10 Ecommerce Payment Methods For Better Checkout Experiences

Have you had a look at your cart abandonment rates recently?

It’s a frustratingly common problem for ecommerce businesses. Sometimes, customers get as far as the point of purchase, then *poof*… vanish.

There are several reasons this happens—some of which are out of your control.

However, one thing you can do is review the ecommerce payment methods you offer. Ensuring you provide a range of options can encourage shoppers to make that final commitment.

In this article, we’ll explore popular payment options and why you might consider trying new ones.

#cta-visual-pb#<cta-title>Increase sales with the right landing page<cta-title>Design the perfect landing page that catches your visitors’ attention and drives conversions.Start building for free

5 Popular payment methods for shoppers

First, let’s look at online payment methods that tend to be popular with shoppers. Luckily, many are also favored by merchants because they contribute to an efficient ecommerce checkout flow.

1. Credit and debit cards

Top of the list comes credit and debit cards. By a significant measure, these remain the most popular online payment options.

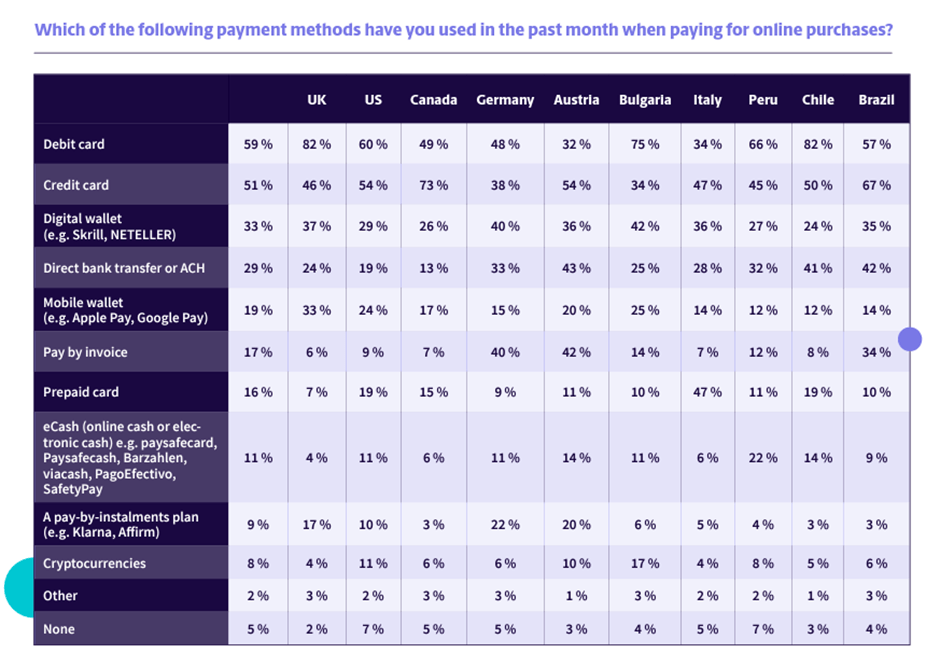

According to Paysafe’s 2022 consumer payment trends report, which looked at consumer behavior across 10 countries in North America and Europe, 59% of all respondents had purchased something online with a debit card in the previous month, while 51% had purchased with a credit card.

If you ship internationally, it’s interesting to know that there are distinctly different patterns from country to country regarding whether debit cards are more popular than credit cards and vice versa.

For example, in Canada, Austria, Italy, and Brazil, credit cards are much more popular for ecommerce payments than debit cards.

Meanwhile, the opposite is true in the US, UK, Germany, Bulgaria, Peru, and Chile.

While this a popular payment option for shoppers, merchants should take into account the transaction fees that may be applicable.

Ecommerce merchants can expect to pay processing fees, interchange fees, and assessment fees on credit and debit card payments.

Rates will vary depending on a variety of factors, so it’s important to consult your payment processor or merchant service provider for more details.

2. Cash on delivery

In the ecommerce context, cash on delivery (COD) doesn’t always mean the payment is in physical cash.

Generally, COD refers to a payment option whereby the goods are delivered to the customer before they pay for them, usually via credit card, check, or mobile payment.

COD is an excellent option for customers because it lets them inspect the goods upfront. But, make sure to look into any additional fees you might have to pay.

That said, it can be less desirable for merchants, as you have less confidence that you’ll get paid. Assuming you do, the process is much slower than an instant transaction.

COD is particularly appropriate in some sectors, like apparel or footwear, where customers like to order more than one size or color of a garment to see which suits them best. They keep the ones they want and return the rest.

Openly encouraging this way of shopping can make your store more attractive to potential customers.

If you do decide to offer COD, it’s essential to track orders and payments on a single platform. This way, you can integrate them into your overall cash flow planning and chase outstanding transactions.

