Buy Now Pay Later: How to Accept BNPL Payments with a Clear Conscience

Despite being a relative newcomer to the world of payment methods, the rapid adoption of buy now pay later (BNPL) across the globe has made it an option you simply cannot ignore as an online retailer. At least not if you want to remain competitive.

Not convinced? BNPL accounted for 2.1% of all global ecommerce transactions in 2020—that’s $97 billion worth of goods. Experts predict it will account for 4.2% of transactions by 2024, making it the fastest-growing payment method.

Despite the uptick in consumers using BNPL options, both lenders and retailers have had their fair share of criticism. Contributing to consumer debt, payment fraud, and product return hassles are things many ecommerce merchants are concerned about when offering BNPL.

Need help? This guide shares how buy now, pay later works, with guidance for figuring out whether your ecommerce website should offer it. We’ll cover:

- What is buy now, pay later?

- How does buy now, pay later work?

- The benefits of offering BNPL on your online store

- How to accept BNPL payments

- Should you offer BNPL services?

Buy now, pay later, also referred to as point-of-sale loans or point-of-sale financing, is a short-term financing option. It gives customers the ability to purchase products in incremental payments.

In other words, it’s exactly as it sounds: consumers buy their goods now and pay for them later.

While the concept of BNPL isn’t an entirely new one–shoppers have been using payment plans for decades to spread the cost of their purchases–it’s only really been an option for US retailers since 2015, when Swedish Fintech, Klarna, introduced it as an ecommerce payment method.

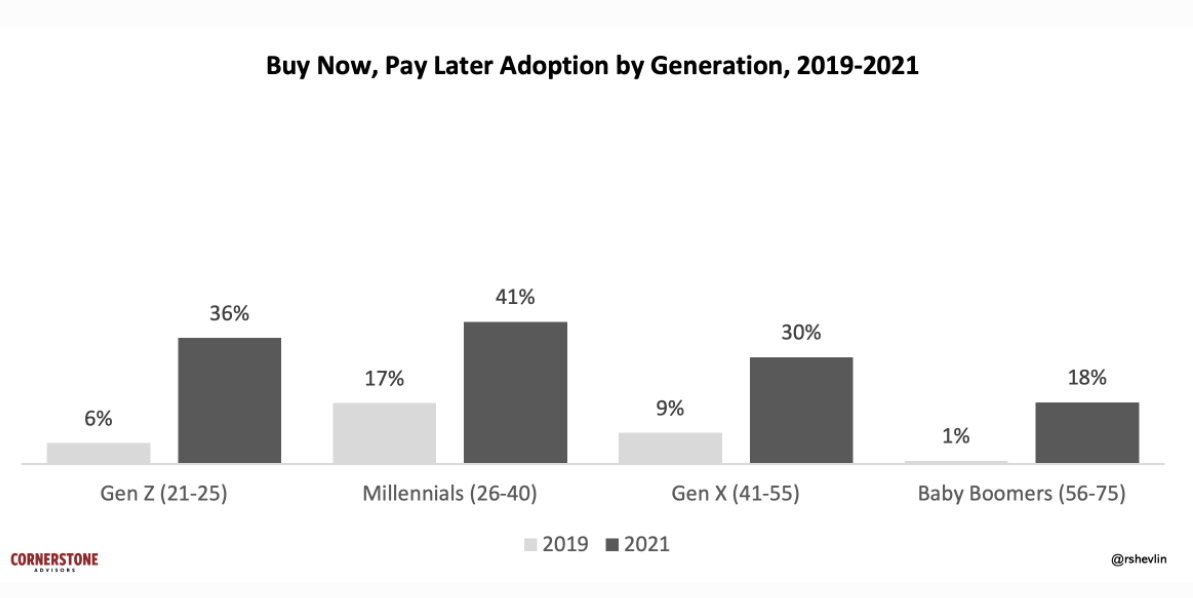

So, why is buy now, pay later so popular these days? The pandemic plays a large role. With consumers pushed to make their purchases online, not only has the ecommerce market itself grown exponentially, but the adoption of BNPL has accelerated too. And it’s not just certain generations driving this growth.

The percentage of Gen Z using BNPL in the US has grown six-fold from 6% in 2019, to 26% in 2021.

While this generation is responsible for the biggest jump in adoption, it can’t be ignored that Millennials’ use of buy now, pay later has more than doubled from 17% to 41% in two short years, too. Baby boomers and Gen Y are also preferring BNPL payments at checkout.

Either way you look at it, buy now, pay later is booming. And it’s changed how we shop online.

