solution is supported in the United States, the United Kingdom, Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Iceland, Ireland, Italy, the Netherlands, Norway, Spain, Sweden, and Switzerland.

Worldpay

This non-hosted solution is supported in the United States, and it is one of the few payment gateways that allows transactions for high-risk items such as firearms on your BigCommerce store.

BigCommerce also supports five digital wallets: Visa Checkout, Apple Pay, Chase Pay, Google Pay, and MasterPass. These options reduce the amount of scrolling that your customers need to do to check out on a mobile device, which leads to fewer abandoned carts and more sales for your store.

For online stores that have brick-and-mortar counterparts, BigCommerce supports the following offline payment methods: bank deposit, cash on delivery, check, money order, and pay in store.

You will need to choose a display name for each of your payment gateways (this is what the customer will see when they’re checking out). If you have multiple payment gateways, they will be listed in alphabetical order based on the names of the payment gateways rather than your chosen display names.

For PayPal Powered by Braintree and some other payment gateways, a button will also be displayed on your cart page.

While it’s possible to add as many payment gateways as you want, we recommend that you add no more than two or three. Too many payment gateways can give your site a cluttered, unprofessional look. Managing multiple payment gateways also makes it more difficult to keep track of your revenue. So, choose wisely.

Detecting and Preventing Fraud

We mentioned above that, when choosing a payment gateway, you should look for an option that provides you with fraud protection tools.

Let’s dive a little deeper into this subject, shall we? Protecting against fraud is incredibly important for your reputation, as well as your bottom line.

There are two main types of fraud that you need to worry about:

- Unauthorized Purchases: Most online stores allow users to save credit card numbers and other personal information. While this is convenient, the drawback to saved information is that a scammer might only need the user’s login credentials (which are often relatively easy to obtain through email phishing) to make purchases in their name.

- Identity Theft: After obtaining someone’s payment and personal information from other sources, a scammer can open an account on your store and make purchases in their name.

Depending on the savviness of the scammer and the alertness of the victim, both of these types of fraud can go on for a long time before the victim catches on (especially identity theft).

You must make an effort to detect fraud yourself. When fraud finally is detected, the victim will usually be able to have the transactions reversed. On top of losing inventory without receiving any revenue in return, you’ll likely incur chargeback fees from your bank for those reversals. Also, the experience may motivate the customer to never go back to your store again.

The following tips will help you prevent fraud and avoid those consequences:

- Monitor transactions and look for red flags: There are a number of suspicious actions that point to possible fraud. Did the customer suddenly change their shipping information? Are they using a different device to access your store than usual? Fraud prevention tools can automatically detect these actions and send alerts to your customers.

- Set a spending limit: Once a scammer is using someone else’s credit card, they’ll often try to use it as much as they can before they’re detected and the card is cancelled. For this reason, you should consider setting a limit on how much a single customer can spend at your store within a 24-hour period. Even with fraud detection tools in place, it can take a little time to stop fraud – a spending limit minimizes the damage.

- Require strong passwords: In addition to email phishing, a scammer could also use password cracking software to gain access to one of your customer’s accounts. This software systematically attempts different combinations of characters until it stumbles on the victim’s password. A simple password can be cracked quickly. If you require passwords to have numbers and special characters, your store will be more secure.

- Require the CVV code: The Card Verification Value (CVV) code is the three or four numbers that are printed on the back of credit cards. To comply with PCI, online stores are not allowed to save CVV information. This ensures that the customer must have their physical credit card to complete a purchase on your store. There’s no reason not to require the CVV code: it’s one of the best tools available for fighting fraud.

- Use AVS: The Address Verification System (AVS) matches up the billing address claimed for a credit card with the information that the credit card company has on file for the customer. Most payment gateways use AVS, but you should check to make sure.

Increase Your Conversion Rate with Shogun

Built-in BigCommerce features such as compatibility with digital wallets will surely increase your conversion rate.

But there’s no reason to stop there. Adding the Shogun page builder app to your store will help you raise your conversion rate even higher.

Shogun has a drag-and-drop interface and a large library of web elements for you to work with, which makes it easy to create high-quality custom pages for your store. You’ll be able to develop content yourself instead of hiring someone else to do it for you. And considering that the average cost of a freelance web developer is $60 – $80 per hour, this app can save you up to $250,000.