One easy way to do this is to adopt an ERP program, so all your business processes are streamlined. ERP software can be used by various departments, including accounting and inventory management teams, giving everyone access to real-time information.

3. Mobile payments

The growing popularity of mobile payments over the past few years has seen many more customers expecting this option at the checkout.

When it comes time to pay, the customer makes a browser-based mobile payment via a Card Not Present (CNP) process and can do so from any device such as a smartphone, tablet, or smartwatch.

Not only is this convenient, but it’s also one of the most secure ways to pay online.

Mobile wallet payments work in conjunction with the best payment gateways to deliver a hassle-free checkout experience.

They also add another layer of security over the top of traditional bank cards.

As well as using PIN-based security, apps like Apple Pay and Google Pay secure the customer’s banking details by replacing them with a token—essentially, a series of randomly generated numbers.

Typically, apps like Apple Pay don’t charge transaction fees to shoppers for making purchases. These platforms primarily rely on the existing infrastructure of credit cards, debit cards, or bank accounts linked to the service.

Therefore, the transaction fees, if any, would be determined by the underlying payment method rather than the service itself.

4. Digital wallets

A digital wallet—like Amazon Pay or Samsung Pay—offers the ultimate convenience for customers. Why? It’s incredibly versatile.

Digital wallets are sometimes confused with mobile payments, but they’re not quite the same. You can certainly use digital wallets to make mobile payments, but they offer additional functionality too.

For instance, some digital wallets allow you to store not only bank card details, but also items like gift cards and loyalty cards.

As with mobile payments in general, another crucial benefit is the high security they offer. All data is encrypted using digital tokens, so the store never retains payment details.

5. Buy Now Pay Later (BNPL) options

To help with budgeting, many customers prefer to use Buy Now Pay Later options. Keep in mind, this is different from COD.

Put simply, pay later options are loans that customers obtain when they buy something.

From the customer’s point of view, it’s similar to paying with a credit card: quick, easy, and convenient. However, shoppers don’t need a credit card to use this payment method.

Popular BNPL platforms include Klarna and Afterpay—these can easily be integrated into your ecommerce site alongside other payment options.

Be aware that some shoppers may not be keen on this option.

These services often charge interest and late payment fees if a deadline is missed. As a merchant you may also have to pay processing fees that could be a fixed amount per transaction or a percentage of the overall purchase cost.

5 of the best online payment methods for ecommerce merchants

Sometimes, the best online payment methods for shoppers aren’t favored by merchants.

After all, when you’re running a business, you’ll want to have a reasonable degree of certainty that you’ll get paid.

With that in mind, here are a few payment options that directly benefit ecommerce store owners while still attracting prospective customers.

1. Direct bank transfer

There’s a reason so many transactions are made using direct bank transfer (where money is paid directly from one bank account into another).

If you’re making a big purchase—buying a property, perhaps—the seller will often ask to be paid this way.

It’s a long-established method that both parties can trust.

There’s also transparency around timescales, with payments usually completed within the same business day, making it ideal for cash flow planning.

Do your research, though, and look into any fees you may need to pay to accept these types of payments. They could include fees for interbank transfers or monthly fees to maintain the service.

2. Automated Clearing House (ACH) payments

ACH payments involve moving money directly from one bank to another through the Automated Clearing House network.

It’s a bank-to-bank transfer rather than an account-to-account one, even though the end result may be similar.

It can take more time to receive your money this way, particularly compared to a direct bank transfer. The money may take up to a few business days to arrive, depending on the situation. You may also need to pay origination fees or transaction fees.

Nevertheless, ACH payments are secure and predictable.

3. Electronic checks

Electronic checks are simply digital versions of traditional checks. They follow much the same clearing process—the only difference being that they can be processed online.

As with paper checks, an electronic check authorizes the transfer of money directly from a customer’s bank account to the merchant’s.

They’re easy to use and tend to have very low charges attached. If you’re processing a large volume of sales, electronic checks are a cheap and reliable way to do so.

4. Cryptocurrency

In the same Paysafe report, 8% of respondents said they had paid for an online purchase with crypto during the previous month.

That may seem like a small percentage, but it’s growing.

According to Grand View Research, the global market for crypto payments is expected to rise by 16.6% annually between 2022 and 2030.

So if you’ve dismissed the idea of accepting crypto payments in the past, it could be time to reconsider.