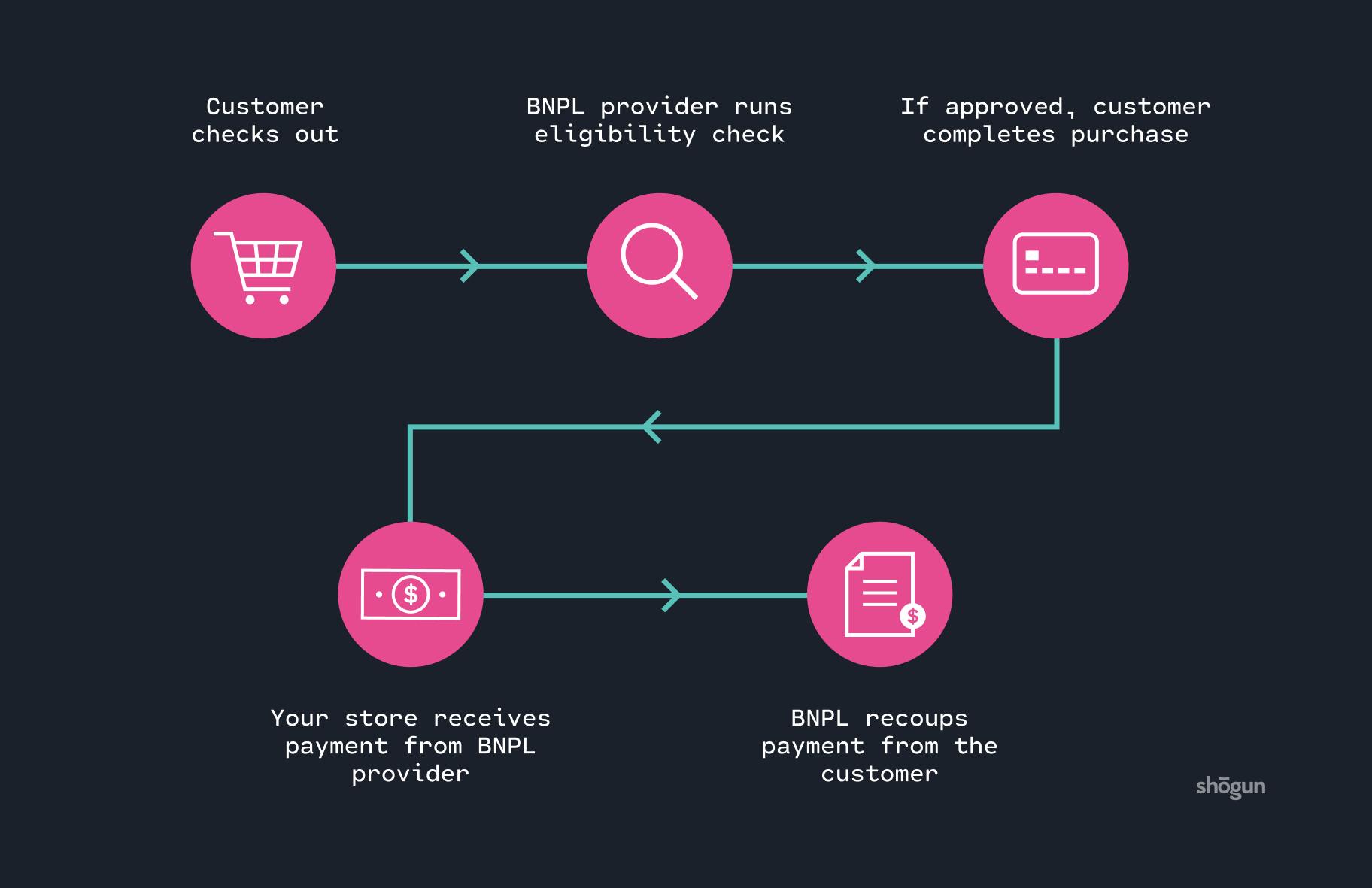

So, how does the process work?

While different BNPL providers will operate in slightly different ways, here’s what typically happens when you offer buy now, pay later as a payment option on your ecommerce website:

- A customer heads to the checkout to complete their purchase, selecting a buy now, pay later option. Depending on the third-party provider(s) you partner with (such as Klarna or Clearpay), the customer has a choice between: a) Paying for their order in installments or b) Paying the total amount at a later date

- The BNPL provider runs a quick eligibility check on the customer to check they can afford repayments, usually in the form of a soft credit check.

- If approved, the customer completes their purchase. You ship their goods as normal.