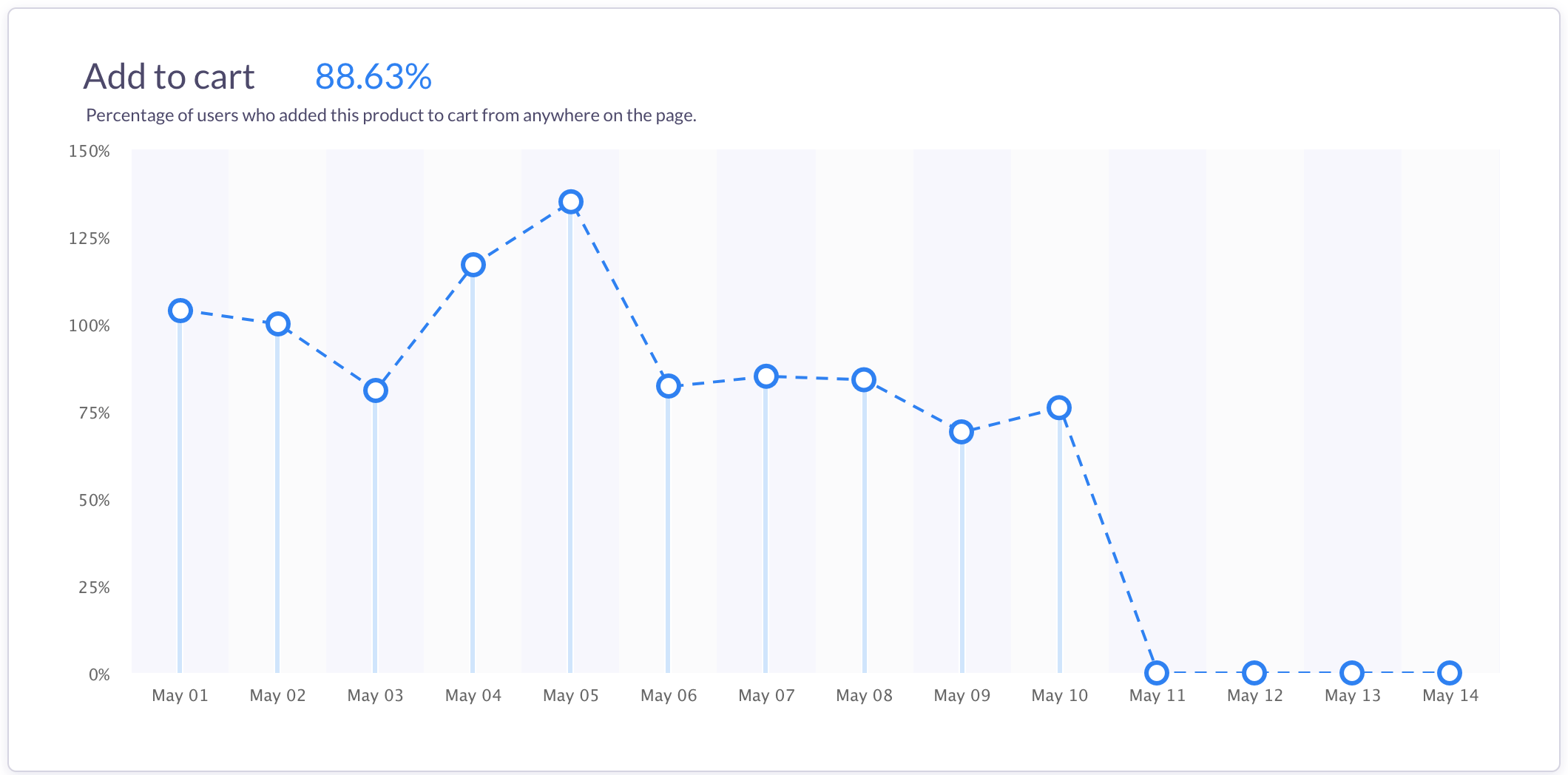

What sets Shogun apart from similar apps is that it doesn’t just allow you to create pages – it shows you how your pages are performing as well.

The following metrics are tracked for each page created in Shogun:

- Total Sessions

- Bounce Rate

- Top Clickthrough Destinations

- Top Outside Referrers

- Sales Conversions

- Add to Cart Conversions

You can even use Shogun to run an AB test that compares the performance of two different versions of a page. How useful is that? Whenever you have an idea for improving your site, you can actually put it to the test and see how your audience responds.

If your change results in a higher conversion rate (or whatever other metric you may be measuring), you’ll know that you should keep the change. If your change results in a page that performs worse, you’ll know that you should reverse the change. This information is simply invaluable.

With the robust e-commerce platform of BigCommerce and the tools provided by Shogun, you’ll have everything you need to create the best customer experience possible.

#cta-visual-fe#<cta-title>Fast and Flexible CMS For BigCommerce<cta-title>Gain full control over your site without sacrificing page speed with Shogun Frontend.Learn more

Adam Ritchie

Adam Ritchie is a writer based in Silver Spring, Maryland. He writes about ecommerce trends and best practices for Shogun. His previous clients include Groupon, Clutch and New Theory.