The Ultimate Shopify Guide to LTV Tracking

Lifetime value carries a lot of weight in the Shopify world.

Along with churn rate, CAC (customer acquisition cost — how much it costs your business to take on a new customer) and a few others, LTV is a live-or-die metric for many merchants, both small stores doing under $1M and larger stores expanding across borders.

In this article, we’ll take a bird’s-eye view of LTV tracking for businesses running on both Shopify and Shopify Plus. We’ll look at:

- Why LTV matters so much

- How to calculate LTV accurately

- How subscription stores can calculate it, too

- How to turn LTV data into actionable insights for store growth

Let’s jump right in.

What is LTV and Why Does it Matter for Shopify Merchants?

Customer lifetime value (LTV or CLV) is the amount of money a consumer will spend on your products or business over the course of their life.

LTV is arguably your single-best tool for decision-making. LTV helps you decide how much money you should invest in both acquiring new customers and retaining your existing ones.

Any Shopify merchant needs to calculate LTV accurately and track it consistently because both your churn rate (customer turnover) and profit rely on how much your customers want to re-engage with your brand.

In other words, the less shoppers care to return to your store, the less you’ll sell.

When you know your LTV, you can:

- Know which kinds of products your high-LTV customers want more of

- Know how much to spend to acquire a “similar” customer and still make a profit based on their projected buying habits

- Promote the products with the highest profitability

- Increase your marketing budget and inbound efforts to attract your most profitable types of customers

By themselves, these strategic moves aren’t likely to cause booming growth for your store. But together, they can offer a nice bump in profit — all thanks to LTV.

Quite a few stores rely on Shopify’s native tracking platform or Google Analytics for their LTV calculations. But it’s a bit more complex than a few clicks.

How to Calculate LTV

This is the baseline formula for calculating lifetime value:

LTV = average purchase value [x] number of times the customer will buy per year [x] average length of the customer relationship (years)

So, a young woman who consistently buys shoes from your online store could be worth:

$50 per pair of shoes [x] 2 pairs per year [x] 4 years = $50 [x] 2 [x] 4=$400

Whereas a dad with two kids could be worth:

$25 per pair [x] 6 pairs per year [x] 4 years = $20 [x] 5 [x] 4 = $600

LTV and CAC are closely tied together, which is why most merchants give them the most attention.

By itself, though, LTV is still your best indicator of future churn, your best projector of profit, and, like we mentioned earlier, your best aid in decision-making. LTV gives clarity to questions like:

- Should we expand into international markets and offer multi-currency payment options?

- Should we experiment with more campaigns targeted to X demographic?

- Should we pause our PPC campaigns that are performing below our Q2/Q3 average CTR?

LTV and Subscription Stores

Up to this point, LTV probably doesn’t seem all that scary. But if you sell by subscription, this is where things can get sticky.

I work with all types of subscription ecommerce businesses. Naturally, these businesses all want to optimize their customer acquisition costs, and all of them have different thoughts on the best way to do that.

But the common thread is this: Nearly all these stores are willing to pay more than the customers’ first subscription payment value. This is because they fully expect the customer to subscribe for at least a few months, which would (in theory) make up for the sunk costs upfront.

But, for how many months do they expect the subscription to last? That’s the million-dollar question.

Spending money on a marketing campaign that brings in trial customers who churn after just one payment (or no payment at all) is a much different ballgame than putting ad spend toward customers that stick around.

It might sound obvious, but marketing directors for any size Shopify store should be more willing to spend much more to bring in sticky customers (who subscribe for 12+ months) rather than save on marketing dollars to bring in customers who churn within three months.

To be exact, 4x more willing.

Marketing Campaigns and Measuring Customer LTV

So besides looking at PPC metrics like CTR and CPC, how do you know which campaigns are working (positively contributing to LTV and store growth) and which are not?

Let’s start from the top.

In Google Analytics, are you using standard ecommerce tracking to measure the first order value from a new subscriber? If so, you’ve fallen into a common pit. Here’s why:

- What first order value does tell us: The main benefit of tracking first order value is to know if your campaign targeting is working. More often than not, that first order is testament to a successful PPC ad.