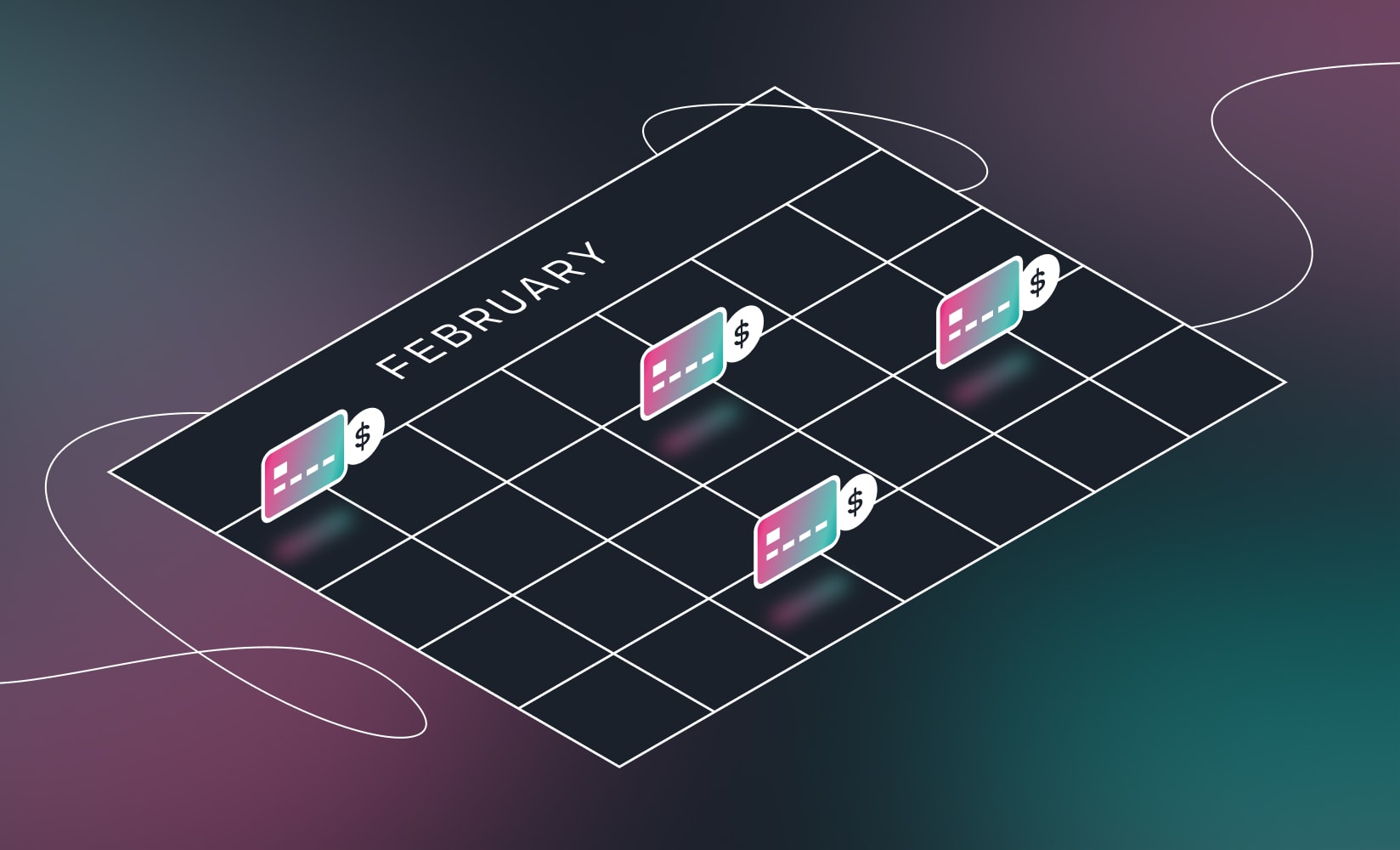

- You receive the payment in full from the BNPL provider minus any transaction or processing fees. While the fee structure will be dependent on the provider you use, expect this to be anywhere between 2% and 10% of the payment processed.

- The BNPL provider will recoup their money from the customer either in installments or at a later date.

At this point, your ecommerce business is removed from the process. You’ve received your money; the customer has received their products.

#cta-paragraph-pb#If the customer fails to make BNPL repayments, most providers won’t charge your customers late fees. However, it is worth being aware that non-payment after a certain amount of time can end up involving debt collection agencies.

Now we know what BNPL is and how it works, let’s take a look at the benefits of offering it on your checkout page.

Increase revenue

Given the option to pay for an item over an extended period of time, some shoppers are increasingly likely to make a purchase. In fact, BNPL has been found to increase conversions by 20% to 30%.

The reason for this is two-fold. Firstly, BNPL is popular amongst people making impulse purchases, particularly in industries such as fashion and electronics.

“When you make something so convenient, people may not be really thinking, ‘Do I have the budget? Can I afford this payment?’ You get more of that impulse-shopping behavior that leads to realizing they may not be able to make the payment.” — Gannesh Bharadhwaj, general manager for credit cards at Credit Karma

