An Overview of Churn Rate: What It is, What Affects It and How to Improve It

What does it take to build a successful online store?

A product that meets customer expectations? Great service? A clear vision?

While all these are essential components to building a strong business, one element will give you a clear picture of whether your efforts are working: your churn rate.

Customers are the lifeline of every business, and your churn rate provides you with a great indicator of how well you’re managing to retain them.

Customer retention is one of the most important areas for an ecommerce merchant to address—in fact, in many ways, it’s even more important than customer acquisition.

When a person visits one of your product pages, there’s a 60-70% chance they’ll make a purchase if they’re an existing customer, but only a 5-20% chance if they’re a new customer.

It’s always easier to make a sale when someone is familiar with your brand rather than discovering you for the first time.

In this article, we’ll dive deeper into understanding your churn, how to calculate it and what systems you can use to reduce it.

#cta-visual-pb#<cta-title>Build a better Shopify store<cta-title>Make your store look and feel as unique as your brand by customizing with the best page builder for Shopify.Start building for free

What is churn rate?

Churn rate measures the number of customers who leave a business or decide to stop buying from a company over a certain period. Customers experience three stages of churn, according to Profit Well:

- Early-stage: Customers are learning about your product, testing it to see if it meets their needs and deciding whether to stick with it.

- Mid-term: Customers may have gotten bored or hit a wall with your product, and if you don’t reengage them, you could lose them.

- Long-term: These customers have a history with your product, and you need to upsell or upgrade them to keep them invested.

Calculating churn is straightforward for traditional business models: You simply need to analyze the number of subscription cancellations your business experiences over a period.

How to calculate churn rate

To calculate your churn, you can start by setting a time period you expect to receive repeat business from customers.

If, by the end of that period, a customer hasn’t repurchased from you again, you can define that as churn.

For example, let’s say you’d like to calculate your churn rate from January to the end of March. You know you had 1,200 customers in January, and by the end of March, you only received repeat business from 1,170 of those customers, meaning that you lost 30 customers.

Your calculation would be as follows:

The number of customers you lost over that period (30), divided by the number of customers you had at the beginning of the period (1,200), times by 100.

30 / 1,200 x 100 = 2.5%. Your churn rate is then 2.5%.

If you’ve been in business for a while, you’ll understand that, although customer churn can be stressful for a company, it’s also pretty normal. And it doesn’t always mean your product or service is terrible—sometimes financial constraints force customers to cancel subscriptions.

Or sometimes people’s lifestyles change, and they no longer use certain products.

While churn is a standard part of business, it’s essential to know when to worry and when not to.

What’s a good and bad churn rate?

After calculating your churn rate, you most probably have one important question — Is your rate OK, or is your business in trouble?

Most people view 5% as a decent churn rate.

While this may be a widespread opinion, it’s crucial to examine your unique business model and industry. Because what may be considered an excellent churn rate for a leading company in a completely different industry, may not be realistically achievable or great for your business.

When analyzing churn, it’s essential to understand that there is no universal “perfect” number. However, you can use the following numbers to understand what type of churn rate you can realistically aim for.

Churn rates across industries

Baremetrics regularly analyzes churn rates across different SaaS companies.

The company's findings are based on two main factors:

- Monthly customer churn rates

- Comparisons of companies with similar Average Revenue Per Account (ARPA)

In June 2020, Baremetrics found the following:

- Company’s Average Revenue Per Account: Under $10 | Churn Rate: 5.1%

- Company’s Average Revenue Per Account: $10-$25 | Churn Rate: 7.2%

- Company’s Average Revenue Per Account: $25-$50 |Churn Rate: 7.7%

- Company’s Average Revenue Per Account: $50-$100 |Churn Rate: 8.3%

- Company’s Average Revenue Per Account: $100-$250 |Churn Rate: 7.4%

- Company’s Average Revenue Per Account: $250+ |Churn Rate: 9.2%

Based on this research, the average monthly churn rate across these companies was 7.5%.

