The 5 Best Payment Gateways in Ecommerce: From Starting Out to Scaling Up

Payments are one of the most technical elements of an ecommerce store. It’s also one of the most important. If you’re unable to process and receive payments, you can’t turn a profit.

A payment gateway is the technology that securely captures and encrypts a customer’s credit card information.

They’re necessary for selling online. But not all ecommerce payment gateways are created equal.

With payment gateways being such a tricky topic for ecommerce merchants, we dove deep into the most important elements of one—from customer ratings to features available.

We’ve got five popular options you may want to consider.

We’ll cover:

- What is a payment gateway?

- How payment gateways work

- Benefits of using a payment gateway

- Types of payment gateways

- How to choose a payment gateway

- The best payment gateways for ecommerce stores

#cta-visual-pb#<cta-title>Build a store that drives conversions<cta-title>Design impactful store pages that turn visitors into customers with the best page builder for Shopify and BigCommerce—no coding needed.Start designing for free

What is a payment gateway?

A payment gateway is a tool that allows ecommerce stores to securely gather payment information from their customers.

It’s a payment gateway’s job to capture a customer’s debit or credit card information and contact their bank for approval for the purchase.

From there, a payment processor transfers the funds to your business’s merchant account.

How does a payment gateway work?

A payment gateway is responsible for safely collecting and transmitting customer data.

Here’s a rough overview of the steps involved in online payments, and where a payment gateway takes over:

- A customer visits your ecommerce store and adds a product to their shopping cart.

- They enter their credit card number, CVV, and expiry date at the checkout process.

- The payment gateway encrypts this data, analyzes the acquiring bank it needs approval from, and transfers the data to a payment processor.

- The customer’s issuing bank uses fraud detection to approve or deny the transaction.

- Money is released into your merchant account.

The benefits of using an online payment gateway

A payment gateway might sound like an overly technical concept you can afford to ignore.

In reality: it’s a non-negotiable element of any online store. Without one, you can’t safely process payments from your customers.

The benefits of using a payment gateway include:

- Process transactions faster. Ecommerce has exploded in recent years because customers can shop at any time, from any device. Compared to a payment gateway that processes transactions instantly, customers who have their payments taken manually spend time they can’t afford to waste.

- Provide a safer checkout and payment experience. Some 18% of shoppers abandon their online cart because they didn’t trust the website with their payment information. A popular third-party gateway, such as Stripe or PayPal, has already earned customer trust.

- Simplify the payment process. Sick of entering the same details each time you order online? Your customers probably are, too. A payment gateway is a safe, easy, and secure way for customers to save their payment details—especially if they’ve used it before.

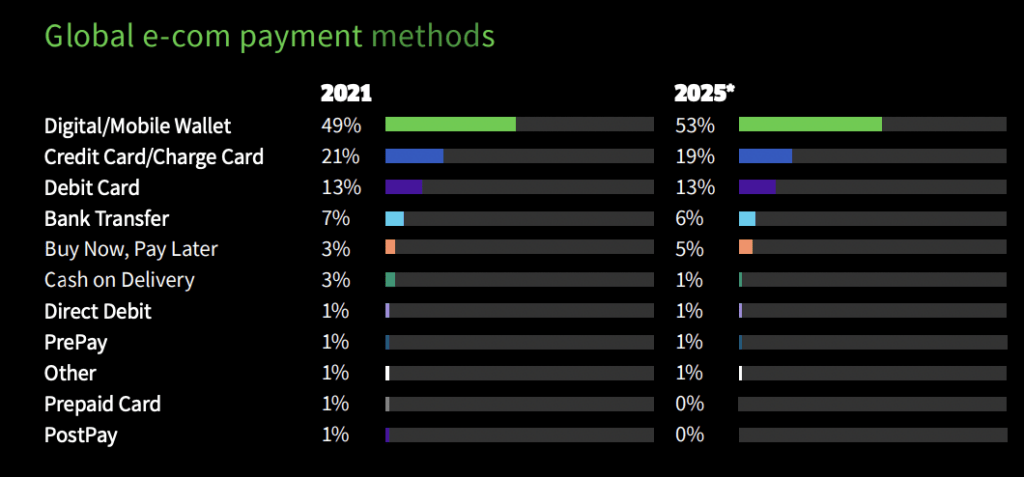

- Accept various payment methods. Studies predict that by 2025, mobile payments via digital wallets will account for more than half of all ecommerce payments. By choosing a payment gateway that accepts these digital payments, you’ll future-proof your ecommerce business and improve conversion rates amongst shoppers who exclusively purchase via apps like Apple Pay.