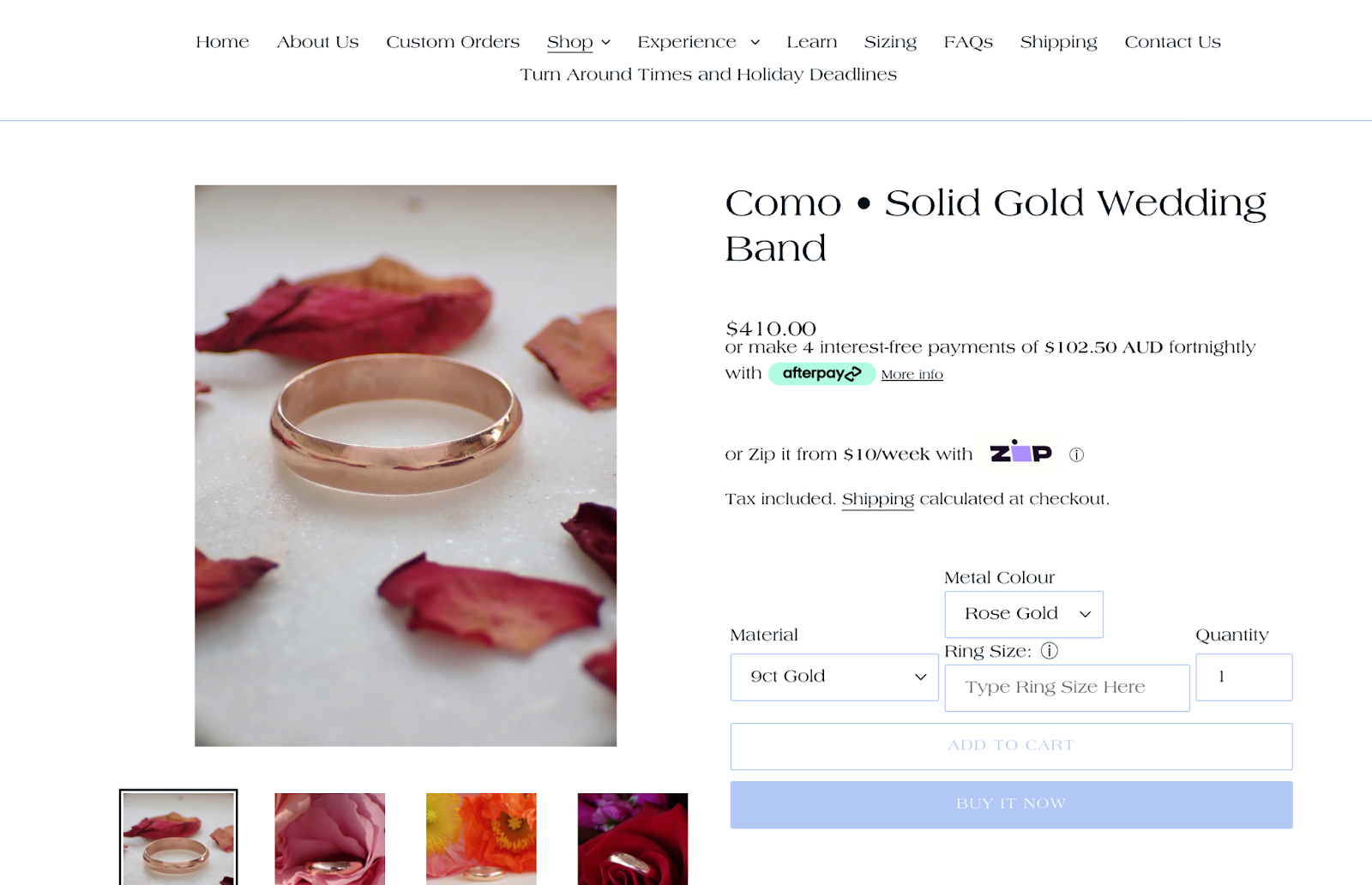

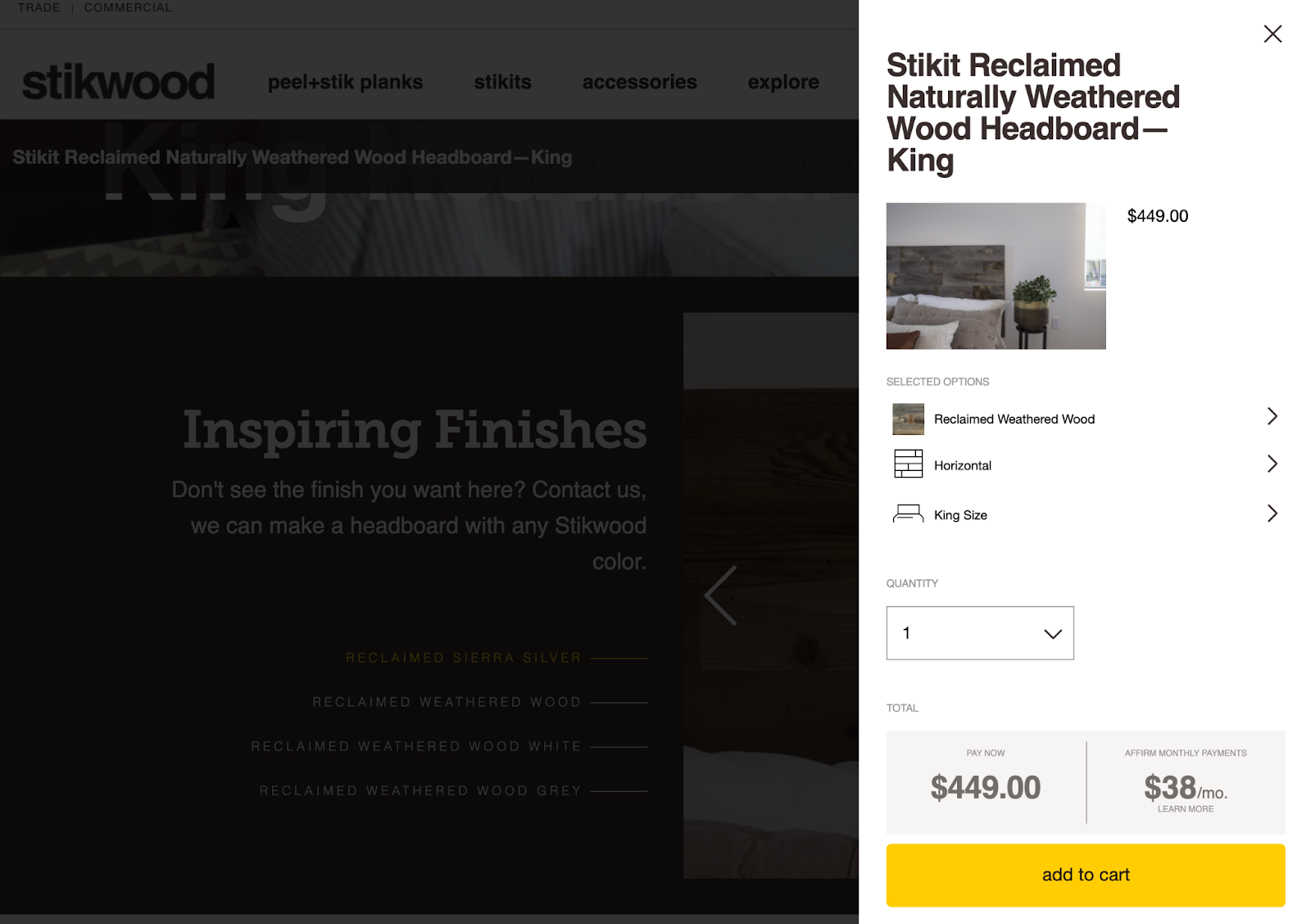

Secondly, it appeals to consumers that are debating whether or not they can justify the expense. This is often the case with higher value purchases, where the concept of paying for the goods at a later date, or spreading the cost over a period of time, is appealing to cash-strapped customers.

Take it from Georgia, the owner & jeweler behind Earth + Heart Jewelry, who says:

“As a jeweler, the products I sell aren’t a necessity and are higher ticket items than a lot of retailers, so the ability for my customers to purchase a piece they wouldn’t have had the money upfront for has made a big difference to lost checkout.”

“While you can expect to pay between 3-5% of each transaction in fees, which does add up for me when I’m selling jewelry for sometimes thousands of dollars, overall I think the downside of the fees is nominal and as a small business, a conversion with higher fees is better than no conversion”.

Incentivized by the fact they don’t need to pay in full (at least not straight away), shoppers have been found to buy more than intended, too. Some 24% of BNPL users spent more than originally planned simply because BNPL was available at the checkout.

#cta-visual-pb#<cta-title>Build landing pages that convert<cta-title>Create and customize landing pages with all the vital elements for conversions—or build a fabulous homepage quickly.Start designing today

Get paid upfront

Another great thing about offering BNPL is that—while your customers have the option to spread the cost of their purchase—you receive the total transaction upfront—minus any deductions. This is regardless of whether the customer repays money to the provider.

In other words: the BNPL provider takes all the risk and is responsible for recouping a shopper’s money, while your business gets paid regardless.

“Other than the initial application, the entire thing has been extremely hands off. Customers checkout using their payment method and I get the money fast. I never have to administrate anything like with the old “interest free” payment methods that involved a credit application for every sale.” — Georgia, owner of Earth + Heart Jewelry

Enhance the customer experience

Buy now, pay later as a checkout option gives your customers greater flexibility around how they buy, while meeting increasing expectations around choice.

Long gone are the days where merchants can get away with not accepting card payments. Consumers want a frictionless checkout experience, and BNPL is another way to offer that—catering to the 65% of undecided prospects who will make the decision to buy if the transaction is a simple one.

“For a mattress brand like ours, with products that consumers might feel unsure of purchasing online, BNPL is an incredible asset to our revenue because it lessens purchase hesitation,” says Stephen Light, CMO and co-owner of Nolah.