- What first order value does NOT tell us: With standard GA tracking, you’re missing the next level of customer analysis — repeat purchases that come from particular campaigns.

Standard GA tracking fails to accurately portray how long these customers will remain subscribers.

Wouldn’t it be nice to see your repeat purchases by channel? That means properly attributing orders to each of your marketing channels. This fails to accurately portray how long these customers will remain subscribers.

Just think for a minute: If you could trace back your orders to the marketing channels from where they came, you could:

- Make more efficient use of media

- Tailor ads by customer segments

- Locate new customers (plus lookalike audiences)

- Boost the effectiveness of customer loyalty campaigns to boost retention

Fortunately, there is more than one way for marketing directors to view this data in Google Analytics. The first way is manual, and the second (which is more dependable) is automated, as it accurately ties repeat payments back to their origin campaigns.

Manual Method: Segment Orders and Assign Each Channel a Lifetime Value

For this solution, you’ll need to collect:

- The source of first orders (just a sample size will do) from over a year ago, by customer number or transaction ID

- These customers’ LTV

Unfortunately, the accuracy of these first order results depend entirely on your Google Analytics setup. If your ecommerce marketing attribution is not accurate — in other words, you’re using the out-of-the-box tracking scripts provided by Shopify — then your analysis will be inherently flawed.

In terms of No. 2, you can get that LTV from the subscription management solution you use; just export a list of customer payments. To link No. 2 to No. 1, you’ll need to have on hand either the customer number or transaction ID of the first payment.

Then, merge the two data sets in Excel or Google Sheets (using VLOOKUP), and average out the LTV by channel. Even though you’re only using a sample here, using 80-100 customer data in each channel should give you enough data to see significant trends (and maybe switch up some of your marketing strategies).

One of the downsides of this manual method is that LTV by channel will change every month, so you’ll need to repeat the process (and analysis) fairly often. And it can be just as time-consuming as it sounds.

But if you’re looking to minimize your spreadsheets and maximize your profit, there’s a better way.

Automated Method: Automate Your LTV Calculation by Channel

Subscription ecommerce isn’t slowing down anytime soon. Since the COVID-19 crisis began, it’s actually surged in some industries.

Shopify Plus subscription stores in particular have a unique problem: Tying repeat customer payments back to the marketing channel that led a customer to subscribe in the first place.

Unfortunately for subscription stores, tracking just the first-time payment isn’t going to cut it. To get an accurate gauge on the value of the customer, you need to look at LTV.

The time-intensive manual solution for subscription tracking. So what does an automated solution entail?

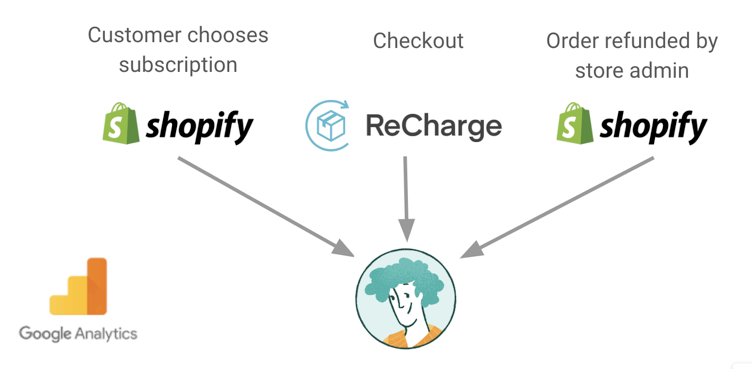

For instance, this Shopify app combines the three steps in the customer lifecycle to bring together a unified view of the customer, all within Google Analytics.

Once that customer has completed checkout, the app also lets you track each subsequent repeat payment back to the marketing channel from which they came (e.g. Google Ads, Facebook Ads, etc.). Plus — and most importantly — you can track other custom dimensions in Google Analytics to help you accurately drill down and calculate LTV.

LTV Tracking for Shopify Subscription Success

Imagine a store selling one subscription product for $50 per month. On average, it takes them $70 to acquire a new subscriber via Google Ads.

Now let’s take three fictional customers of that store: Claire, Eric and Luke.

These customers offer three very different values to the business, so segmenting them in Google Analytics is critical.