Types of payment gateways available in ecommerce

As you begin your search for an ecommerce payment gateway, you’ll notice each is categorized into one of the following groups:

- Hosted payment gateways. This type of payment gateway redirects customers to a separately-hosted page that encrypts customer card information. PayPal, for example, diverts online shoppers to a PayPal-hosted checkout page to enter payment details.

- Self-hosted payment gateways. When a payment gateway is self-hosted, customers aren’t diverted to a third-party website when their payment is being processed. This option is usually more customizable and user-friendly than hosted alternatives. One example is Stripe, which processes payments without diverting shoppers away from a merchant’s site.

- API-hosted payment gateways. Designed for ecommerce operators who want total control over their payments process, an API-hosted gateway collects data on-site. The online store is responsible for extra security including SSL certificates and PCI compliance. Adyen is one provider that offers an API-hosted gateway.

- Local bank integration gateway. When customers initiate a purchase on a website using a local bank integration payment gateway, they’re diverted to their bank’s app or website to enter their credit card details. It’s the most limiting option for modern merchants.

You don’t have to choose just one of the options we’ve selected.

By stacking or layering payment gateways, customers get greater choice. There’s also less risk—should one gateway encounter problems, your online store will still be open for business.

How to choose the best payment gateway for your scaling store

Now we know the ins and outs of payment gateways, let’s dig into the features you should look for when evaluating different options.

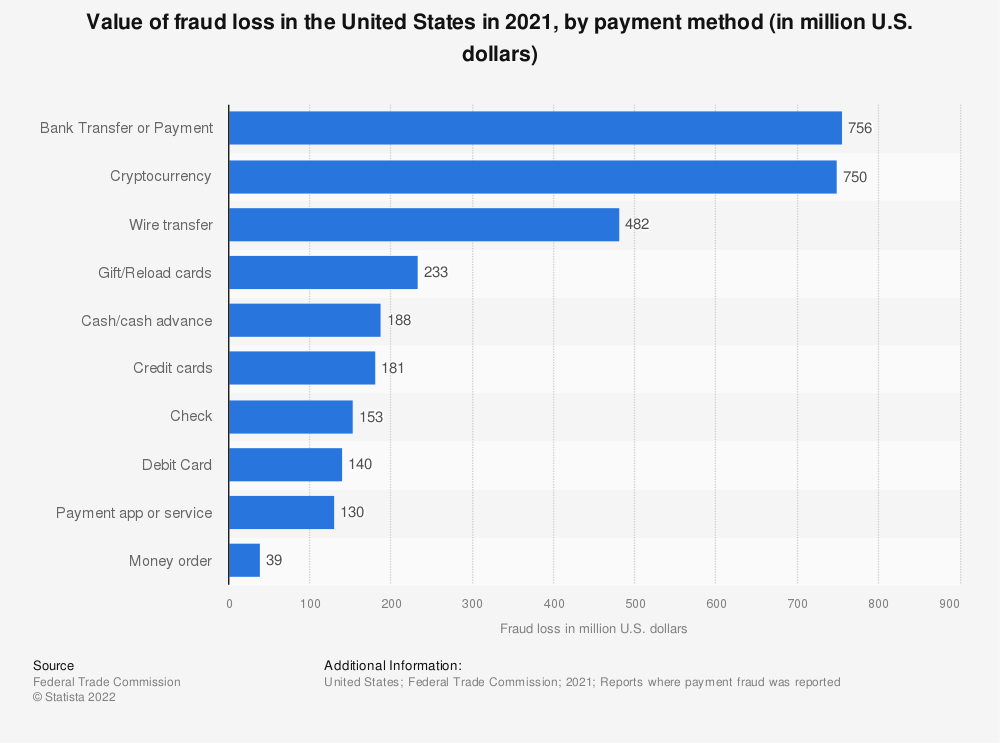

Security

Customers are protective over their personal data—and rightly so. Collectively, consumers in the US lose $756 billion to payment fraud each year.

When choosing a payment gateway, check they have extensive security features to protect the sensitive information being passed through.

The last thing you want to do is be liable for a data breach or payment scam which happened through your payment gateway.