“Purchasing costly products online can really dissuade consumers from committing, especially if they don’t have the funds to immediately put down, so offering the opportunity to pay in installments has transformed ecommerce for merchants like us.

“It also doesn’t add any extra hassle for us, either, because it functions as simply as adding any other new payment method to our options,” Stephen says. “In the end, more payment methods mean more opportunities for customers to commit.”

Reach more customers

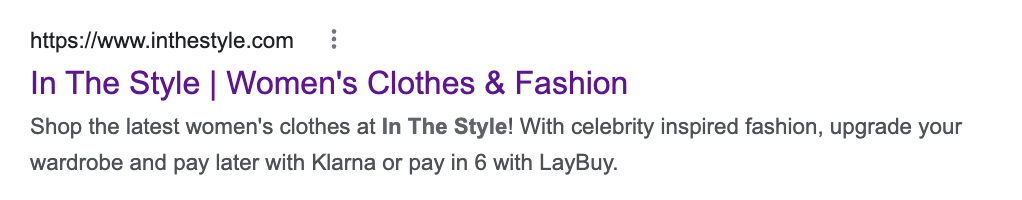

Many ecommerce sites promote the fact they offer BNPL across their site before the consumer even gets to the checkout. It captures the interest of shoppers that may only have been window shopping—many of whom wouldn’t have made it to the checkout without a BNPL option available.

Fashion retailer In The Style, for example, promotes its Laybuy and Klarna partnership in its meta description. Shoppers passively searching for clothes immediately see the store accepts BNPL payments—an incentive for them to visit and add items to their shopping cart.

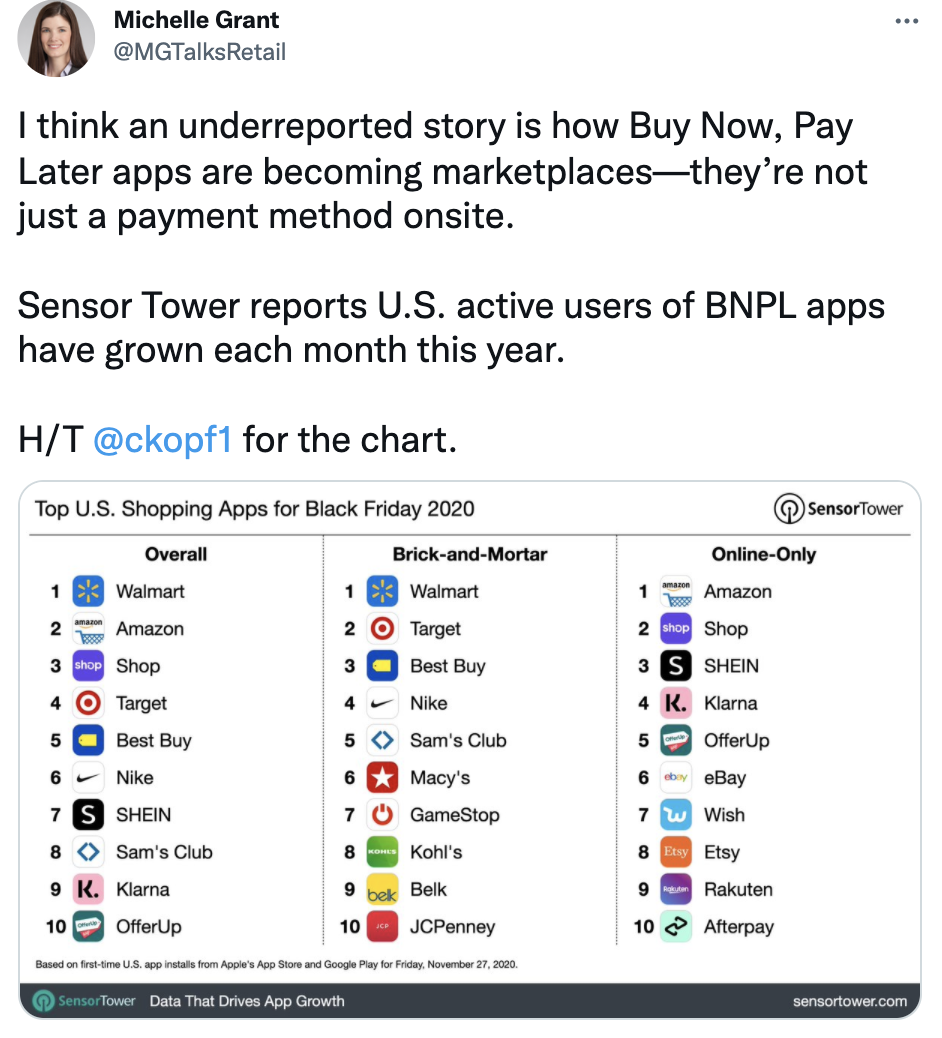

But the benefit to reaching more customers doesn’t end there. Another lesser known advantage to offering buy now, pay later is that you also stand to reach customers that may otherwise not have visited your site.

Most third-party providers have directories listing the online retailers that accept their payment installation plans. These apps are being used by more people each year—so much so, Klarna and Afterpay reached the top ten list of online-only shopping apps used throughout Black Friday.

Remain competitive

We already know that an increasing number of shoppers are opting to use BNPL as a form of credit. What happens if, as an online retailer, you don’t offer the option to your customers?

The short answer: You risk losing opportunities. One of the main reasons why BNPL is so popular, particularly amongst the younger generations, is because many don’t have a credit card. They also may not have immediate funds to pay with their debit card, leaving BNPL as their only option.

“When we first contemplated offering BNPL, I didn’t think that many people would use it. After a few months of use, however, I was shocked to see we were doing well over 20k a month in customers using BNPL.” — John Frigo, Ecommerce Manager at Best Price Nutrition

As more of your customers’ favorite brands (and potentially your competitors) begin to offer BNPL as a form of payment, expectations will change. Online shopping sites will very quickly be expected to offer alternative payment options as a result.

#cta-paragraph-pb#Learn more about Shopify Payments, the native gateway on Shopify with lower fees and access to features like Shop Pay and Buy Now, Pay Later.