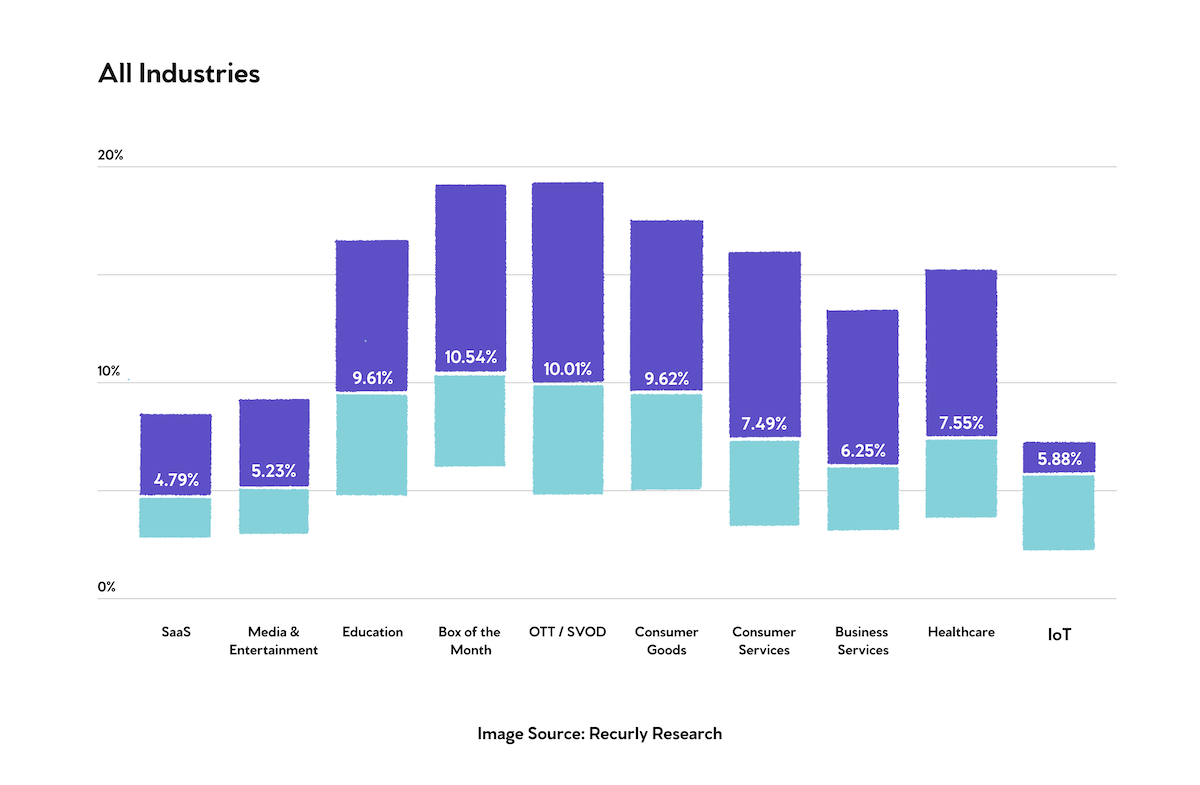

Expanding beyond SaaS, Recurly Research analyzed the churn rate of subscription businesses across different industries. The company found the following:

Recurly’s findings show that companies with more B2B customers (e.g. SaaS), experience less churn than B2C businesses.

And the average churn rate varies greatly across different industries.

Of course, one of your main objectives is to keep your churn rate as low as possible. To achieve this goal, you first need to understand the key factors contributing to customer churn rate.

What affects churn rate?

As we’ve already highlighted, multiple factors affect churn. Here are some of the most notable.

1. The length of the contract

Most subscription plans are done on a monthly basis, but the data shows that you would be better off if more of your customers signed up for annual contracts.

Stores that have 0% of their customers on an annual contract have an average churn rate of 9%, while stores that have 75-100% of their customers on an annual contract have an average churn rate of just 3%.

Of course, it’s easy to see why this is the case: An annual contract guarantees that you’ve got the customer for a whole year. With a monthly plan, the customer has 12 chances to opt out over that same period of time.

