Battle of the Brands

The State of

Direct-to-Consumer

Buying Report

Overview

With a global pandemic as a catalyst in 2020, ecommerce sales surged. A year later, that surge continues.

But more activity online has meant more competition and disruption, especially when it comes to direct-to-consumer (DTC). We conducted original research at the end of 2020 to help you know how to adapt.

We surveyed 2,000 adults in the United States who had recently purchased something online to take stock of current attitudes toward online shopping. With the pandemic, we wanted to compare shopping with major retailers (think stores offering a wide variety of brands and products like Amazon, Best Buy, Walmart, Barnes & Noble), versus directly from a brand’s website or app (such as when you purchase a Casper mattress from Casper.com).

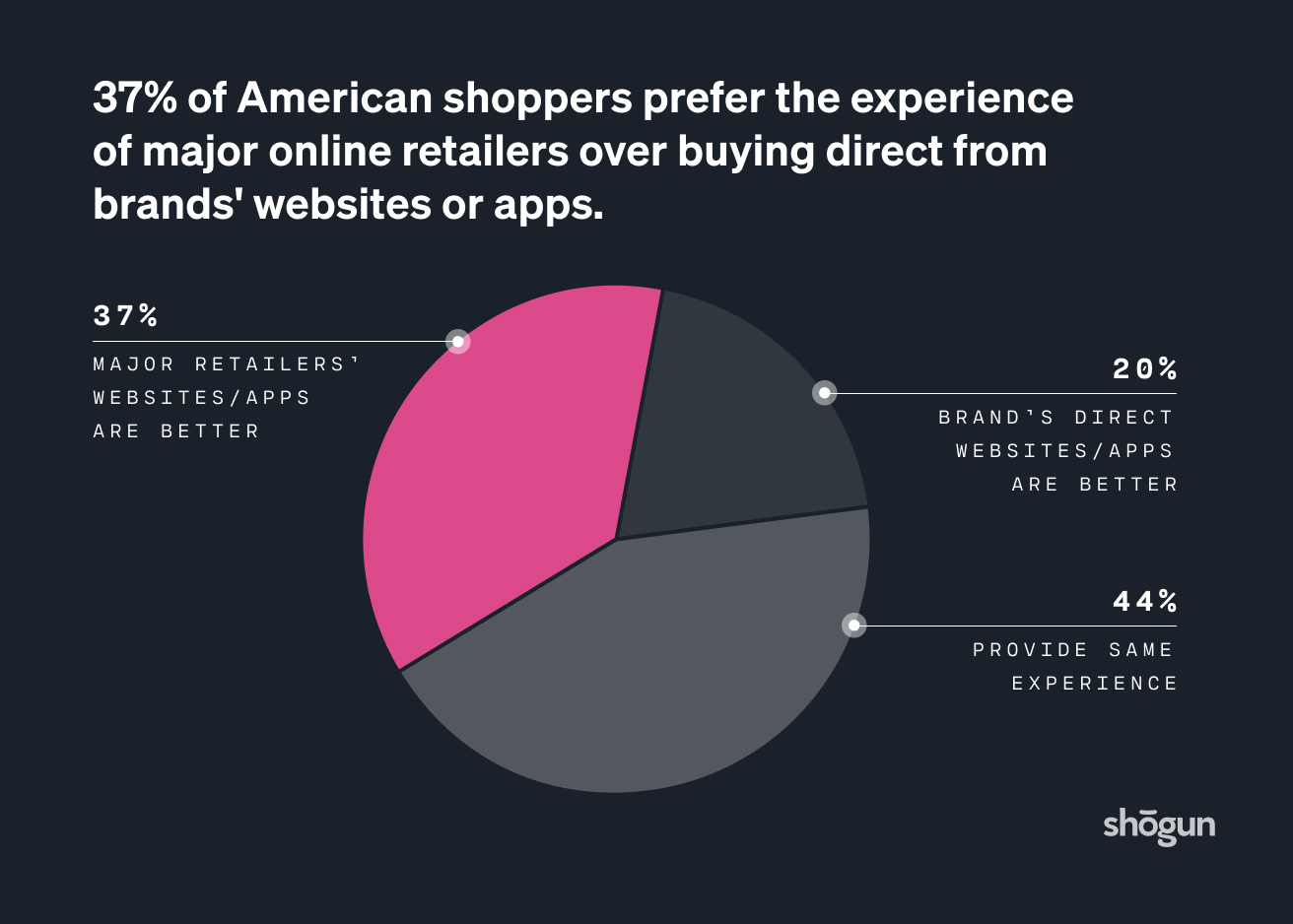

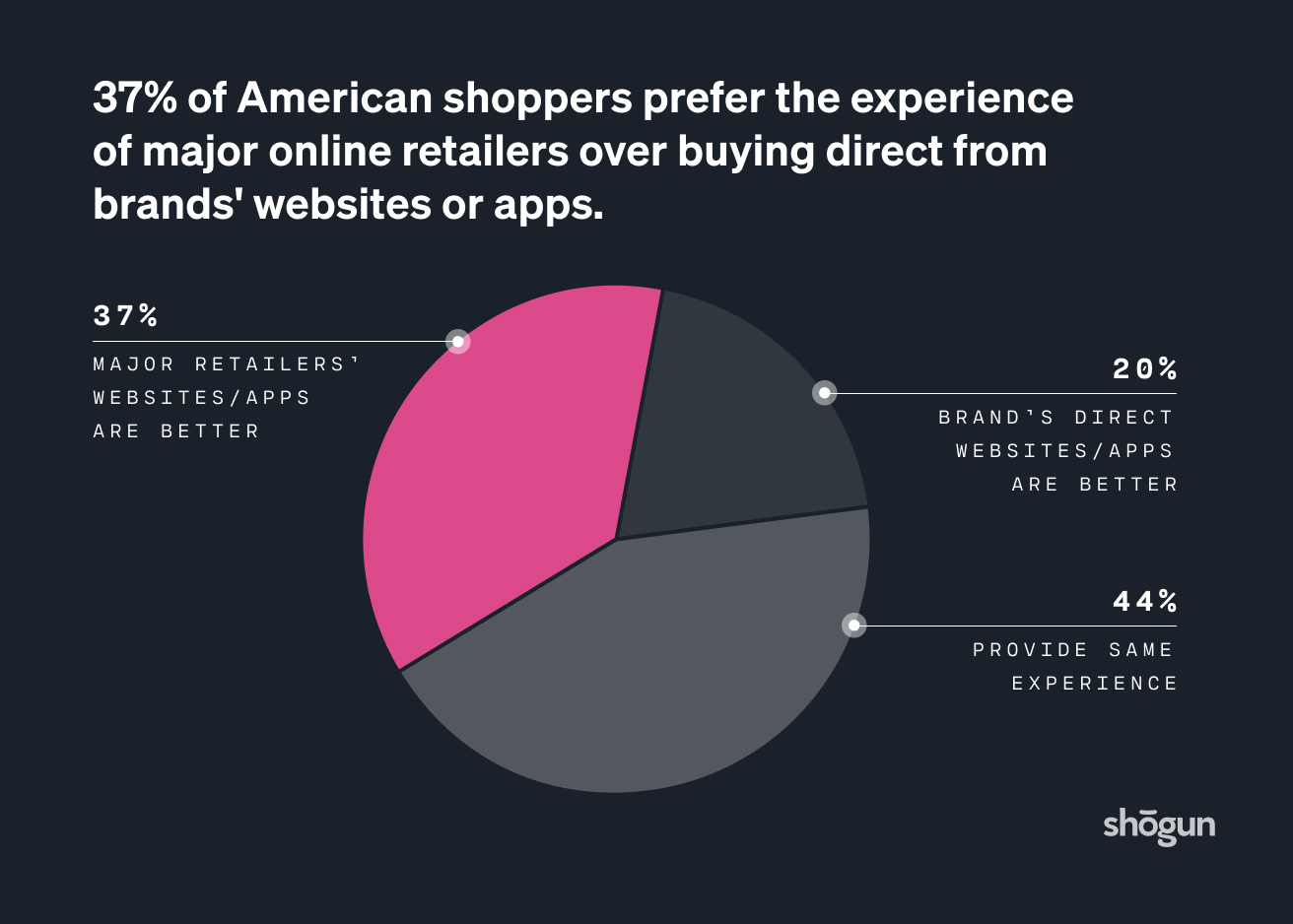

And a common theme emerged: while ecommerce has thrived in a hectic year, many Americans admittedly feel major online retailers provide a better shopping experience than brands’ current direct websites or apps.

Here we highlight our learnings on consumer preferences, how brands can build exceptional experiences, and why the time to do this is now.