To offer BNPL as a retailer, you’ll need two things: an ecommerce website and a buy now, pay later integration—the latter of which you’ll still need to decide on.

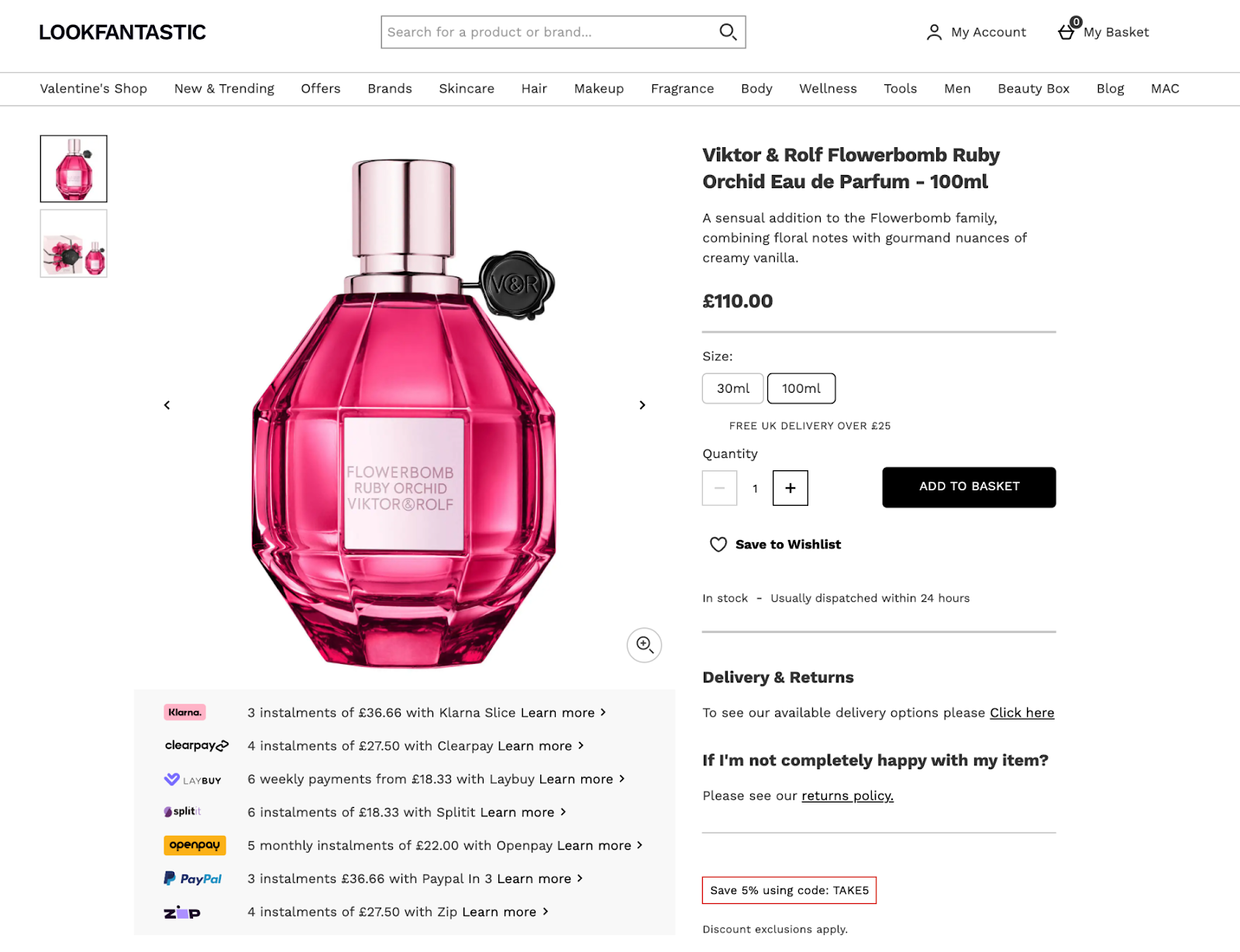

So, what are your options when choosing a third-party BNPL provider? And how do you go about integrating each one on your ecommerce site? Here are some of the most popular options available to you, their fees, and how to integrate them with your online store.