“The most important feature of a payment gateway for ecommerce is usually security, as customers need to trust that their personal and financial information is protected during transactions.”

— Anthony Bautista, founder of Pure CBD Now

When evaluating your options, look for an ecommerce payment gateway with:

- PCI compliance. All online retailers need to meet the Payment Card Industry Data Security Standard (PCI-DSS) when processing credit card payments. These standards keep customers’ card data secure.

- 3D secure authentication. 3D secure is an additional security layer to encrypt online payment data. If this extra layer of authentication is successfully verified and the payment is processed, you’re covered against disputes and chargebacks by a liability shift.

- Tokenization. Payment gateways with this feature turn sensitive data into useless tokens. Scammers can’t interpret this data and steal customer information.

Fees

A payment gateway makes its money by taking a percentage commission from each transaction. These credit card processing fees range from 1.4% to 3.5%, sometimes alongside a flat monthly fee.

When evaluating payment gateways for your online store, keep your profit margins in mind.

If you’re buying products from a wholesaler and marking them up by 50% when selling online, you’ll likely feel the impact if a payment gateway claims 3.5% of the transaction value. (It also leaves little wiggle room for overheads like warehousing, logistics, or marketing.)

Similarly, check whether your payment gateway charges additional fees for instant payouts. Some only run payments a handful of times per week.

If you want to take your money out earlier or have greater control over cash flow, look for a payment gateway that doesn’t charge an additional fee for instant or early payouts.

Market reputation

Brand reputation has its place in customer buying decisions. It makes sense: companies loved by our peers ease pre-purchase anxiety.

Apply the same concept to ecommerce payment gateways on your shortlist.

Ask fellow ecommerce operators to share their experiences. Put out a call in Slack communities for DTC experts. Ask accountants or finance managers to weigh in.

Search Twitter for mentions of the brand name and analyze sentiment.

Remember: reputations are earned, not built. Payment gateways with a solid reputation should naturally fall higher on your shortlist.

International payments

The beauty of ecommerce is that it’s global.

Studies predict that by 2025, worldwide ecommerce sales will exceed $7 trillion, hence why a key element of any scaling ecommerce strategy is international expansion.

Payments often cause friction for scaling brands, especially if their payment gateway penalizes them for processing cross-border transactions.

Choose a payment gateway with the ability to gather financial information from shoppers in as many countries as possible.

Some are able to initiate transactions in multiple currencies and payout in your local one, too. Check whether your key markets are covered and any exchange rate fees associated with conversions.

Analytics

Not only is basing decisions off a hunch bad business practice, but it’s risky.

Choose a payment gateway that provides in-depth analytics about your payments—such as subscription churn, customer value, or payment trends.

If your gateway indicates an uplift in mobile wallet transactions, for example, appeal to future customers by adding Apple Pay or Google Pay logos in your website footer.

For Wolfe Bowart, CEO of VIVIPINS, “The most important feature for me when selecting a payment gateway for my ecommerce store is being able to access advanced analytics data.

“With the insights provided by this information, I can gain valuable business intelligence about who is visiting and buying from my store, providing key insights into how we should adjust our strategies going forward.”

Flexibility

Scaling an online store can feel like stepping into the unknown.

Who knows how many orders you’ll be fulfilling, where your customers will be based, and how much they’ll spend?

The last thing you want is to cause interruption when switching gateways because the one you initially chose no longer meets your needs.

Raine Gui, the founder of Model Chic, recommends choosing a flexible payment gateway provider for this reason: “Although technological advancements have been tremendous, problems with systems are still possible.

“What would happen to your online shop if the payment processor it relies on went down right when a consumer wanted to make a purchase? This highlights the significance of providing at least two different payment options.”

Raine adds, “In the event that your primary payment gateway experiences technical difficulties or becomes unavailable, a flexible payments platform will automatically redirect any pending or completed transactions to the backup payment gateway.”

It’s also worth evaluating that the payment gateway you’ll use is compatible with several commerce platforms. It’ll be easier to use a single gateway for each sales channel, rather than one for online and another offline.

#cta-visual-pb#<cta-title>Maximize your store’s conversions<cta-title>Build high-converting landing pages that turn visitors into customers with the best page builder for Shopify and BigCommerce—no coding needed.Start designing for free

The 5 best payment gateways for ecommerce stores

Still unsure about which payment gateway to choose?