Table of Contents

The pandemic effect

What DTC brands need to do to win in 2021 and beyond

Takeaways

Methodology

The Pandemic Effect

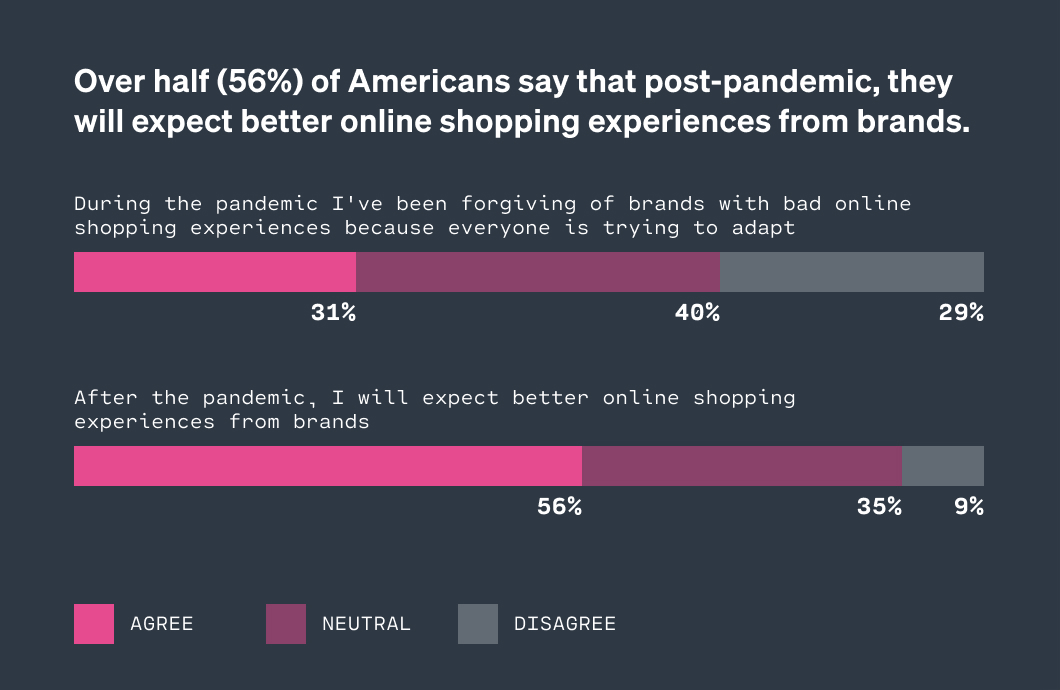

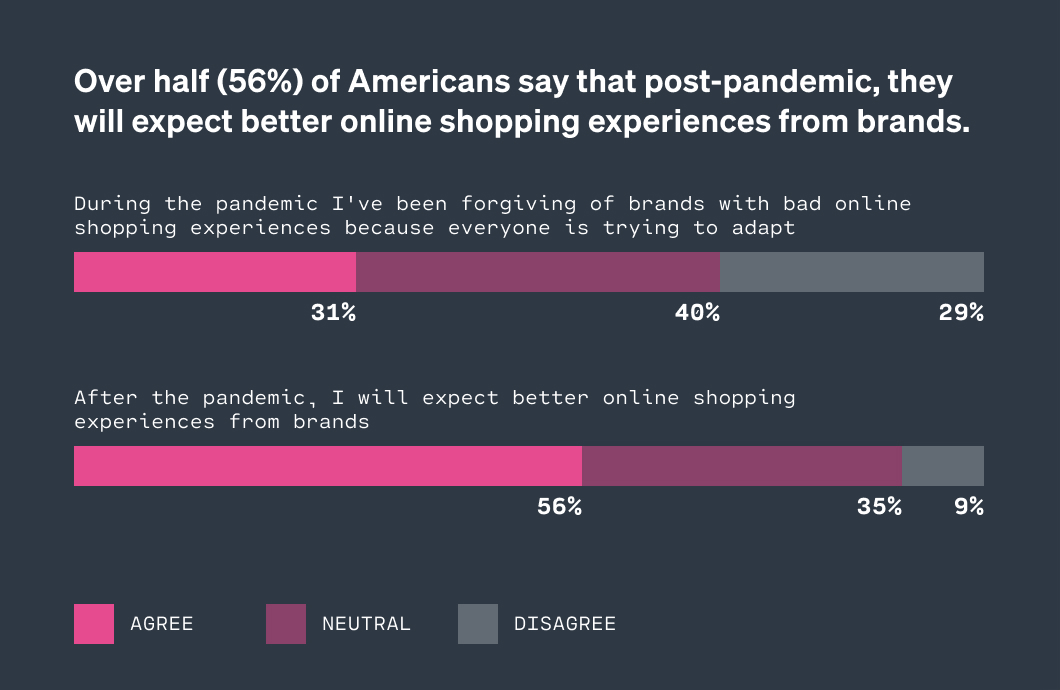

As we found, consumers are shopping online more since the pandemic and say they’re now more likely to buy direct from a brand. But the majority of our respondents still expect better shopping experiences — there’s still work to be done to please DTC store visitors.

Online sales are high, along with consumers’ expectations for better shopping experiences

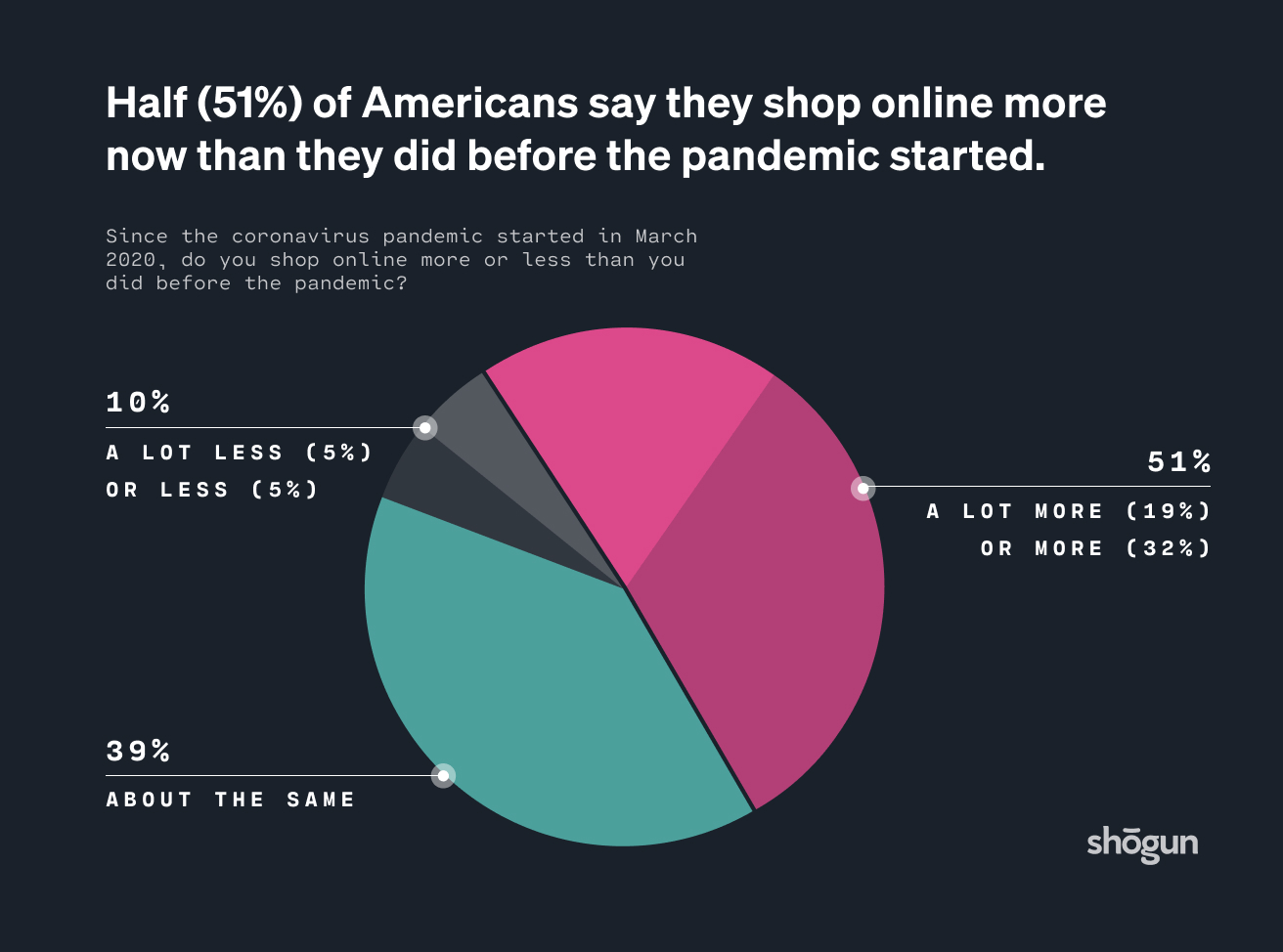

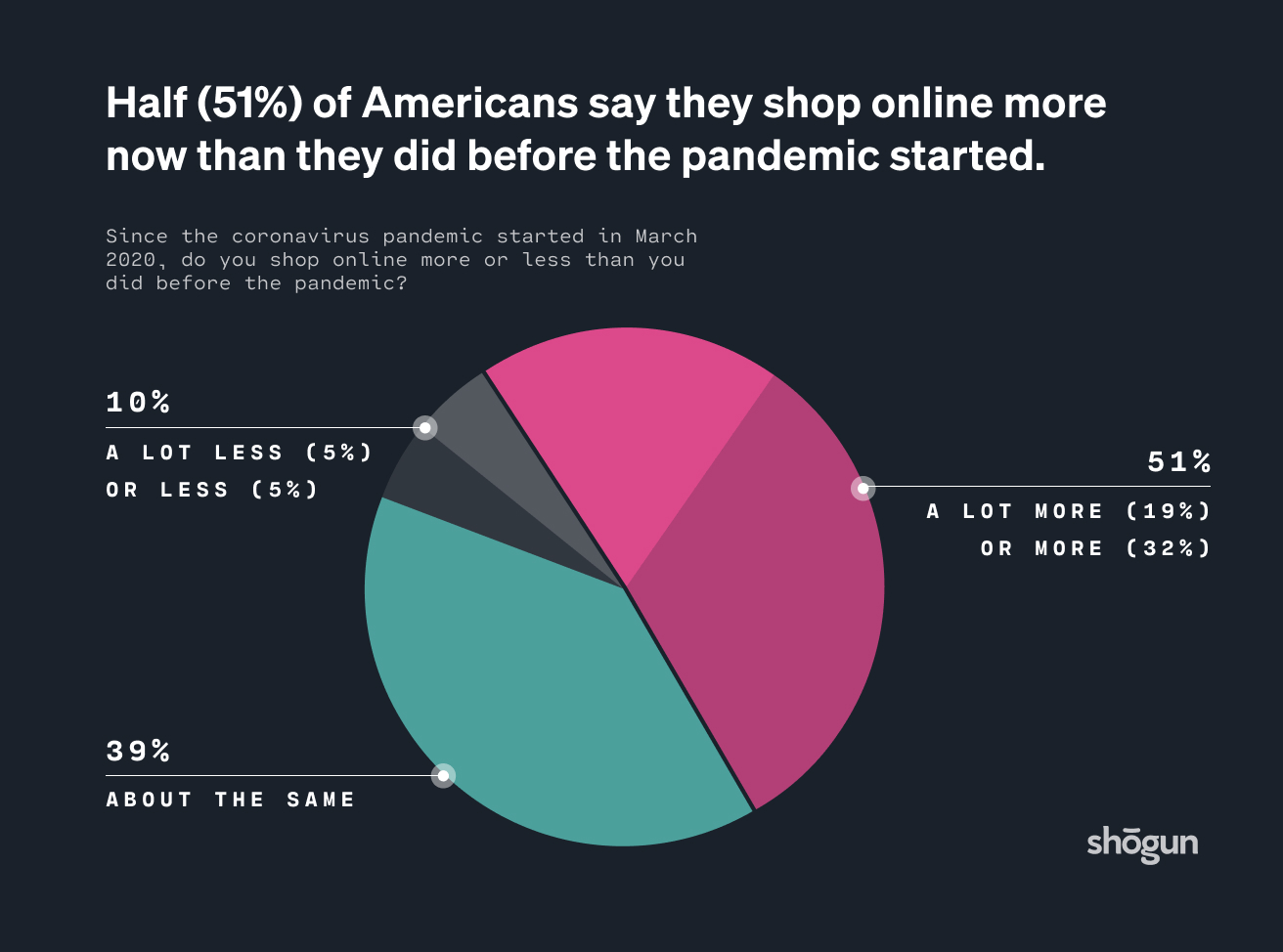

The majority of Americans say they’re shopping online more now than prior to March 2020:

DTC’s need to build sites to rival the major retailer experience

While more than two in five Americans think they provide the same experience, a very close 37% actually prefer the shopping experience of major online retailers over buying direct from brands.