Klarna

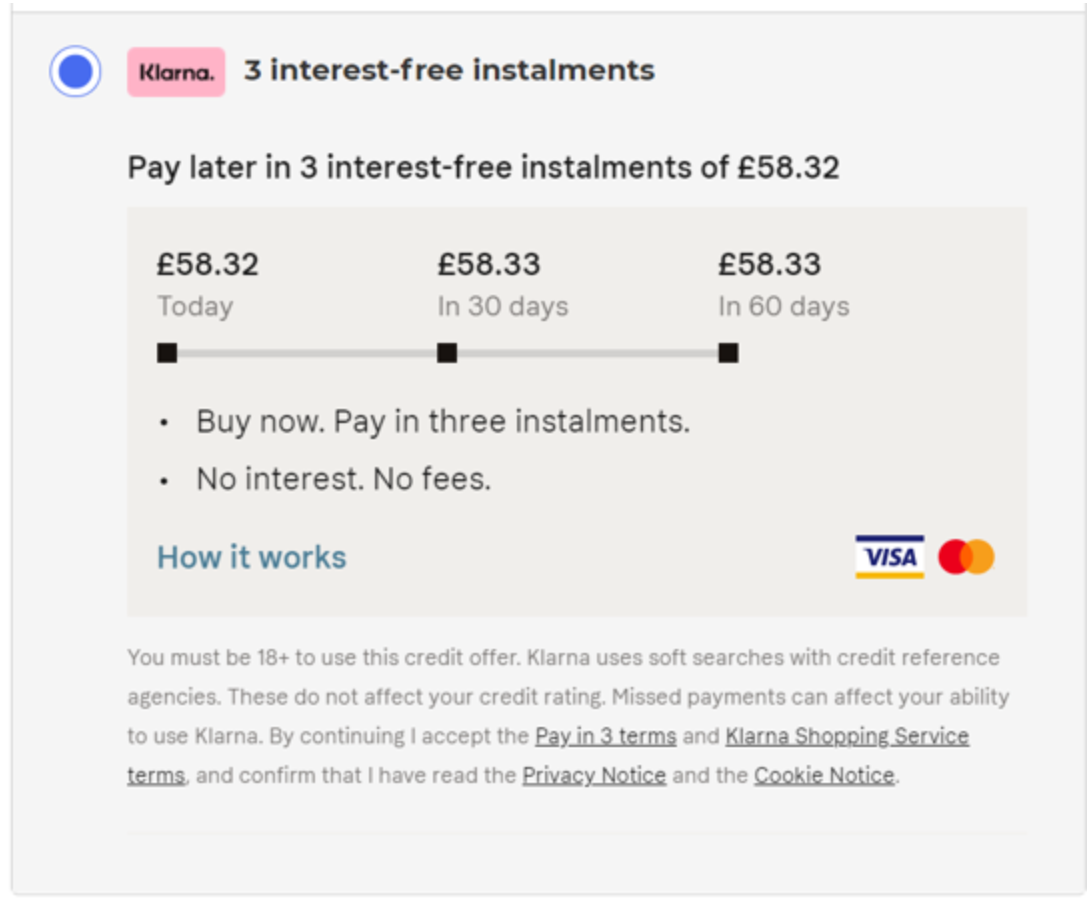

When it comes to offering buy now, pay later, Swedish payments company Klarna is one of the market leaders. It provides two alternative payment options to shoppers:

- Pay Later: Customers can defer payment for 30 days, at which point the payment is due in full.

- Pay in 3: Customers can split the cost of their purchase into three installments, with the first due as a down payment, the second due after 30 days, and the final installment due after 60 days.

Expect to pay a fixed $0.30 transaction fee when customers take out financing with Klarna, alongside a variable percentage fee of up to 5.99%. These fees are applicable regardless of whether your customer opts to Pay Later or Pay in 3, and will be automatically deducted from your Klarna payout.

The exact process of integrating Klarna will ultimately depend on which ecommerce website provider you use, but many of them make this process as seamless as possible.

For example: if you sell through a Shopify site, install the Klarna payments app in the app store, enter the required Klarna API credentials, and then follow the required instructions.

Regardless of which ecommerce platform you use, enable on-site messaging when integrating with Klarna. This informs website visitors early on that you accept Klarna payments, keeping frequent BNPL users around for longer.

Affirm

Affirm, another BNPL provider, offers two payment options to shoppers:

- Affirm Pay in 4

- Monthly Payments

While both options require your customers to pay for their purchase in installments, Pay in 4 allows them to make four interest-free payments every two weeks. Monthly payments, on the other hand, offer more flexibility by paying in monthly installments.

Should you choose Affirm as a third-party BNPL provider, expect to pay a $0.30 transaction fee, along with a typical variable fee of 5.99%. This fee is ultimately dependent on the type and size of your business.

You’ll need to complete an application before accepting Affirm payments on your ecommerce store. Once approved, follow the detailed instructions here to add Affirm as a payment option to both your ecommerce store and mobile app.

Afterpay

Afterpay, also known as Clearpay in the UK, allows shoppers to borrow money for a period of six weeks, making a total of four interest-free payments during this time–the first upfront.

Similar to both Affirm and Klarna, you will be charged a $0.30 fee per transaction that goes through AfterPay. There’s also a variable 3-7% commission rate.

Plus, much like with the alternative BNPL providers, the process of integrating AfterPay into your online store is a relatively straightforward one. It provides a bespoke option for businesses that use their own developers, meaning it’s still possible to offer AfterPay even if you’re not using one an out-of-the-box ecommerce platform.

#cta-visual-pb#<cta-title>Build landing pages that convert<cta-title>Create and customize landing pages with all the vital elements for conversions—or build a fabulous homepage quickly.Start designing today

Laybuy

Laybuy is another buy now, pay later provider that gives customers the opportunity to pay for online purchases in installments. But unlike some of the alternatives we’ve listed, Laybuy allows customers to spread the cost over six weekly payments. They even give consumers the option to pick their preferred payment day.

Laybuy’s fees fall anywhere between 4% and 10% of the total transaction, depending on your business and the country you operate in.

And, as with all of the other providers we’ve listed, Laybuy integrates most ecommerce platforms. Once your Laybuy application has been approved and processed, you will be able to access the API codes and integrate Laybuy with your Shopify, WooCommerce, or Magento store.

As a retailer, you want to get paid straight away, and your customers–at least some of them–want to pay in installments. Buy now, pay later providers tick those boxes. But as with anything, there are downsides to offering BNPL options to your customers.

Here’s what you need to consider before deciding if it’s right for your ecommerce business.

Enabling consumer debt

Perhaps the biggest issue with BNPL is that it’s not currently regulated in the way that other forms of credit are. Consumers are being encouraged to spend more than they can afford, leading to many unmanageable debts.

As a result, both merchants and the BNPL providers themselves are under increasing pressure to ensure they’re not misleading consumers—and driving unsuspecting shoppers into debt that they can’t afford.

The question is: as a retailer, how can you avoid contributing to the problem?