With so many options to choose from and potentially millions of dollars being transferred through the gateway you choose, it can feel overwhelming.

We evaluated the pros and cons of five popular payment gateways, alongside their compatibility with popular ecommerce platforms.

Let’s break down each.

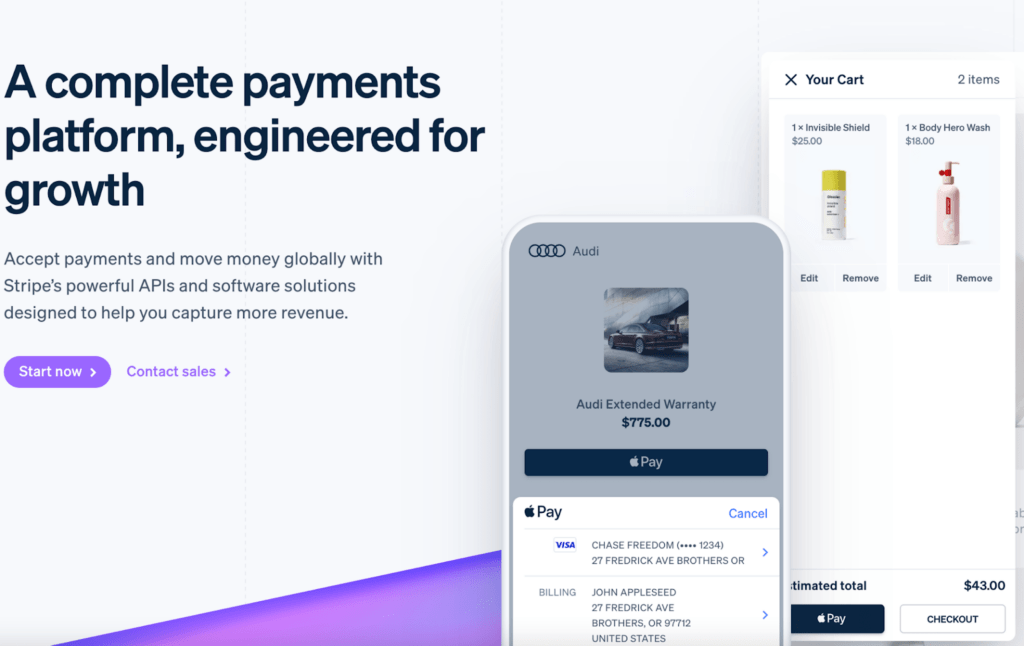

1. Stripe

Best for: Scaling ecommerce stores that primarily accept credit or debit cards like American Express, Visa, or Mastercard.

Stripe is an all-in-one payment gateway and processor designed for online businesses.

It’s one of the most popular payment solutions in the world used by more than 3.5 million merchants.

Casey Allen, CEO of Barista Warrior, says, “We use Stripe for our payment gateway and chose it because it’s a leading provider of payment processing software. Furthermore, they have good customer support and their process is easy to set up and understand.

“We haven’t yet changed to another gateway as we’ve had no need for it and are very pleased with Stripe,” Casey adds. “We anticipate that we’ll stick with it as our business grows.”

“Using Stripe we have found that it is easily integrated, one of the lowest rates for card runs, and has allowed us to expand beyond our wildest dreams. We don’t anticipate a change unless something happens where their card radar feature starts to allow fraudulent charges.”

— Carl Anderson, owner of Cande Shop

Pros of Stripe’s payment gateway:

- Accepts 135+ currencies with one local payout

- Strong market reputation as an ecommerce payment platform

- Extremely customizable payment features for scaling online stores

- Accepts a variety of payment methods, such as ACH transfers and digital wallets

- No contract—you can start (and finish) using Stripe whenever you want

- Access in-depth payment and subscription analytics

Cons of Stripe’s payment gateway:

- While Stripe is customizable, its documentation is very technical

- It’s not the best payment gateway for businesses that sell in-store

- No free trial or freemium plan available

Compatible with Shopify? Yes.

Compatible with BigCommerce? Yes.

Instant payouts? Yes.

G2 rating: 4.3 out of 5 stars.

Pricing: 2.9% plus $0.30 per successful card charge. No monthly flat fee.

2. Adyen

Best for: International ecommerce stores that sell omnichannel.

Adyen is a Dutch payment gateway and service provider used by companies like Microsoft, McDonald’s, and eBay.