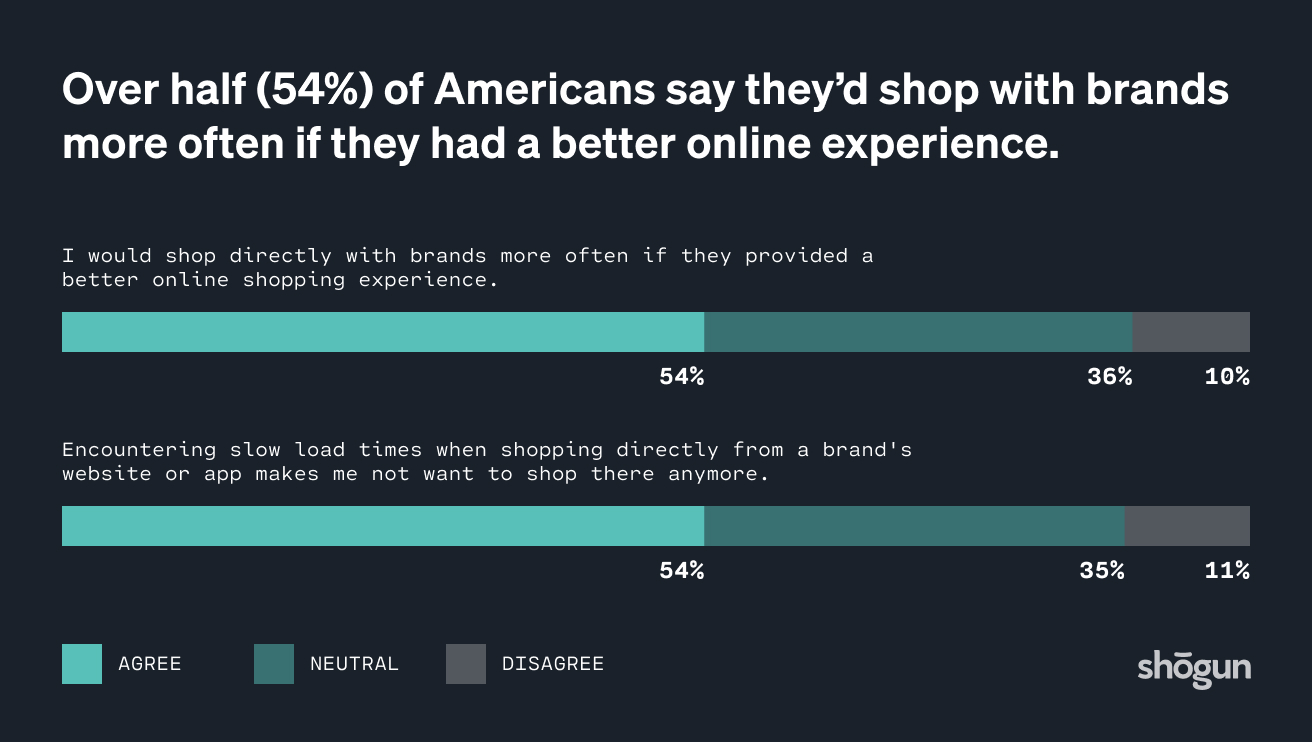

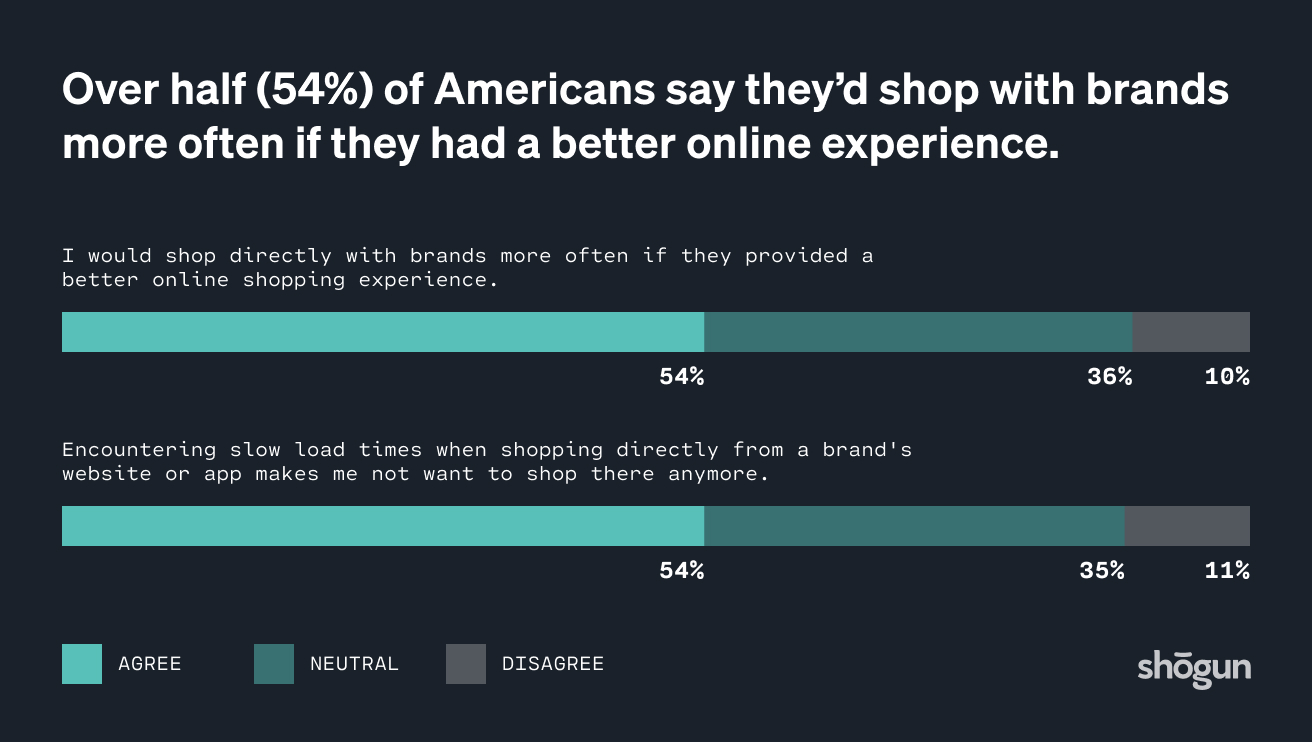

We also found that over half (54%) of American consumers say they’d shop directly with brands more often if they provided a better experience.

What exactly goes into a “better” experience? Well, we also saw that 54% of Americans say that encountering slow load times when shopping directly from a brand’s website or app makes them not want to shop there anymore.

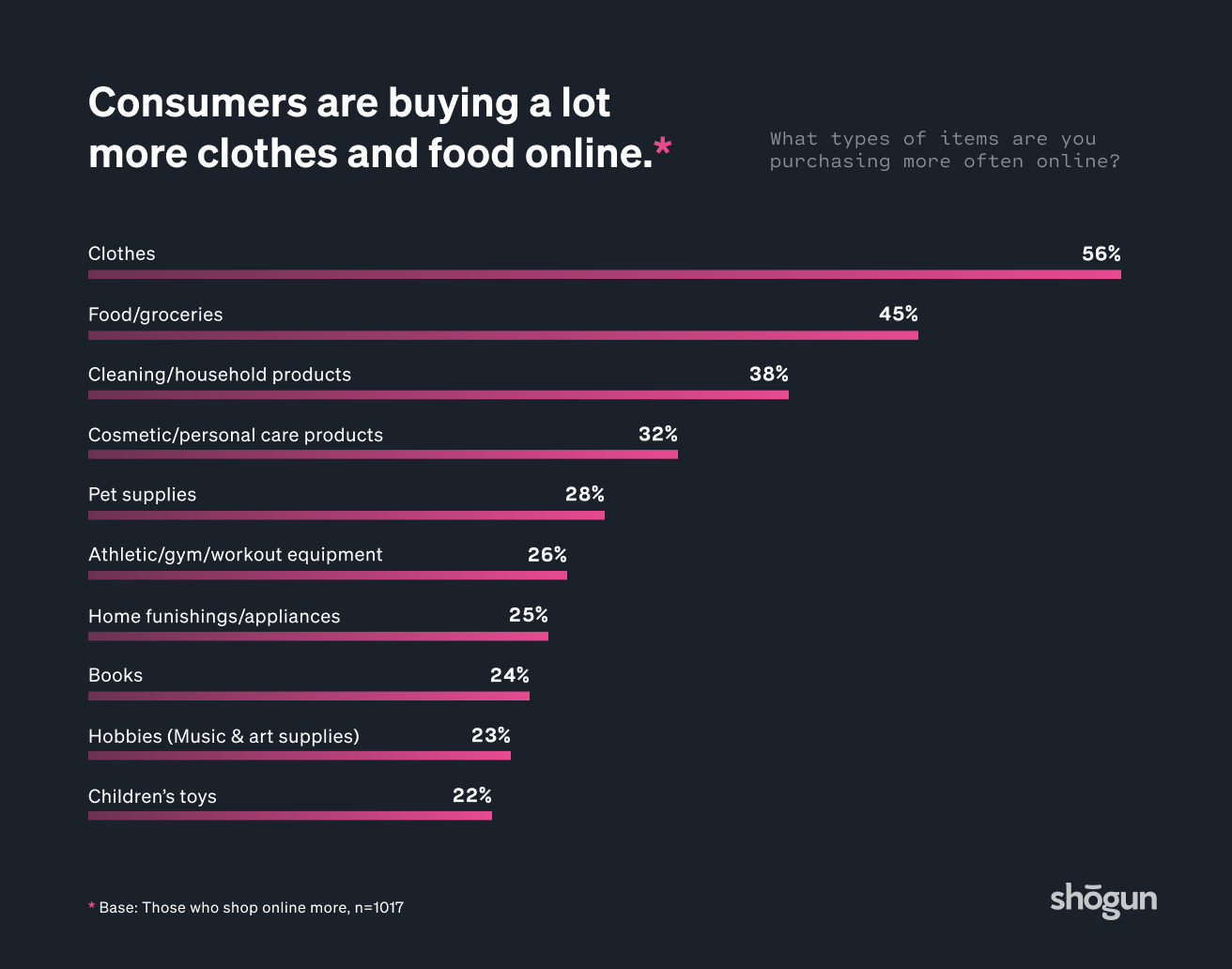

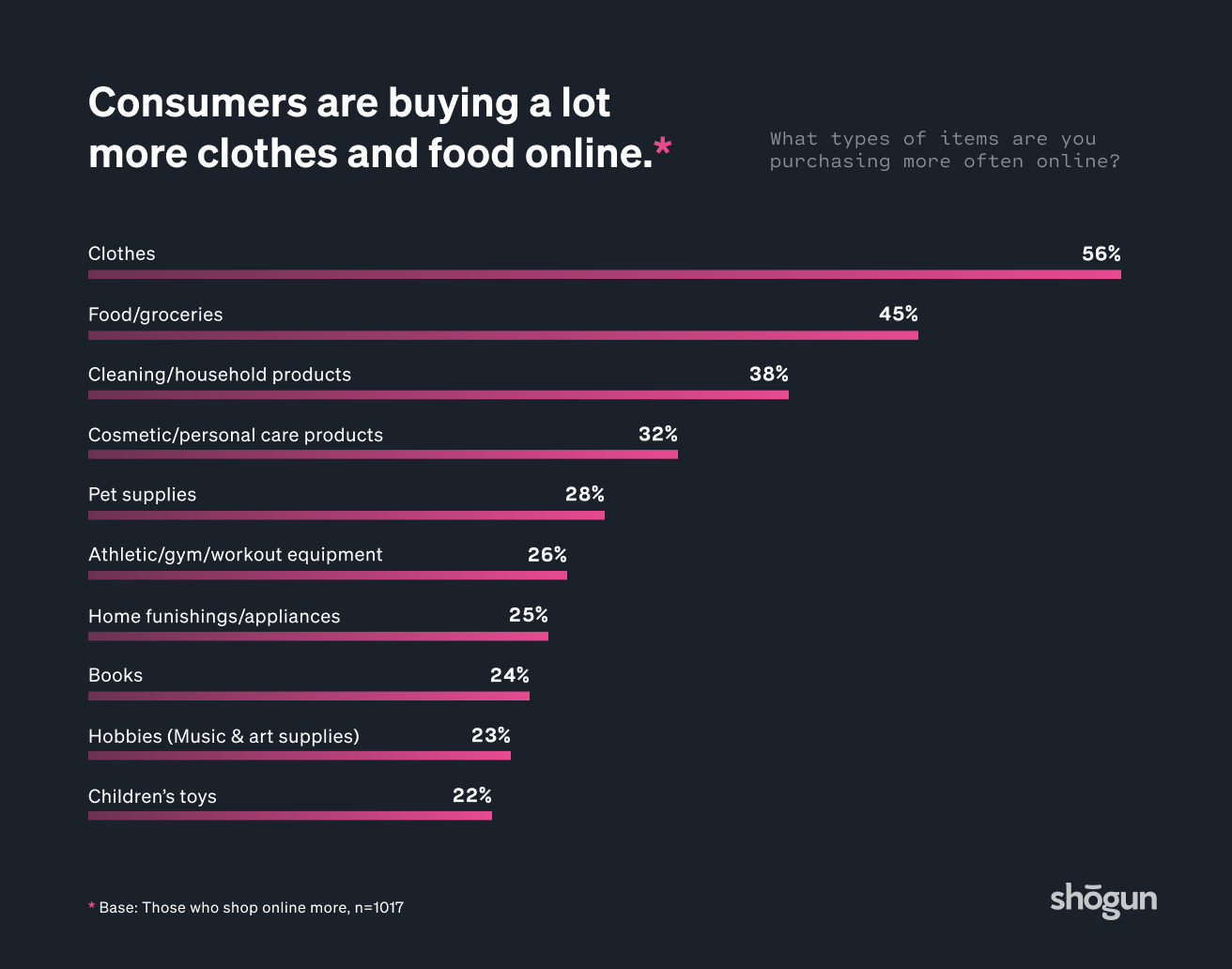

Apparel, food, household, and cosmetics brands are seeing especially strong opportunity (and preference) amid pandemic

Out of the Americans who say they are shopping online more since the pandemic began, 56% are purchasing clothing most often, followed by food/groceries (45%), and cleaning/household products (38%).