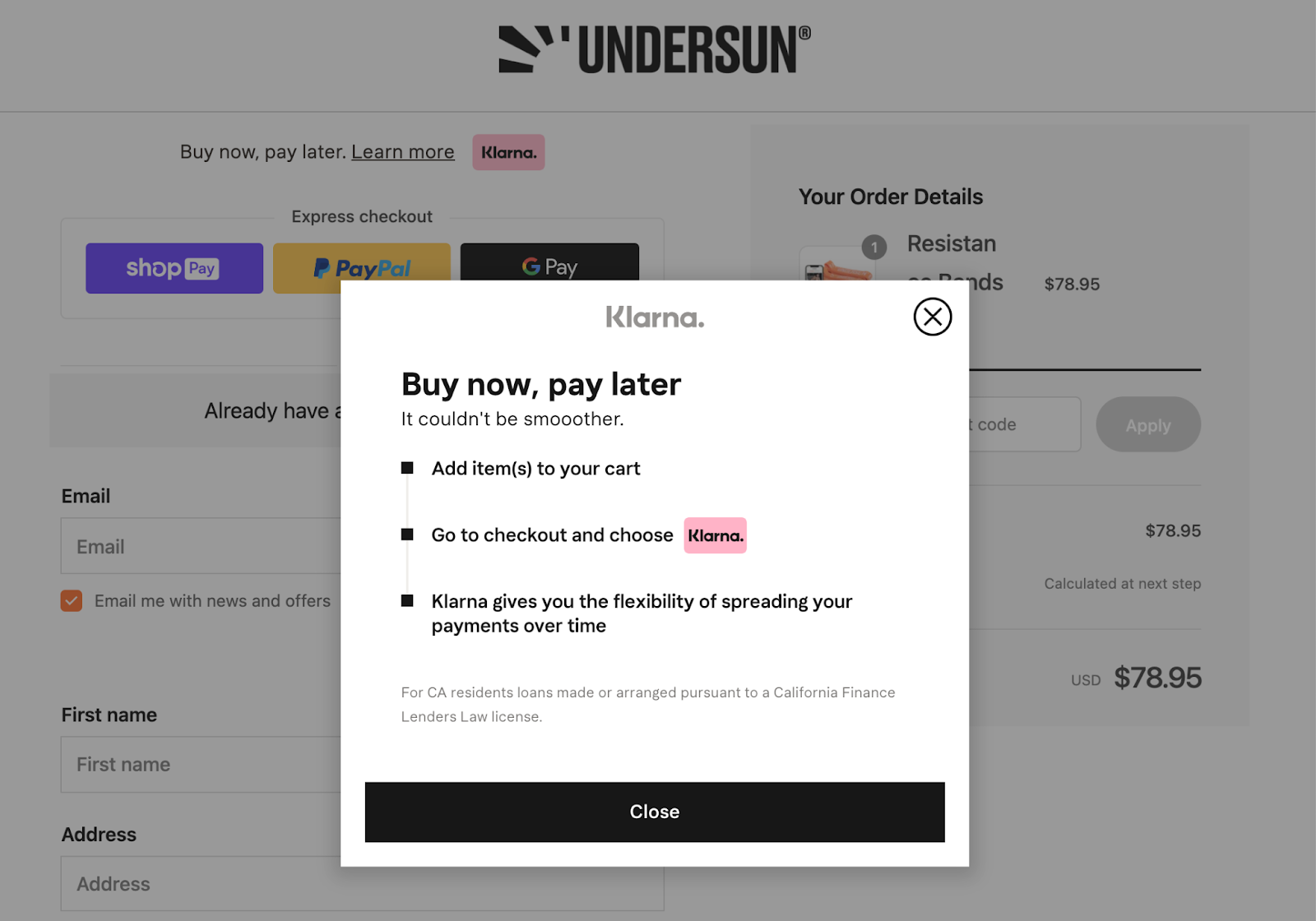

To start, always be transparent about the risk of late fees and credit checks at the point of purchase. Many BNPL companies are providing retailers with guidelines on how to present buy now, pay later. Some recommend that when offering their service at the checkout, you should consider having a standalone page or pop-up that clearly explains how it works.

Klarna provides some great examples of BNPL disclosures in its documentation. Here’s an example of how to communicate the risks associated with buy now, pay later plans at the checkout page.

Many consumers aren’t aware that third-party BNPL lends are required to report credit accounts to credit bureaus, either.

While this can help them build a good credit history, failing to make payments could cause late fees to be tacked onto their original purchase cost and damage their credit score even further. It’s critical you do your bit to educate your customers about these risks before taking out a payment installation plan.

Buy now, pay later fraud

Criminals are finding security holes in BNPL payment plans and claiming items for just a fraction of their retail cost.

Fraudulent chargebacks aren’t uncommon with buy now, pay later payments, either. This happens when either the owner of the card realizes it has been used to make an unauthorized payment, or when the card owner makes the purchase and later tries to claim it was fraudulent.

Most BNPL providers accept financial liability should this happen, but the less-than-ideal truth is that fraud can still be damaging to your business’ reputation.

Minimize BNPL fraud by screening out orders that have strong fraud indicators—such as those with unusual purchasing activity, logins from new devices, multiple transactions within a short amount of time, and even changes to the shipping address. Tools like ClearSale, Riskified, and Kount help combat this risk.

More product returns

Returns have always been a challenge for retailers, but by offering buy now, pay later could add fuel to the fire.

With some consumers opting to delay payment for 30 days, they can essentially return a purchase before the money even leaves their account. It’s why many consumers treat BNPL as a ‘try before you buy’ option.

While the financial aspect of returns won’t fall to you as the retailer (the BNPL provider will be responsible for issuing refunds), it will be in your interest to educate your customers on how they can request refunds through your BNPL provider. Make sure the returns process is outlined in your return policy.

Offer buy now, pay later sensibly

There’s no doubt that buy now, pay later has taken the ecommerce world by storm. In fact, driven by a shift in consumer spending habits, combined with an increasing need for instant gratification, BNPL has become one of the fastest-growing payment methods in the market—making it an option worthy of consideration.

Our advice to you? Take time to determine whether BNPL fits with your business’ core values. If it does, and you’ve decided to add BNPL to your online store, use it sensibly. Ensure you’re clear on the guidelines in your checkout process (including the downsides for your customer). Also, consider reserving BNPL options for high-ticket items only.

Granted, your customer has the ultimate responsibility for taking care of their finances, but you don’t want your conscience to be cloudy if you’re leading them into unnecessary debt.

#cta-visual-pb#<cta-title>Build landing pages that convert<cta-title>Create and customize landing pages with all the vital elements for conversions—or build a fabulous homepage quickly.Start designing today

Elise Dopson

Elise Dopson is a freelance writer for B2B commerce and martech companies. When she's not writing, you'll find her in the Peak Freelance community or on Twitter.