Ecommerce stores using Adyen can take international payments from any sales channel—your online store, mobile app, and social media storefronts included.

Pros of Adyen:

- Adyen has advanced security tools designed to protect larger ecommerce stores

- Get a dedicated merchant account manager to answer questions

- Integrations with Salesforce, NetSuite, and Oracle

- See cross-channel insights as you sell online, in-person, and via mobile apps

- Built-in fraud protection to prevent disputes and block repeat offenders

Cons of Adyen:

- Retailers need to be approved before using Adyen’s payment gateway

- The pricing system can be confusing

- Minimum monthly invoice requirement which varies by industry and business

Compatible with Shopify? Yes.

Compatible with BigCommerce? Yes.

Instant payouts? Yes.

G2 rating: 3.2 out of 5 stars.

Pricing: Depends on the customer’s card issuing bank. There’s no monthly flat fee but a two-month notice period should you wish to cancel.

3. Payflow by PayPal

Best for: Scaling ecommerce stores with a customer base that uses digital wallets.

Boasting over 432 million users, PayPal is a popular way for customers to make online payments.

Ecommerce stores can use its open payment gateway, Payflow, to take digital payments using their own checkout page.

Wolfe Bowart, CEO of VIVIPINS, chose this option because of its scalability:

“It allows customers to pay in more than 100 currencies and keep their transactions secure no matter their geographic location. This ensures that customers have a safe and consistent shopping experience, which helps us build trust over time with our customer base.”

Pros of PayPal’s payment gateway:

- PayPal is a global household name; 35% of cross-border shoppers use it when online shopping

- Accept payments in 25 currencies across 200+ countries

- Low pricing with no cancellation fees or monthly minimums

- Enable buyer authentication with Verified By Visa and MasterCard SecureCode

- Get a merchant account alongside a payment gateway

Cons of PayPal’s payment gateway:

- Customer support isn’t as good as other payment providers

- PayPal has been known to freeze merchant accounts without reason

- It doesn’t have advanced functionality to support recurring payments

Compatible with Shopify? Yes.

Compatible with BigCommerce? Yes.

Instant payouts? Within 30 minutes for instant payouts (extra fee).

G2 rating: 4.4 out of 5 stars.

Pricing: The basic Payflow plan is $0.10 per transaction. You can upgrade to Payflow Pro, which has unlimited checkout customization, for $25 per month.

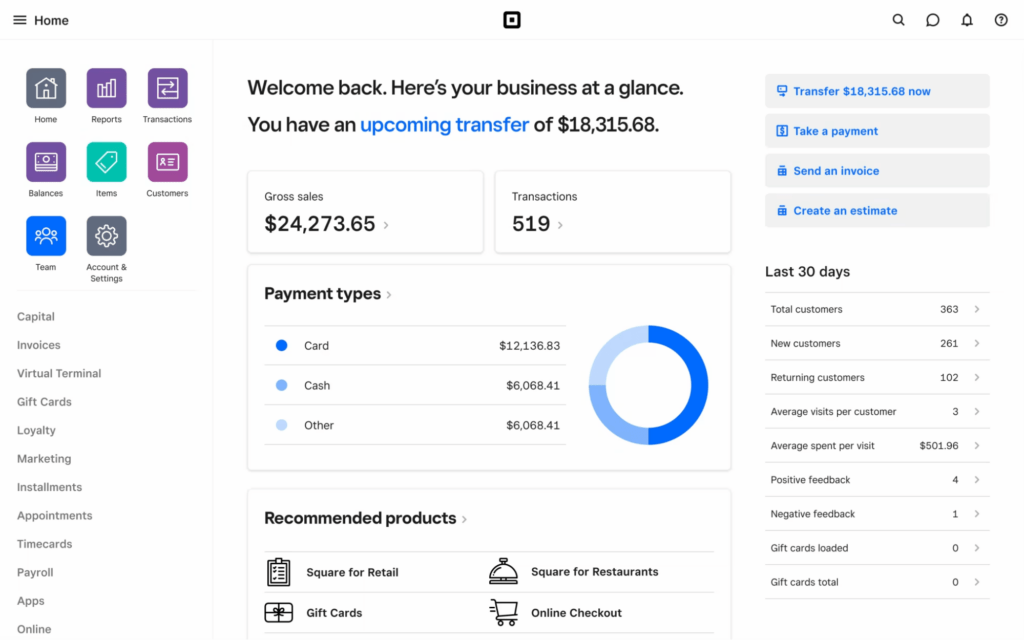

4. Square Payments

Best for: Ecommerce businesses that also sell in-person.