In the graphic below, do you see that Claire is costing the business money? This is because her lifetime value is less than the cost of acquiring her as a customer.

Eric might buy a product from the store once or twice, but he still has a short buying lifetime.

Only Luke continues to make repeat payments (and continue subscribing) for enough time to actually turn a profit for the business.

Many subscription businesses only make money on customers who subscribe for three or more months. But loyalty pays — loyal customers may subscribe for years (even if it’s on again, off again), which speaks to how valuable customer retention is for Shopify stores, especially those running on Shopify Plus.

What Can You Do With This Data?

Now that we’ve gone over LTV calculation for both standard ecommerce and subscription stores, what can you do with this raw LTV data?

The answer is simple: Use it for actionable insights to optimize your marketing campaigns.

This starts with segmenting your customer types. By segmenting customers, you can:

- Increase budget in the marketing channels that bring the highest-return customers, and

- Minimize your budget in your less effective campaigns

Maybe you have one channel that brings more Lukes and some that only bring you Claires.

Fool-Proof Tips to Increase LTV

By now, you’re likely already using optimization strategies to boost your return on ad spend (ROAS), CAC, and other crucial sink-or-swim metrics.

But don’t forget about the holy grail: LTV. You should know how much money your marketing leads are spending with you, what your acquisition cost is per customer and where to find the leads that will bring you the most bang for your buck.

Have you thought about:

- How much time customer group X is spending on your store?

- Which marketing channels are bringing the stickiest clients?

- Which marketing channels bring the most recurring purchases and subscriptions?

Here are a few tips for boosting your customers’ LTV to scale your business faster.

1. Track Your Shopify Events With Accuracy

There are dozens of reasons for inaccurate data, including:

- Shopify orders going unrecorded in GA

- Errors in Google Tag Manager (GTM)

- Too many products in one transaction, etc.

You can use an automated solution like Littledata to fix your tracking in Google Analytics and ensure your orders are automatically traced back to their original marketing channels. Your Shopify orders should match what you’re seeing in Shopify, right?

2. Retarget First-Time Buyers

Turn those one-time customers into recurring customers. Simple retargeting campaigns on Google, Facebook, Instagram and Twitter can help nudge those buyers to buy from you again.

Post-purchase surveys and an optimized, amazing on-site experience (including a smooth checkout flow) can also give you enough brownie points to convince a customer to return. And getting them to return once more is sometimes the key to turning them loyal.

3. Create Retention Campaigns and Customer Loyalty Programs

You might already have these programs running on your store. There’s a reason retention campaigns work for Shopify stores:

- Retained customers have higher average order value (AOV): Of your loyal customers, your top 10% spend three times more per order than the bottom 90% of your business, according to research from RJ Metrics. But that’s not even the wildest part. Did you know your top 1% loyal spenders spend five times more than your bottom 99%? Loyalty and AOV have a very direct correlation.

- Retained customers are more likely to return: After one sale, a customer has a 27% chance of converting again. After a second and third sale, their chances increase to a 54% chance of returning.

More Tips for the Road

According to eConsultancy, your chances of selling to an existing customer are hovering around 65%. Your odds of selling to a new customer drop to about 12%.

It goes without saying that investing your resources (and ad spend) in your current customer/subscriber base is a wise move. Here are a few bonus tactics to take away that encourage repeat purchases:

- Customer returns should be a breeze. Making the return process expensive or annoying for customers is a surefire way to lose them as a future repeat customer and brand advocate.

- Offer freebies to build brand loyalty.

- Use simple, on-store upsells to boost your AOV.

- Make it easy for long-time customers to reach you — stay in touch!

When you focus on attracting and retaining customers that are “in it for the long haul,” you’ll have an easier time scaling your Shopify store. Not only will these repeat buyers pay you more money for a longer period of time (providing you a higher LTV), they’ll also become advocates for your products, encouraging others to buy from you, too.

Nico Ghibaudy

Nico Ghibaudy is Marketing Manager at Littledata, a smart analytics app that fixes tracking for Shopify and Shopify Plus stores. Get accurate data in Google Analytics or Segment (whichever destination you prefer), plus connections for marketing tools (Facebook Ads, Google Ads) checkout flows (CartHook) and subscription management (ReCharge, Bold).