We found men are more likely than women to purchase athletic/gym/workout equipment and hobby equipment online (32% of men vs. 20% of women), while women are more likely to purchase cosmetics and personal care products (40% of women vs. 25% of men).

Not only are some items getting purchased online more often,

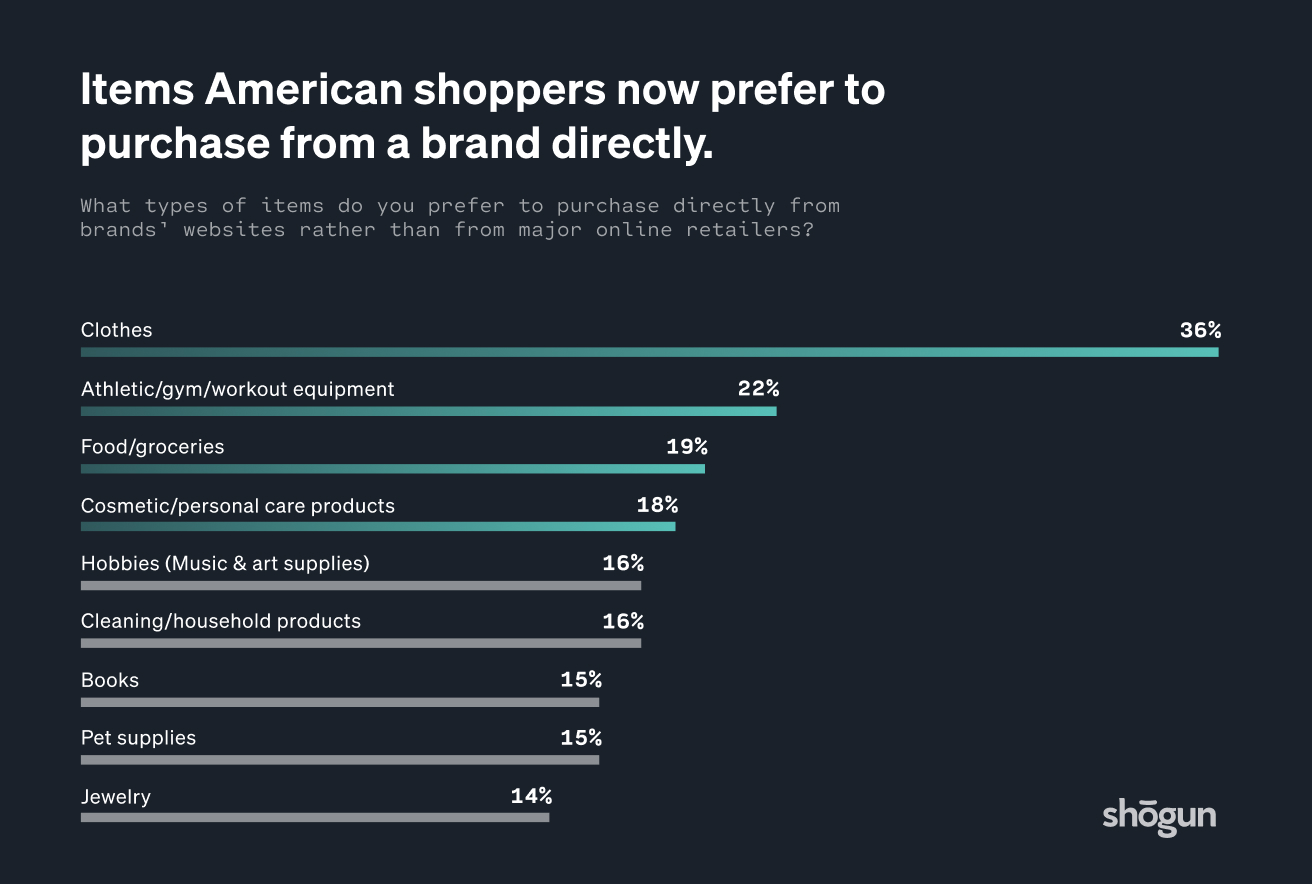

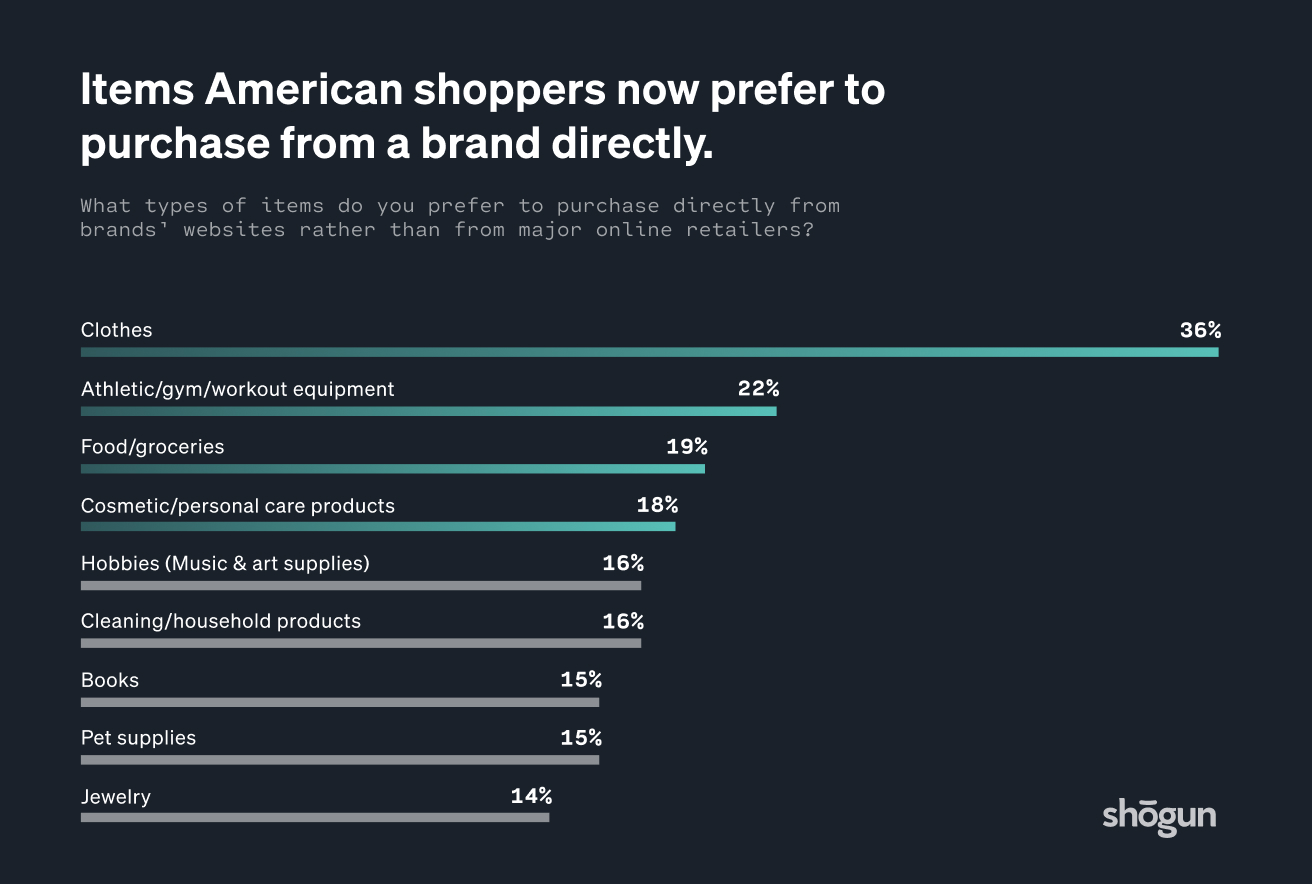

Over one-third (36%) of consumers now prefer to purchase clothing directly from brands’ websites rather than from major online retailers, followed by athletic/gym/workout equipment (22%), and food/groceries (19%). Notably, across product types, younger generations are more likely to purchase directly from brands’ websites rather than from major retailers (compared to older generations).

These popular ecommerce verticals will want to strike while the iron’s hot and pay close attention to their DTC buyer experience at this time.

Americans are increasingly open to buying direct from brands, especially men

Interestingly, men’s online shopping habits have changed more than women’s due to the pandemic , with men saying they are more likely to purchase items directly from a brand’s own site or app now:

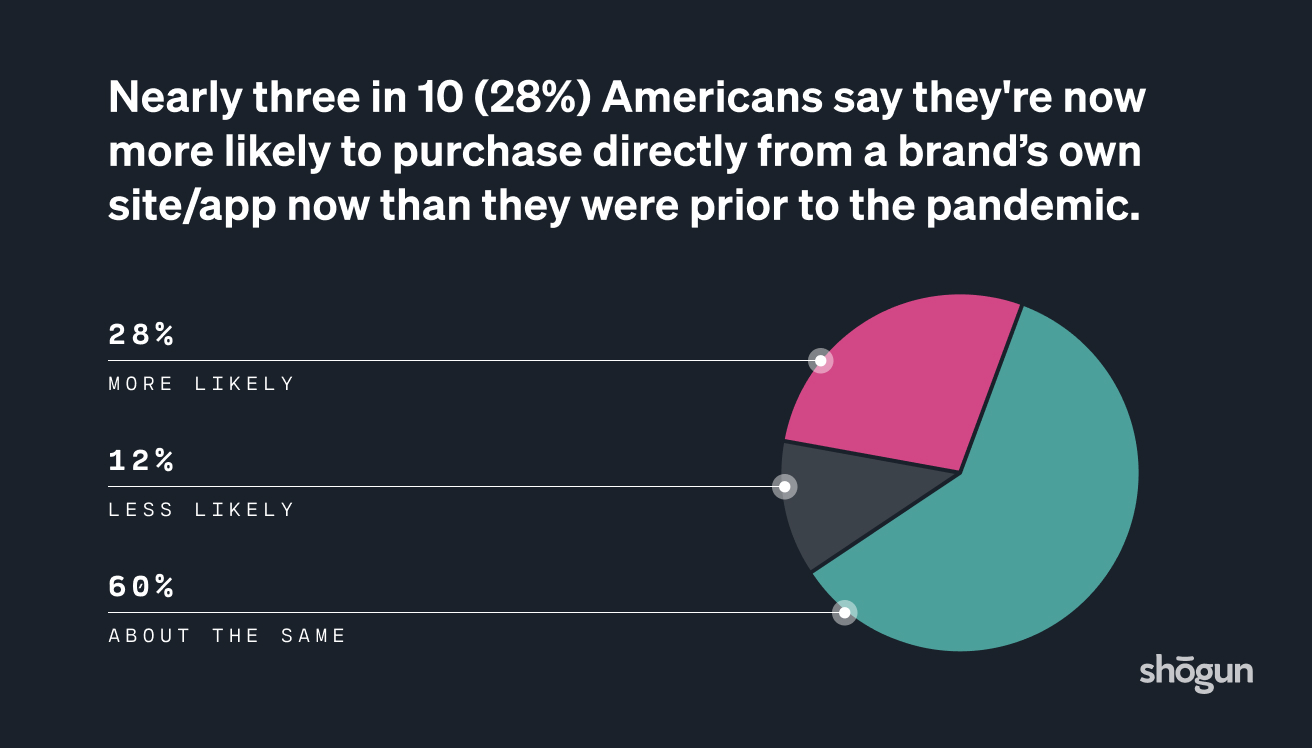

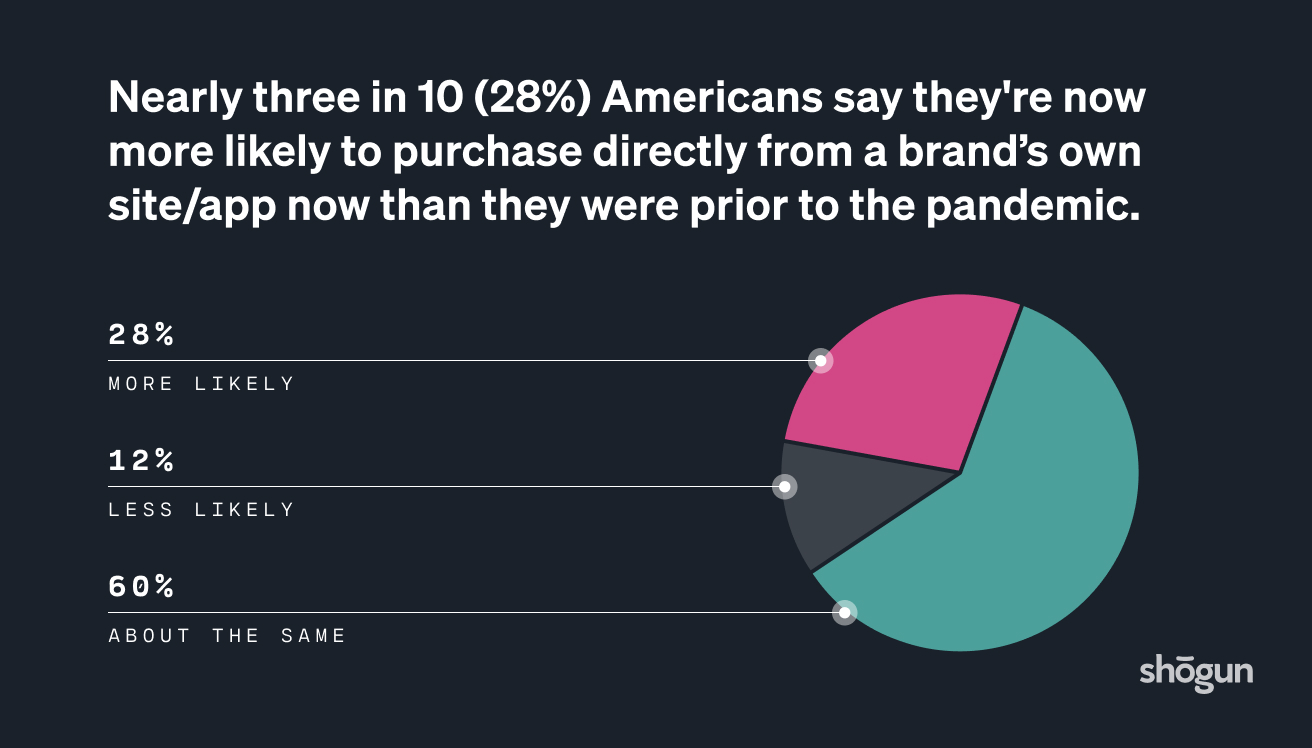

- 32% of men say they are more likely to purchase items directly from a brand’s own website/app now than they were pre-pandemic, compared to 24% of women.

- 65% of women say that the likelihood of purchasing items directly from a brand’s own website/app now is about the same as pre-pandemic, compared to 55% of men.

Millennials’ online shopping habits have changed the most during the pandemic

As we discovered, this generation are now the most likely to purchase items directly from a brand’s own website or app (36%) compared to other generations. Older generations reported that their likelihood is about the same as pre-pandemic. With this in mind, targeting millennial men could be the sweet spot for direct-to-consumer brands right now.

Gen Z has a high bar, too

Our survey found brands especially need to up their online experience if they want to attract Gen Z. Younger generations across all platform types (mobile app and desktop) are more likely to state that an online shopping experience doesn’t meet their expectations.

- 21% of Gen Z state that major online retailers’ mobile apps rarely or never meet their expectations, followed by millennials (13%), Gen X (6%), and boomers (5%).