Square is known for its point-of-sale (POS) systems. However, it has a payment gateway that allows merchants to receive and transmit a customer’s card data.

Ethan Pompeo, the founder and CEO of Green Valley Nutrition, chose Square because its “integrations make it easy to take payments and sync customer data with our email marketing platform.

“When managing a large team of sales reps, these features make it easy for me to capture new leads, analyze sales data, and send payments to my employees,” Ethan says.

“We can also use Square’s POS systems to take payments in real time at retail pop-ups, trade shows, and other local events.”

Pros of Square’s payment gateway:

- It’s quick and easy to set up—no application required

- Cost-effective for smaller businesses

- Square has a free POS app and supporting hardware to process in-person payments

- Accept manual payments (common with B2B ordering) using Square

- Integrate with buy now, pay later services like Clearpay

Cons of Square’s payment gateway:

- Limited customization options

- Certain business categories can’t use Square’s payment service

- You need to use Square’s POS systems to access its payment gateway

Compatible with Shopify? No, but there are workarounds using tools like Zapier.

Compatible with BigCommerce? Yes.

Instant payouts? Within 20 minutes for instant transfers (extra fee).

G2 rating: 4.6 out of 5 stars.

Pricing: Depends on the customer’s payment method. For ecommerce, it’s 2.6% plus $0.30 per transaction.

5. Worldpay

Best for: Ecommerce stores processing a large volume of international transactions.

Worldpay is a complete payment platform with gateway functionality.

As the name suggests, it’s a good option for scaling ecommerce stores that sell internationally. It’s owned by FIS, a fintech platform that reportedly manages half of the world’s wealth.

“With Worldpay, customers can choose their preferred method of payment. And there are plenty. For example, online payments and in-person payments are available. Plus, it’s a super reliable gateway.”

— Aviad Faruz, CEO of Faruzo

Pros of Worldpay’s payment gateway:

- Quick, easy, and free sign-up process

- Accept payments in 120+ currencies at no extra cost

- Advanced payment analytics through Worldpay iQ

- Customize the design of your payment page

Cons of Worldpay’s payment gateway:

- Unclear pricing

- Some reviewers report poor customer support

- Funds are transferred to your bank account twice per week (unlike alternatives with instant payout options)

Compatible with Shopify? Yes.

Compatible with BigCommerce? Yes.

Instant payouts? No. WorldPay says money will be transferred within a few days of an order being approved.

G2 rating: 3.3 out of 5 stars.

Pricing: Not publicly available. You’ll need to reach out to their sales team for a custom quote.

Payment gateway FAQs

Do I need a payment gateway for my store?

Every ecommerce store needs a payment gateway. It’s the technology that allows you to take online payments safely and securely, preventing your business from payment fraud.

What’s the difference between payment gateways vs processors?

A payment gateway securely collects a customer’s payment data.

This information is passed to a payment processor—the technology responsible for taking the payment from a customer’s bank and transferring it to yours.

Some tools offer both payment gateways and processors in a single platform.

What’s a multi-currency payment gateway?

A multi-currency payment gateway allows you to securely take online payments from international shoppers.

Worldpay is an example. With its payment gateway, online stores can take payments from customers in 126 currencies.

What’s the best payment gateway?

There are several ecommerce payment gateways to choose from, but the best option depends on your store. If you’re a small business, consider PayPal’s Payflow.

If you’re a larger online store looking for greater flexibility, consider Stripe.

Choose the right payment gateway for your scaling store

Payment gateways are critical for any ecommerce business.

With one, you’ll be able to securely process payment transactions, as well as protect your customers’ financial data and prevent payment fraud.

Use the criteria we’ve listed here to shortlist potential ecommerce payment gateways.

Security, transaction fees, reputation, and flexibility are all important factors to consider when money is at stake.

#cta-visual-pb#<cta-title>Build a better Shopify store<cta-title>Make your store look and feel as unique as your brand by customizing with the best page builder for Shopify.Start building for free

Elise Dopson

Elise Dopson is a freelance writer for B2B commerce and martech companies. When she's not writing, you'll find her in the Peak Freelance community or on Twitter.