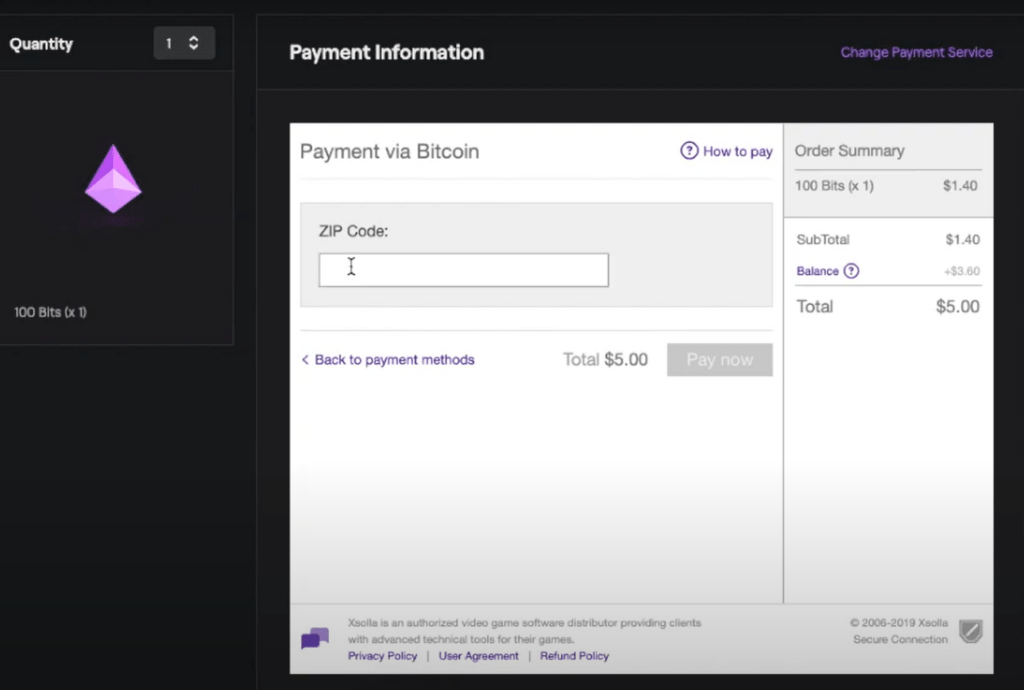

Modern crypto payment tools are better than ever. For example, if you want to accept Bitcoin, all you need to do is install a BTC payment processor on your site.

You might not even have to do that.

Some ecommerce platforms, such as Shopify and WooCommerce, already offer this functionality as part of the service. It’s worth checking your current tools to see if you can take advantage of the growing popularity of crypto.

Offering cryptocurrency payment methods could be the first step in your company’s growth strategy.

For example, if you’re considering selling shares of stock to the public for the first time, crypto transactions show potential investors that your company is forward-thinking.

As you prepare to go public, investing in IPO accounting software will streamline your accounting and reporting processes, ensure you remain SOX compliant, and allow you to scale the company’s financial capability to grow.

You can also visualize financial data.

This way, you can compare the number of crypto transactions against other payment methods and make better-informed, data-driven decisions in the future.

5. Direct debit

For regular payments, nothing quite beats direct debit.

These tend to be used by companies offering a subscription-based service. This could be anything from software to contact lenses.

Once the customer has authorized a direct debit to be set up with their bank, you can then charge them at regular intervals.

You can also vary the amount of money you charge without the customer having to approve each payment in advance.

This makes it a flexible option for merchants and is especially useful for subscription services.

#cta-visual-pb#<cta-title>Customize your store for more conversions<cta-title>Easily create custom product pages, collection pages, and more with Shogun Page Builder.Start building for free

Balancing the needs of shoppers and merchants

When it comes to online payments, not all shoppers’ needs are the same—and neither are merchants’.

It goes without saying that a small ecommerce store won’t have access to the same resources as a multinational corporation.

But a good guiding principle for merchants is to try to meet as many shoppers as possible somewhere in the middle.

The more payment methods you offer, the greater your pool of potential customers.

That said, there’s no point offering every type of payment method without considering how it may impact your business.

Instead, try to provide as many options as possible that can be easily implemented and will improve the customer experience.

Find the right ecommerce payment methods for you

In today’s digital environment, customers are spoiled for choice when shopping online.

Providing alternative online payment options is a great way to ensure your ecommerce platform stands out from the crowd.

Additionally, they could be the difference between abandoned carts and visitors that convert to valued customers.

From old-fashioned bank transfers to digital wallets, there are various payment methods available.

The right choice for your business will depend on which sector you operate in and who your customers are.

As long as you tailor the options to your target market, you can’t go far wrong.

#cta-visual-pb#<cta-title>Design beautiful pages for your store<cta-title>Easily create product pages, collection pages, and more with Shogun Page Builder.Start designing for free

The Shogun Team

Shogun's team is full of whipsmart ecommerce experts, dedicated to making the process of building and customizing your Shopify store simpler, faster, and more intuitive.