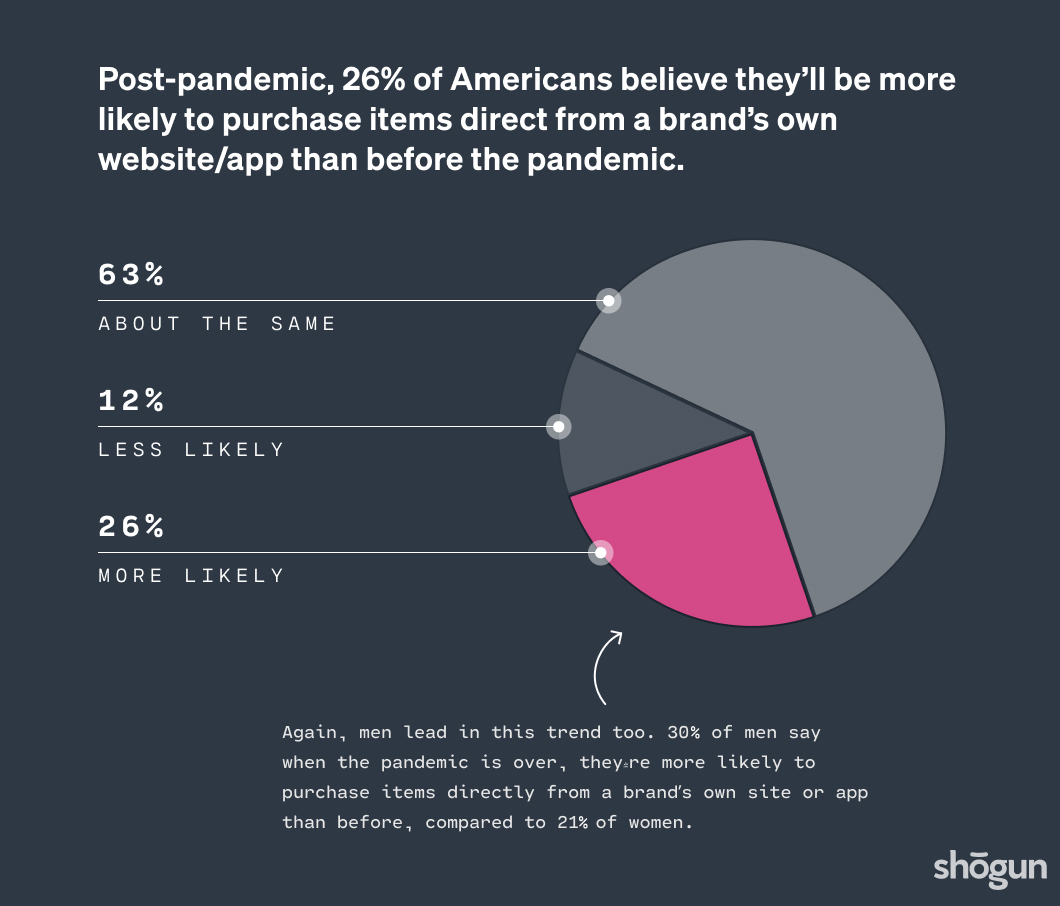

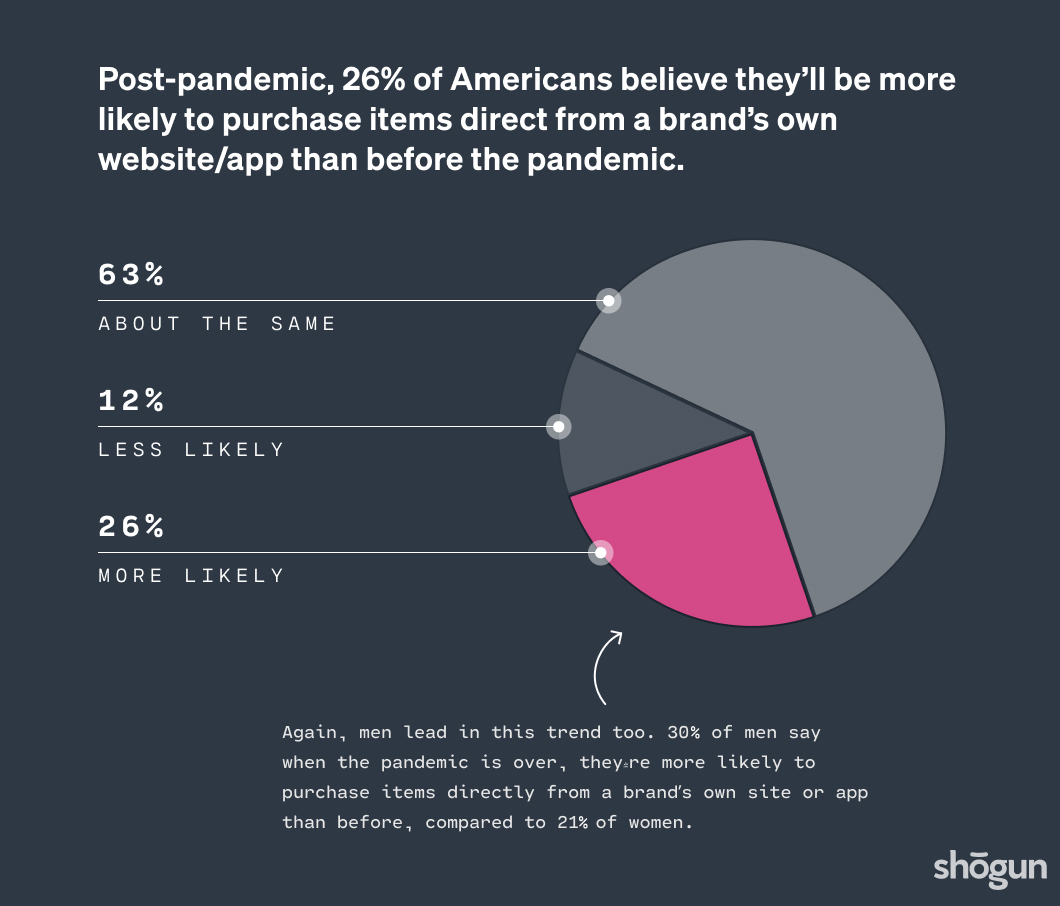

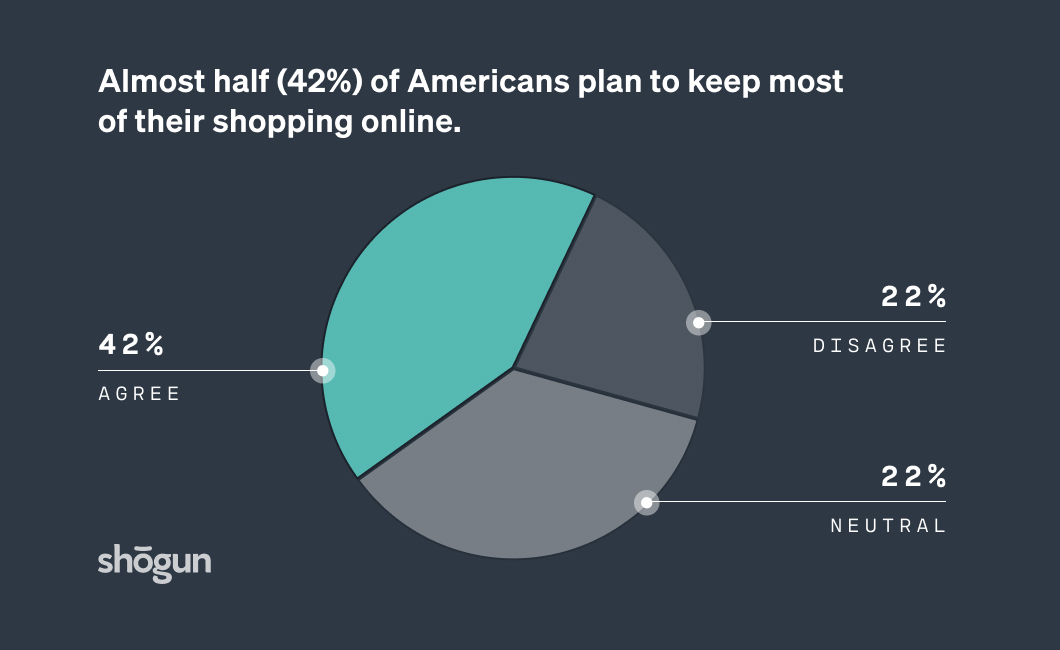

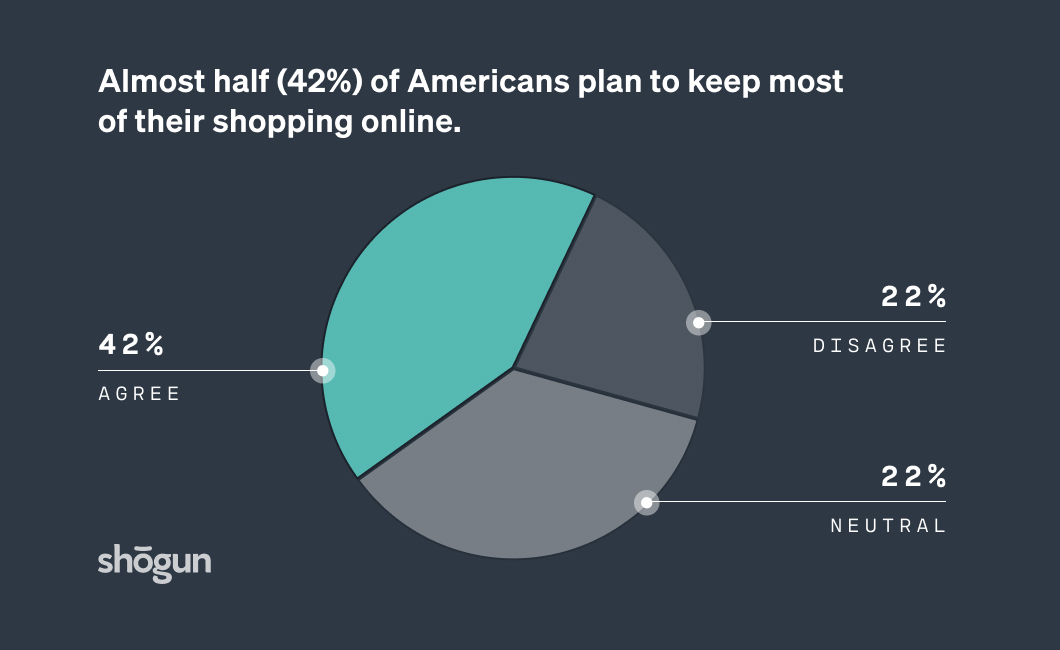

The new affinity for buying direct is expected to continue

Overall, with the increase in shoppers buying direct, especially men and millennials, and many expecting better experience once the pandemic’s over, DTCs need a game plan for both the near and long term.

What DTCs need to do to win in 2021

(And beyond)

More consumers are looking to buy direct, but some brands still struggle to match the level of experience shoppers get with a major online retailer.

To compete in 2021 and beyond, there are four fundamentals our research revealed about customers; specifically that they:

- Expect fast site speed

- Have a weakness for deals, but will only return for satisfying online experiences

- Need to see ample product reviews, and

- Can’t stand some very specific online shopping deal breakers

This in mind, here are our recommendations for how you can compete:

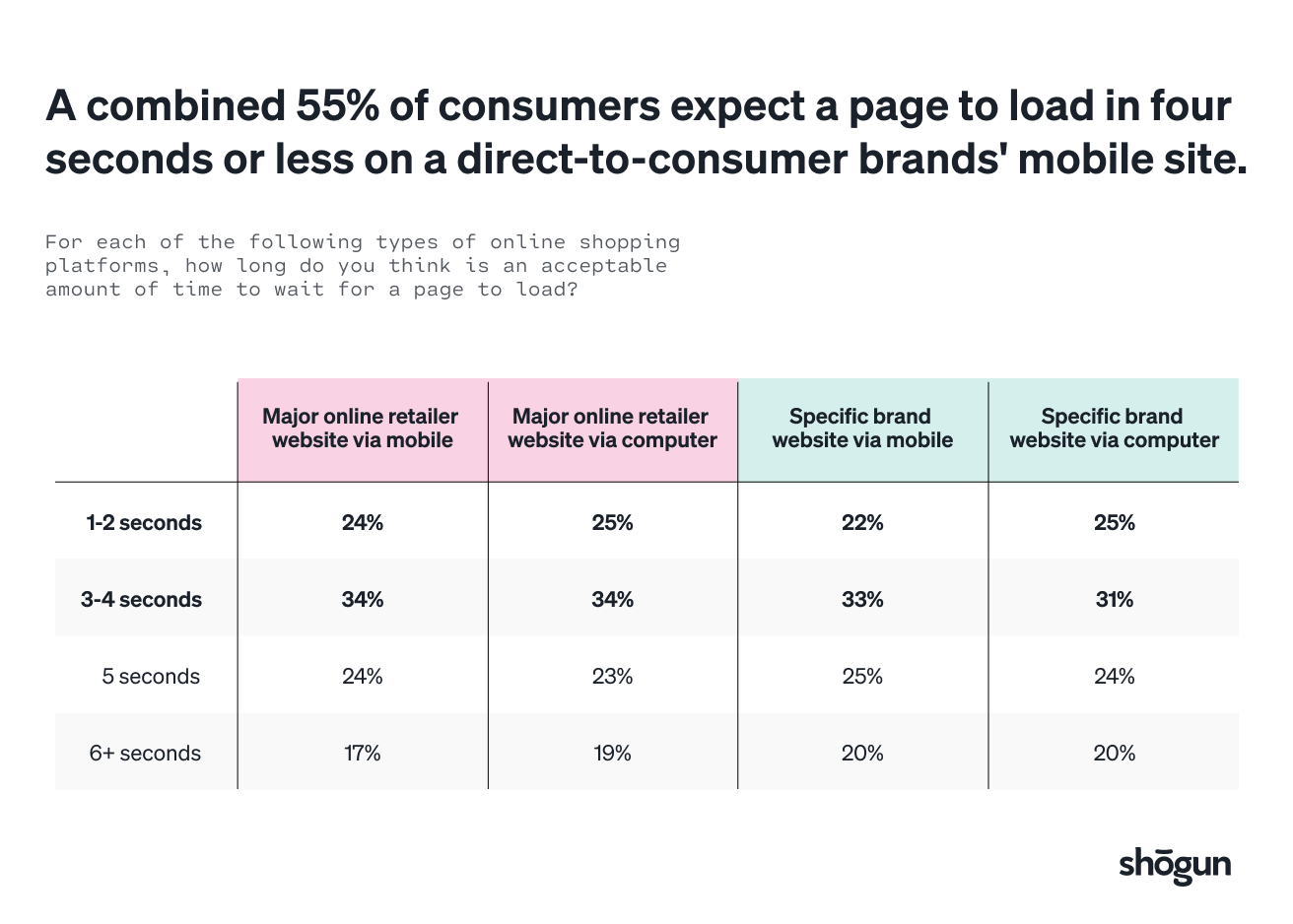

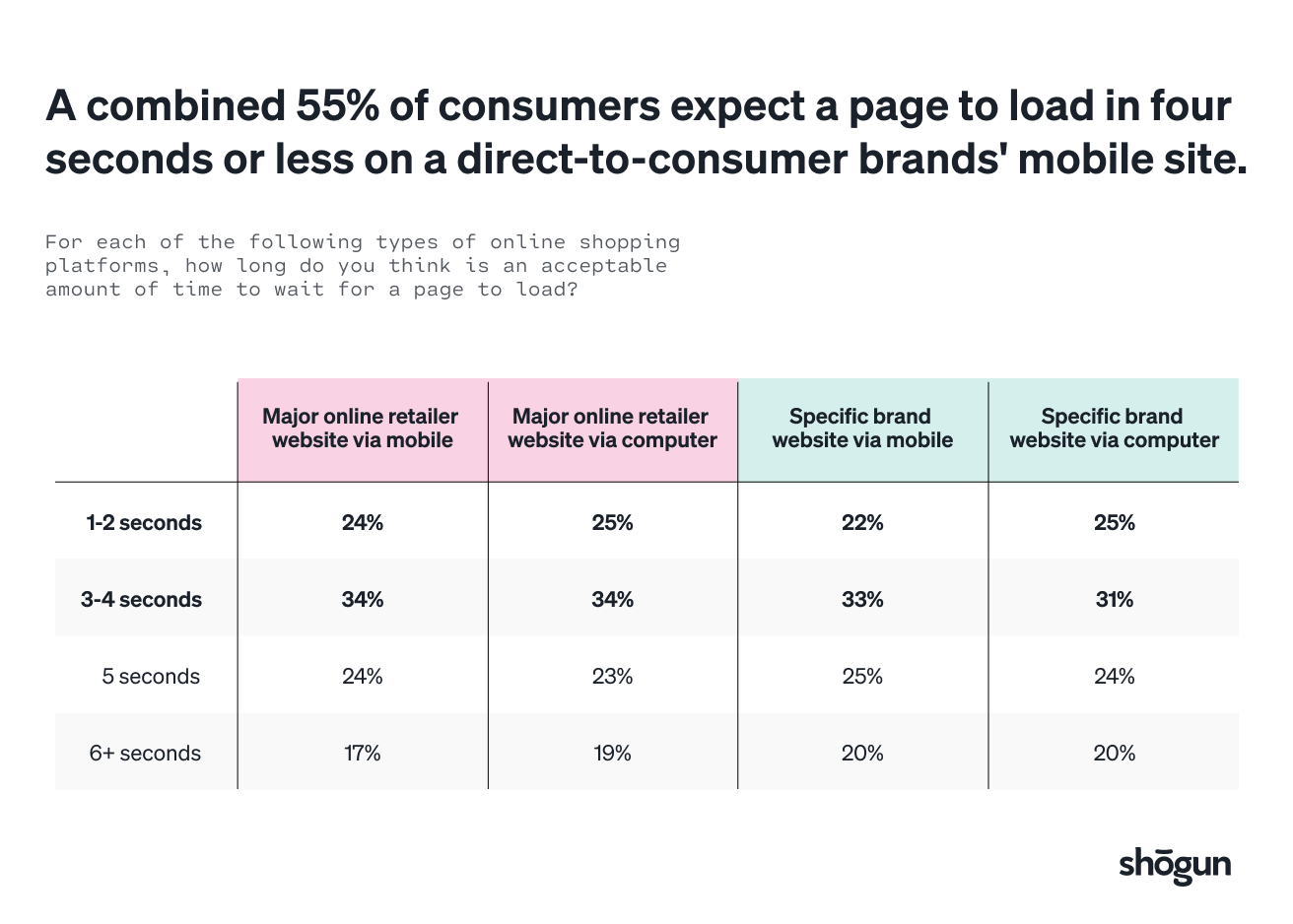

As we saw in our survey, there’s a need for speed on desktop and mobile. 24% of our respondents believe a major online retailer or direct-to-consumer site should load within 1-2 seconds. Further, a combined 55% of consumers expect a brand’s mobile site to load in four seconds or less:

Gen X and boomers especially don’t have time to wait. Across platform types, Gen X and boomers tend to be less patient. These groups expect sites to load within 1-2 seconds in higher proportions than younger consumers do.