And monthly plans not only give customers more chances to opt out, they also make it more likely that they will eventually do so. This is because of the commitment involved with annual contracts.

For example, if a customer’s on a monthly plan, they may get frustrated when learning how to use your interface and opt out before even the first month is up.

But if they’ve signed up for an annual contract, they’ll have an incentive to be patient and discover everything your product has to offer in these early stages, which then increases the odds that they’ll remain a customer for years to come.

2. The ARPU

There’s a clear correlation between churn rate and average revenue per user (ARPU)—stores with an ARPU under $100 have a median churn rate of 6-9%, while stores with an ARPU over $500 have a median churn rate of 3-4%.

To understand this effect, you just need to look at online purchases from the perspective of the customer.

If the customer is only making a small purchase, they probably won’t think much about it. There’s no need to put in hours of research if you’re only parting with $5 or $10.

So, if they need to purchase the same product again in the future, they might as well use any of their other options rather than the store they initially chose.

But for larger purchases, there’s a good chance the customer will feel compelled to extensively research their options. And in that case, when they need to purchase the same product at a later date, they can save a lot of time by going with the store they already decided was the best value instead of researching their options all over again.

3. The age of a company

Studies have shown that if you have a new company, the average churn rate can be between 6% and 24%. On the other hand, companies with over 10 years experience an average of 2% and 4% churn.

These numbers make sense because, if you’ve been operating for more than a decade, you’ve most likely built a more reliable brand, you understand your customers better and you’ve formed long-term relationships with them.

With all these factors that can affect your churn rate, let’s get into how to reduce your churn and form longer-term relationships with your customers.

Tips on how to improve your churn rate

As you analyze your stats and uncover why your customers are no longer buying from you, you’ll realize that improving customer churn is never a one-step process. It requires a collection of strategies that all work in unison.

Here are some of the most helpful steps:

1. Improve Customer Support

Customers are essential for every ecommerce business.

Not only do they spend their hard-earned money on your products, they’ll also most likely tell their family and friends about your company because positive customer experiences often lead to recommendations.

So, invest money and time in ensuring that your customers always have a positive experience with your brand.

Improving customer support includes key components, such as hiring and providing adequate training for your customer service team, responding quickly to customer queries and actively listening to your customers, so they feel heard and understood.

2. Create a loyalty program

Loyalty programs are great for businesses and customers.

Customers like to be appreciated by the companies they buy from, and creating a program can be a bigger drawing card.

Research also shows that companies with loyalty programs see high returns.

For instance, 49% of consumers agree they spend more after joining a loyalty program.

Your loyalty program can offer points, rewards, coupons or anything relevant to your business and valuable to your customers. The key to a great loyalty program is understanding what your customers value and creating a points system that works for both your customers and your business.

3. Understand your churners

Sometimes it’s challenging to know why your customers are churning when they don’t say anything. Unfortunately, many consumers do this. Reputation Refinery, an online reputation management firm, found that 96% of unhappy customers won’t complain to you, but will tell 15 friends.

The best way to remedy this is to engage your churners actively. Ask them why they no longer want to hear from your company. You can achieve this through a short survey on the unsubscribe or opt-out page.

Feedback from the survey will help you understand the key components of your business that aren’t working and how to improve them.

Reducing churn starts with analyzing your numbers and industry

In an ideal world, churn rate would be non-existent. But gaining and losing customers is all a standard part of business. While it’s perfectly normal, it’s also essential to ensure that you keep a close eye on your numbers.

Start by doing your math and comparing your churn rate with your industry competitors.

If you find that you’re losing too many customers, take a look at why your customers are leaving. Is there a disconnect between product and customer expectations? Is your service team letting you down?

Whatever the reason is, find it quickly. Address the issues and continue keeping a close eye on your numbers.

#cta-visual-pb#<cta-title>Build a better Shopify store<cta-title>Make your store look and feel as unique as your brand by customizing with the best page builder for Shopify.Start building for free

Khanyi Molomo

Khanyi Molomo is a writer for ecommerce, SaaS and marketing brands. In addition to Shogun, she's written for Big Cartel, Demio and Growcode.