For example, Gen X (28%) and boomers (25%) say that when accessing a brand’s website via desktop, they expect the pages to load within 1-2 seconds, compared to Gen Z (18%) and millennials (22%).

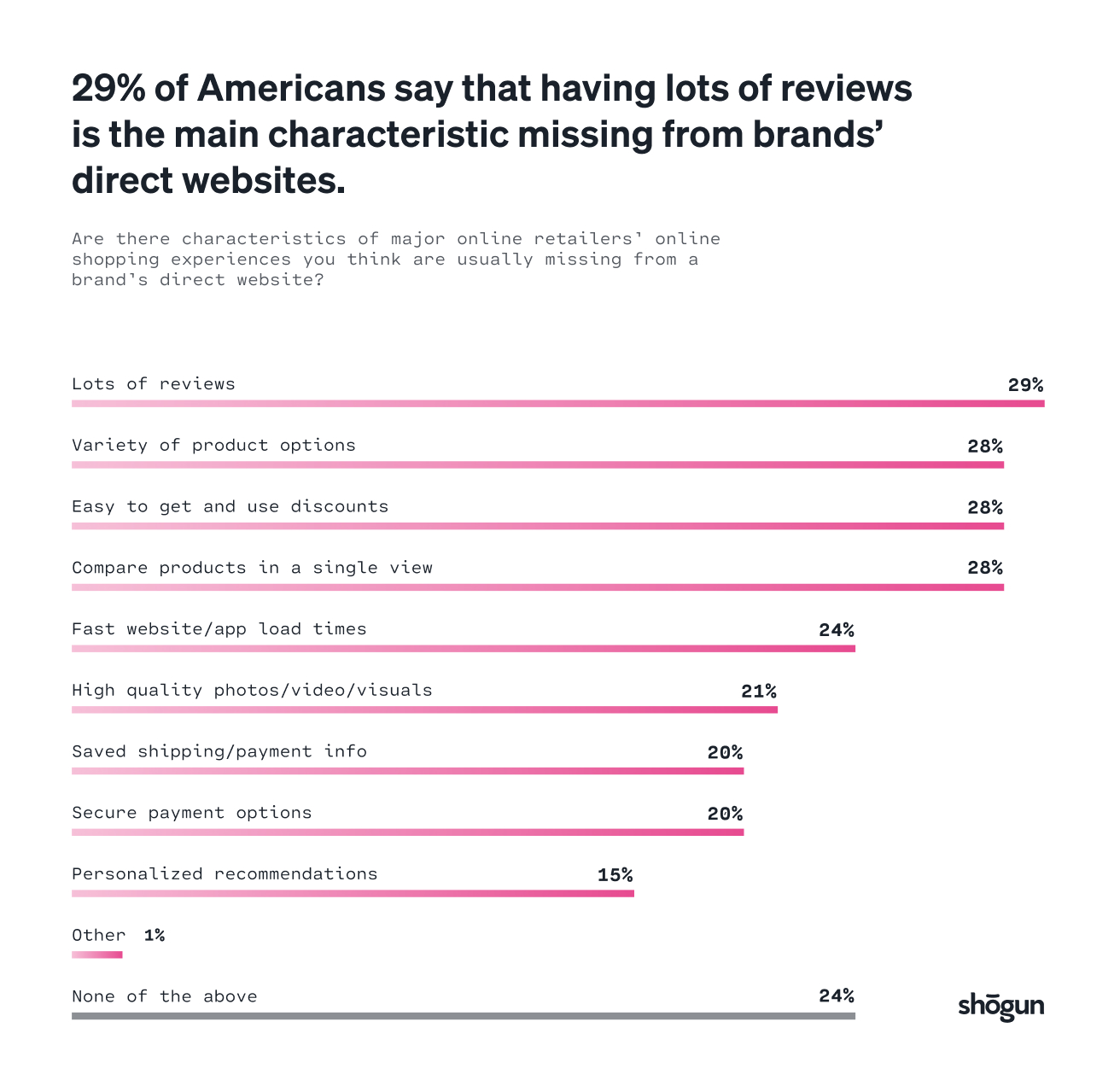

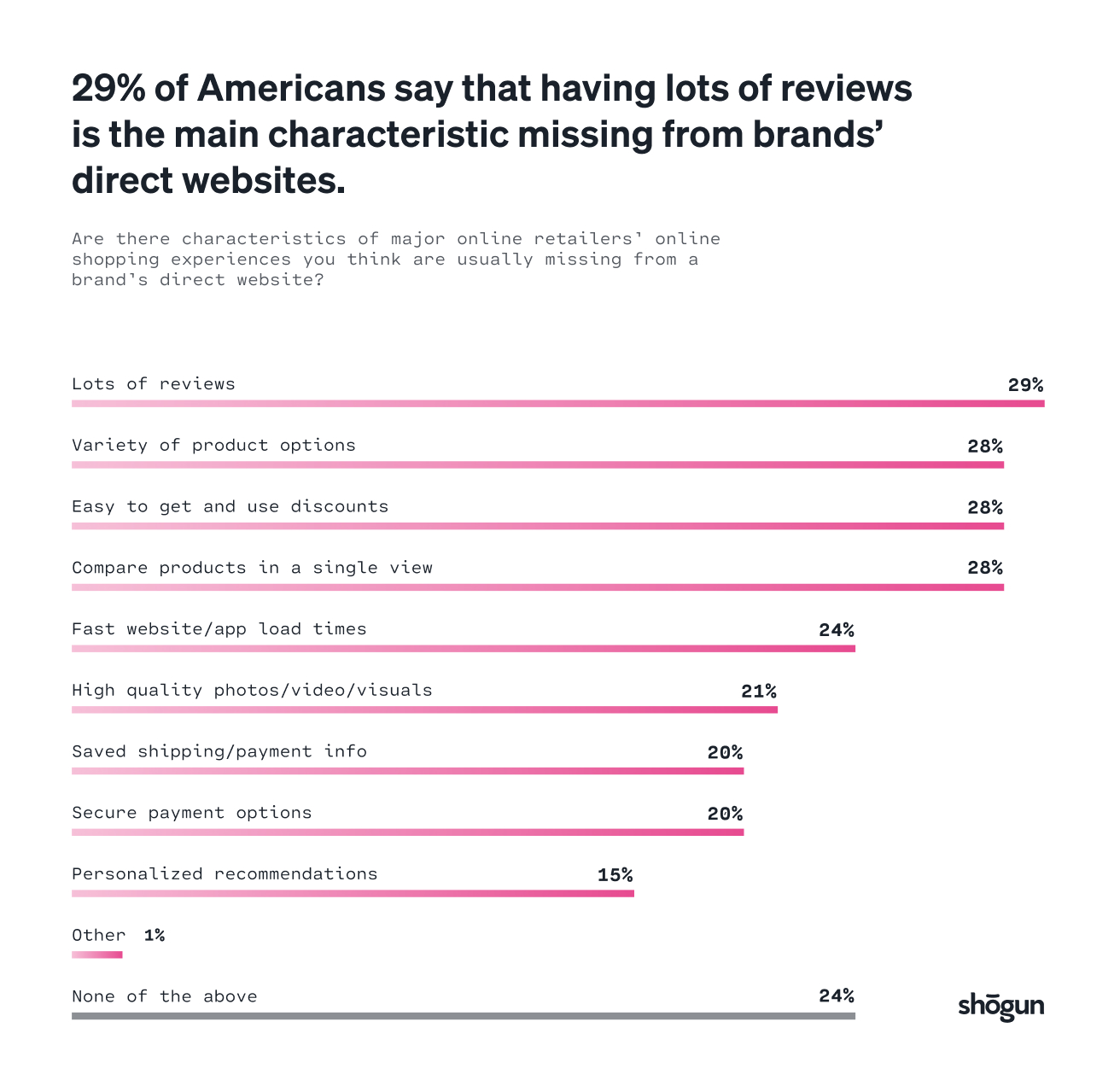

We also discovered consumers feel they are missing ways to compare and contrast items on brands’ direct sites. The top four cited characteristics found to be missing include satisfactory amount of customer reviews, product variety, and ways to see product comparisons more easily:

One-third (32%) of women say that brands’ direct websites are just as good as online retailers’ websites, compared to just 17% of men.One characteristic that men care about particularly is speed:27% say that fast website or app load times are a characteristic of major online retailers’ online shopping experiences that are usually missing from a brand’s direct website, compared to only 20% of women.

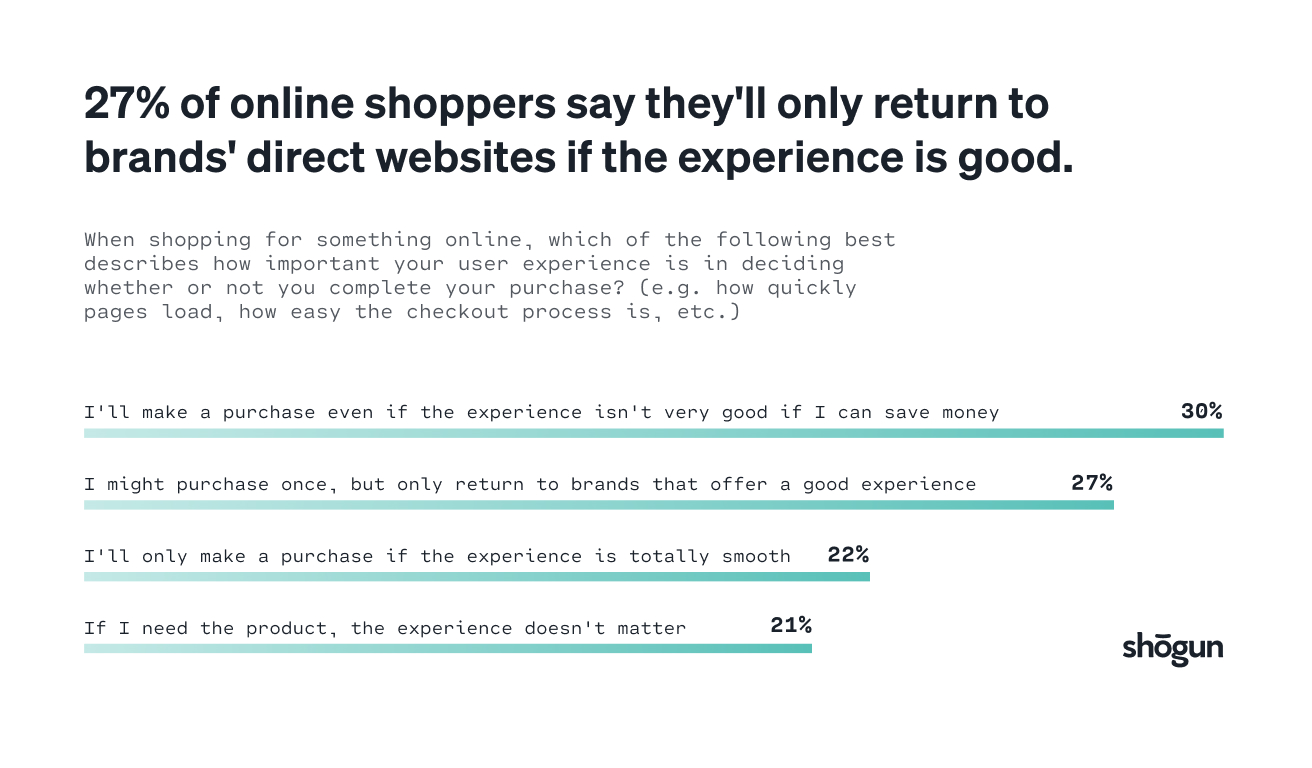

Your visitors may be charmed by a good deal and decent experience in the short-term, but prioritizing exceptional experiences builds loyalty and brings customers back for the long-term wins. As much as 22% of our respondents admitted they’ll only make a purchase if the experience is completely smooth.

While 30% of American shoppers say they’ll make an online purchase even if the user experience isn’t very good if they can save money or get a good deal, a very close 27% indicated they’ll only return if the online experience is good.

Your visitors may be charmed by a good deal and decent experience in the short-term, but prioritizing exceptional experiences builds loyalty and brings customers back for the long-term wins. As much as 22% of our respondents admitted they’ll only make a purchase if the experience is completely smooth.

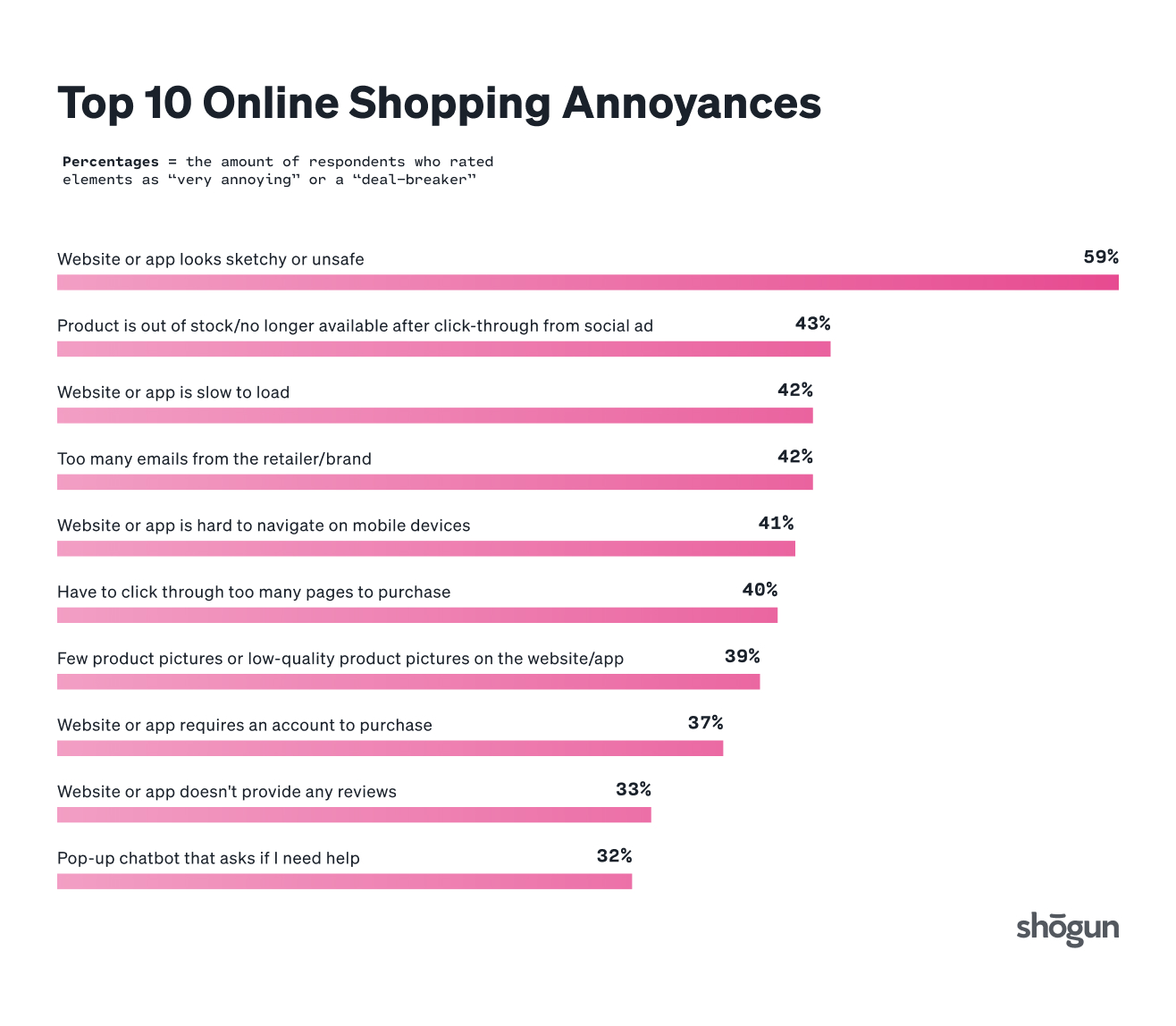

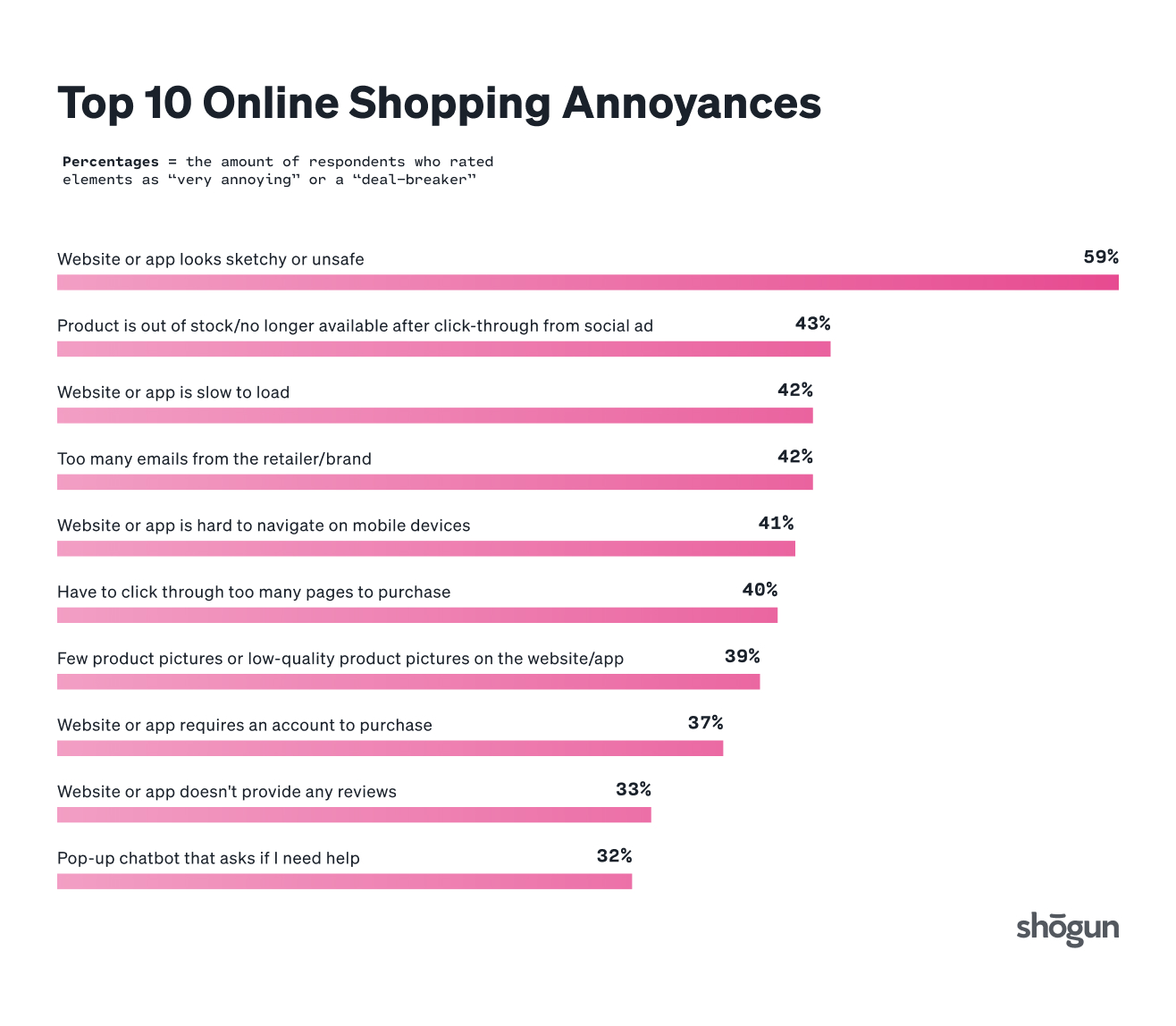

We had shoppers rate aspects of their online shopping experience on a scale from one (not at all annoying) to five (a “deal-breaker — I would no longer shop on that brand’s website). Overwhelmingly, shoppers cited some of the simplest things as the biggest turn-offs, such as “sketchy” or not-secure-looking sites, unkept promises from ads-to-site, slow site load times, bad mobile experiences, and email spamming as their top deal breakers. Be sure to check that your site isn’t a repeat offender of any multiples on this list:

The Ultimate Takeaway

With consumers continuing to spend more online, brands should focus on elevating their digital storefronts and differentiating their shopping experiences.

Consumers’ expectations will only continue to rise, so brands need to meet the challenge.

Major online retailers may be pulling ahead in the online shopping wars for now, but that doesn’t mean independent brands can’t catch up. To be successful, put the consumer first, and hone in on their evolving preferences — the four fundamentals outlined in this report are a great place to start.

- Optimize your store’s site speed

- Expand availability of product reviews

- Don’t rely on one-time deals — aim for long-term loyalty with experiences that reinforce repeat purchases, and

- Be aware of and avoid multiple deal breakers in your site experience.

This consumer-first investment will pay off as more shoppers will return to brands’ DTC websites and apps as the affinity for online retail continues.

Methodology

Shogun conducted this research using an online survey prepared by Method Research. and distributed by Dynata among n=2,000 adults in the United States who have purchased something online within the past 6 months. The sample was balanced across age, gender and geography to be nationally representative of the US population. Data was collected from December 23 to December 30, 2020.

To help guide the respondents, these were the definitions provided:

- Major online retailer: : Offers a wide variety of products and brands to its customers. Examples include Amazon, Best Buy, Target, Walmart, Kohl’s, Costco, Home Depot, Barnes & Noble, etc.

- Buying direct from a brand’s website/app: When you purchase an item from a brand’s own website or app, such as when you purchase a pair of Nike shoes from Nike.com or the Nike app, a Casper mattress from Casper.com, or Honest Company baby supplies from honest.com.

Respondent technical information:

Want to exceed the limits of modern commerce?

See how a headless storefront can drive more conversions.